植物工場市場調査 – 施設別(温室、屋内、その他)、光タイプ別(人工光、太陽光)、および地域別 および地域別 ー予測2025-2037年

出版日: Aug 2025

- 2020ー2024年

- 2025-2037年

- 必要に応じて日本語レポートが入手可能

植物工場市場規模

植物工場市場の収益は、2024 年には約 140 億米ドルに達すると予想されます。さらに、当社の植物工場市場に関する洞察によると、市場は予測期間中に約 8% の CAGR で成長し、2037 年までに約 390 億米ドルの価値に達すると予想されています。

2037年の市場価値

390億 米ドル

成長速度

CAGR

(2025-2037年)主要な市場プレーヤー

Aerofarms

Brightfarms

Bowery Farming

Gotham Greens

日本の主要なプレーヤー

NARK

Citi Inspire Minds

Ferma.ge

Water Design Japan

植物工場 市場概況

世界市場分析、地域別2037年

2037年 には、アジア太平洋地域市場は、約 33% の最大の市場シェアを保持すると予測されています

市場セグメンテーションシェア、光タイプ別 (%), 2037年

市場セグメンテーションシェア、地域別 (%)、2037 年

| 予測年 | : 2025 – 2037年 |

| 基準年 | : 2024年 |

| 最も急成長している市場 | : ヨーロッパ |

| 最大の市場 | : アジア太平洋地域 |

植物工場市場分析

植物工場は、産業自動化とバイオインフォマティクスを活用して、作物生産をまったく新しいモデルに変革することを目指す産業です。植物工場は、植物の自然な生育環境を模倣することで、最大の収穫量、収穫密度、経済的利益を達成することが予想されています。

植物工場市場の成長要因

植物工場市場における主な成長要因は次のとおりです。

-

人口増加と食糧需要の増加が植物工場市場の成長を促進 - 世界人口が増加するにつれて、食糧生産の増加の必要性も高まります。植物工場は、天候に関係なく、年間を通じて効率的かつ安定的に作物を生産する方法を提供します。食用作物の需要の増加により、屋外の植物と作物の生産に対する大きな需要が生まれました。当社の分析によると、食品業界は年間6.74%のCAGR(2024-2028年)で成長すると予想されています。食品市場は常に上昇傾向にあるため、植物工場市場も比例して成長します。

-

都市化が牽引する植物工場市場の成長:都市化の傾向により利用可能な農地が減少し、食糧生産のニーズを満たすことがさらに困難になっています。植物工場は都市部に設置できるため、食糧ベースの作物を生産するための長距離輸送の必要性が減ります。当社の分析によると、都市農業市場は2021-2028年の予測期間中に5.20%のCAGRで市場成長すると予想されています。都市化と都市作物の需要の絶え間ない増加は、都市植物工場産業の成長につながります。

最新の開発

- 2021年4月、ヨーロッパ連合は、世帯収入の向上と輸出市場へのアクセスを目的として、今後4年間でケニアの園芸部門に約6百万米ドルを投資すると発表しました。

- 2021年3月、日本の産学官コンソーシアムは、アジアモンスーン地域向けの植物工場システムの開発を発表しました。

市場の課題

高度な技術と管理された環境を備えた植物工場を設立するには、初期投資コストが高いため、多額の先行資本が必要になる場合があります。これには、照明、HVAC システム、自動化機器、その他のインフラストラクチャへの投資が含まれます。初期コストが高いと、潜在的な投資家が敬遠し、市場の成長が制限される可能性があります。

植物工場市場セグメンテーション施設別(%), 2037年

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

植物工場市場レポートの洞察

|

レポート洞察 |

|

|

CAGR |

約8% |

|

予測年 |

2025-2037年 |

|

基準年 |

2024年 |

|

予測年の市場価値 |

約390億米ドル |

植物工場市場のセグメンテーション

当社は、植物工場市場に関連するさまざまなセグメントの需要と機会を説明する調査を実施しました。当社は市場を施設別と光タイプ別にセグメント化しました。

植物工場は、施設に基づいて、温室、屋内、その他に分割されています。温室は通常、換金作物に使用される繊細な植物のために維持されます。これらはバラ、チューリップ、さらには野菜である可能性があります。ほとんどの植物は屋内で栽培されており、ハーブ、花、その他の薬用作物として使用されます。屋内植物はこのセグメントを支配しており、市場シェアの約60%を占めています。その成長の理由は、植物の成長を制御するエネルギー効率の高い工場システムの革新です。さまざまなセクターでエネルギー効率を改善することは、植物工場市場の成長につながる重要な課題です。当社の分析によると、エネルギー効率の高い管理システムは、2024-2028年に13.2%のCAGRで成長すると予想されています。

植物工場市場は、光タイプに基づいて、太陽光、人工光に分割されています。太陽光セグメントは、2037年までにかなりの市場シェアを占めると予測されています。太陽光は自然の光源です。そのため、ほとんどの植物工場は太陽光の利用を好みます。これらは、環境に優しい生産プロセスのために、太陽光を自由に利用できます。太陽光は温室農場でも利用されています。完全人工光セグメントも、将来的に大幅な成長が予想されています。このセグメントの成長は、屋内農場の数の増加によるものです。

|

施設 |

|

|

光タイプ |

|

植物工場市場の地域別概要

アジア太平洋地域は植物工場の潜在的市場であり、その成長は主に人口増加と経済の繁栄によるものです。作物生産の需要はピークを迎えており、スペースの活用が重要です。当社の分析によると、アジア太平洋地域の精密農業市場は、2021-2027年の予測期間中に7.9%のCAGRで成長すると予想されています。精密農業は、経済と人口の増加により増加します。この需要は、植物工場市場でも同様の成長につながります。アジア太平洋地域では同様の分野でさまざまな科学的発展があり、これらすべての要因が成長を導きます。

日本では、園芸と花卉栽培の需要増加により、植物工場市場が成長しています。当社の分析によると、日本の園芸市場は2024-2028年に3.5%のCAGRで成長すると予想されています。花卉生産と園芸の需要増加が、日本の植物工場市場の成長の理由です。

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ヨーロッパは植物工場市場において重要な地域です。この地域の市場成長の理由は、高度な研究開発と顧客の認知度です。当社の分析によると、ヨーロッパの精密農業市場は13.7%の成長率で成長し、2026年までに43.8億米ドルに達すると推定されています。ヨーロッパの精密農業市場の成長は、工場市場の発展と同様の結果をもたらす可能性があります。農村部でも農業の需要が高まっています。ヨーロッパでは耕作地が減少しているため、地元の需要を満たすのに十分な量の新鮮で高品質の農産物を生産することが難しくなっています。植物工場は、都市部で新鮮な地元産の農産物を生産し、近隣のコミュニティに配布することで、このギャップを埋めるのに役立ちます。

植物工場調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

植物工場市場の成長影響分析、地域別 (2025―2037年)

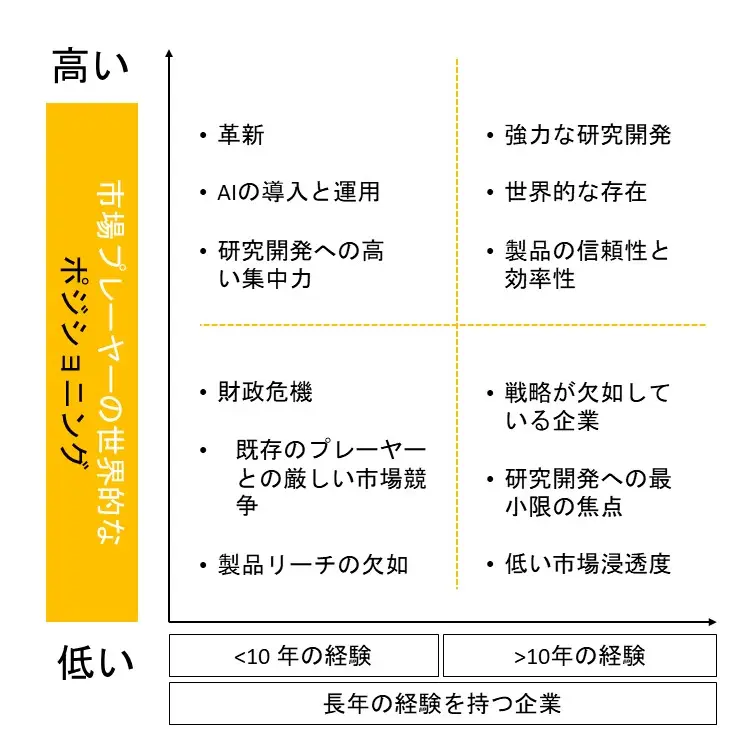

競争力ランドスケープ

世界の植物工場市場の主要プレーヤーとは、AeroFarms、BrightFarms、Gotham Greens、Bowery Farming、Transaera Inc. などが含まれます。さらに、日本の植物工場市場のトップ5プレーヤーは、NARK、Citi Inspire Minds、Ferma.ge、Water Design Japan、Momo Ltd. などです。この調査には、世界の植物工場市場における主要企業の詳細な競合分析、企業プロファイル、最近の傾向、主要な市場戦略が含まれています。

植物工場主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

植物工場マーケットレポート

関連レポート

- 2020ー2024年

- 2025-2037年

- 必要に応じて日本語レポートが入手可能