飼料アミノ酸市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― 家畜別、アミノ酸のタイプ別、形態別、及び地域別―世界市場の見通しと予測 2026-2035年

出版日: Nov 2025

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

飼料アミノ酸市場エグゼクティブサマリ

1) 飼料アミノ酸市場規模

飼料アミノ酸市場に関する弊社の調査レポートによると、市場は2026―2035年の予測期間中に複利年間成長率(CAGR)5.8%で成長すると予測されています来年には、市場規模は約14742百万米ドルに達すると見込まれています。

しかし、弊社の調査アナリストによると、基準年の市場規模は約8387百万米ドルでしました。動物性タンパク質の需要の高まりと効率重視の最適化により、飼料アミノ酸市場は世界的に拡大しています。

2) 飼料アミノ酸市場の傾向 – 好調な推移を示す分野

SDKI Analyticsの専門家によると、予測期間中に予測される飼料アミノ酸市場の傾向には、リジン、メチオニン、乾燥飼料などが含まれます。以下では、予測期間中に飼料アミノ酸市場を牽引すると予想される主要な傾向について、さらに詳しく説明します:

|

市場セグメント |

主要地域 |

CAGR (2026-2035年) |

主な成長要因 |

|

リジン |

アジア太平洋地域 |

5.9 % |

家禽類の需要の高まり、コスト最適化、飼料タンパク質比率の見直し |

|

メチオニン |

アジア太平洋地域 |

5.7 % |

含硫アミノ酸の不足、飼料配合バランス、養豚と水産養殖における需要の高まり |

|

乾燥(配合) |

北米/ヨーロッパ地域 |

5.5 % |

取り扱いやすさ、保存安定性、既存インフラ |

|

発酵製造法 |

アジア太平洋地域 |

6.0 % |

バイオ技術の進歩、規模の経済、環境負荷の低減 |

|

家畜(種) - 家禽 |

アジア太平洋地域 |

5.8 % |

家禽生産量の増加、飼料転換圧力、都市部におけるタンパク質消費 |

ソース: SDKI Analytics 専門家分析

3) 市場の定義 – 飼料アミノ酸とは何ですか?

飼料アミノ酸は、家畜のタンパク質必要量を満たすために工業的に製造され、飼料に添加される有機化合物です。リジンやスレオニンなどのアミノ酸は、飼料効率を向上させ、タンパク質合成を最適化します。飼料アミノ酸の世界市場は、持続可能な農業の基盤となっています。

これらのアミノ酸は、一次分類に基づいてL-リジン、DL-メチオニン、L-スレオニンに分類できます。さらに、グリシン、L-セリン、L-アルギニンに基づいて細分化できます。

4) 日本の飼料アミノ酸市場規模:

日本の飼料アミノ酸市場は、2035年まで複利年間成長率(CAGR)4.1%で成長すると予測されています。環境と規制への重点化は、日本市場の主要な成長刺激要因の一つです。陸上家畜に加え、アミノ酸プロファイルが飼料生産性と製品品質を向上させる、より付加価値の高い養殖種への利用が広がっています。供給の信頼性とバッチ間の一貫性への重点化は、ベンダーの選択と在庫計画に影響を与える可能性があります。

飼料効率と環境的に持続可能な畜産システムに関する政府のプログラムは、日本の飼料アミノ酸産業の主要な成長促進要因です。家禽や豚に加え、乳製品のアミノ酸バランス調整や水産動物飼料へのアプリケーションも進んでおり、窒素排泄量を抑えながら最適な成長を目指しています。日本では、「J-クレジット制度」により、窒素と温室効果ガスの排出量を最小限に抑える方法として、2025年5月に牛の飼料へのバイパスアミノ酸の使用が正式に承認されました。これは、炭素クレジットのインセンティブと給餌方法との関連性を示唆しています。

- 日本の現地市場プレーヤーの収益機会:

日本の現地市場プレーヤーにとって、飼料アミノ酸市場に関連するさまざまな収益機会は次のとおりです:

|

収益創出の機会 |

主要成功指標 |

主な成長要因 |

市場インサイト |

競争の激しさ |

|

豚用精密栄養配合 |

FCR(飼料要求率)の向上、窒素排泄量の減少 |

豚肉生産コストの上昇、廃棄物管理に関する環境規制の強化、赤身肉の品質向上への需要 |

日本の養豚生産者は、飼料効率の最適化と環境への影響軽減にますます注力しています;国の持続可能性目標に沿って、動物の健康をサポートし、過剰な栄養分の流出を抑制する、個々のニーズに合わせたアミノ酸プロファイルへの評価が高まっています。 |

高 |

|

高収量鶏(ブロイラー及びレイヤー)ソリューション |

平均日増体量(ADG)、卵塊産出量、卵殻質の均一性 |

鶏肉消費の安定、養殖業の集約化、安定した卵の品質に対する消費者の需要 |

家禽部門は利益率が低いため、費用対効果の高い高性能飼料が求められています;飼料メーカーは、特に自動化された大規模生産において、ブロイラーの成長率を最大化し、産卵鶏の産卵率と殻の強度を最大限に維持するために、精密なアミノ酸ブレンドを求めています。 |

高 |

|

高付加価値種向け水産養殖飼料 |

比成長率(SGR)、飼料摂取量、肉質マーカー |

政府による国内養殖の推進、高品質な魚(ブリ、サーモンなど)に対する消費者の強い嗜好、魚粉価格の変動 |

日本の水産養殖業界は、高度なアミノ酸強化を必要とする持続可能な植物由来の飼料へと移行しています;成功の鍵は、最適な成長と最終製品の望ましい味と食感を確保するために、従来の魚粉ベースの飼料の栄養プロファイルを反映した配合を開発することがあります。 |

中 |

|

ペットフード業界向け特殊飼料 |

Mask |

|||

|

持続可能かつ低炭素フットプリント飼料 |

||||

|

高齢化及び健康維持のための家畜飼料 |

||||

|

地域流通及び技術サービスパートナーシップ |

||||

|

輸入代替及び現地生産 |

||||

ソース: SDKI Analytics 専門家分析

- 日本の飼料アミノ酸市場の都道府県別内訳:

以下は、日本における飼料アミノ酸市場の都道府県別の内訳の概要です:

|

都道府県 |

CAGR (%) |

主な成長要因 |

|

東京都 |

6.2 % |

飼料研究開発企業の拠点、規制当局への近接性、物流面での優位性 |

|

大阪府 |

6.0 % |

農薬/バイオ技術クラスター、飼料添加物研究拠点 |

|

神奈川県 |

5.8 % |

東京市場への近接性、流通インフラ、実証農場 |

|

愛知県 |

Mask |

|

|

福岡県 |

||

ソース: SDKI Analytics 専門家分析

飼料アミノ酸市場成長要因

弊社の最新の飼料アミノ酸市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています:

-

持続可能性と低タンパク質ダイエット政策がアミノ酸サプリメントを推進:

弊社の調査報告書では、国家排出量目標と農場レベルの効率化プログラムによって推進されている、家畜からの窒素損失削減に向けた政策と研究の重点化が、必須アミノ酸を具体的な移行手段へと転換させつつあることを明らかにしています。さらに、ここ10年間のUSDA-ARSプロジェクトなどの政府研究プログラムは、腸管からの窒素排出量を削減し、飼料効率を向上させるための飼料添加物やアミノ酸製剤の研究に明示的に資金提供しており、アミノ酸中心のソリューションへの公的投資拡大を示唆しています。

さらに、エボニック、アディセオなどの業界リーダーは、合成アミノ酸が、パフォーマンスを維持しながら粗タンパク質飼料含有量を低減し、窒素排泄量と肥料相当量の環境影響を低減する技術的手段として公に位置付けています。飼料添加物に関する規則の改訂やガイダンス、国レベルの飼料品質監督通知などのEUの政策傾向は、飼料添加物製造者による精密栄養への取り組みをさらに後押ししています。政府が環境コンプライアンスやインセンティブを測定可能な削減(国家目標、農場レベルの管理計画)に結び付けている場合、アミノ酸補給は費用対効果の高いコンプライアンスツールとなり、環境政策を飼料中の合成アミノ酸に対する増分的で継続的な需要に変換します。

-

業界の供給側投資と生産能力の拡大:

弊社の分析によると、主要なアミノ酸生産企業は、世界的な供給弾力性を大幅に高める生産能力の拡大と垂直統合を進めています。例えば、アディセオの投資家向けと報道機関向け開示情報には、特定のメチオニングレードの単位当たり生産コストの削減とリードタイムの短縮を実現する具体的な生産量増加と工場の最適化が記載されています。

さらに、エボニックの財務報告書及び動物栄養事業の開示情報では、アミノ酸技術と規模の経済への投資が強調されています。これらの企業活動は、中国のMOA登録やDL-メチオニンの生産者リストといった各国の規制シグナル、そしてこれまで供給のボトルネックとなっていた貿易傾向への対応策があります。

その影響は、主要な飼料アミノ酸(メチオニン、リジン、スレオニン、バリン)の世界的な設備容量の拡大、地理的柔軟性の向上(地域的な液体供給と粉末供給)、そしてスポットプレミアムへの下方圧力に表れています。これにより、より多くの飼料配合者にとってアミノ酸補給が経済的に実現可能となり、価格に敏感な地域での大量導入が加速すると予測されます。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

レポートの洞察 - 飼料アミノ酸市場の世界シェア

SDKI Analytics の専門家は、飼料アミノ酸市場の世界シェアレポートに関して、以下のように洞察を共有しています:

|

レポートの洞察 |

|

|

2026-2035年のCAGR |

5.8% |

|

2025年の市場価値 |

8,387 百万 |

|

2035年の市場価値 |

14,742 百万 |

|

過去のデータ共有 |

過去5年間(2024年まで) |

|

将来予測 |

今後10年間(2035年まで) |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

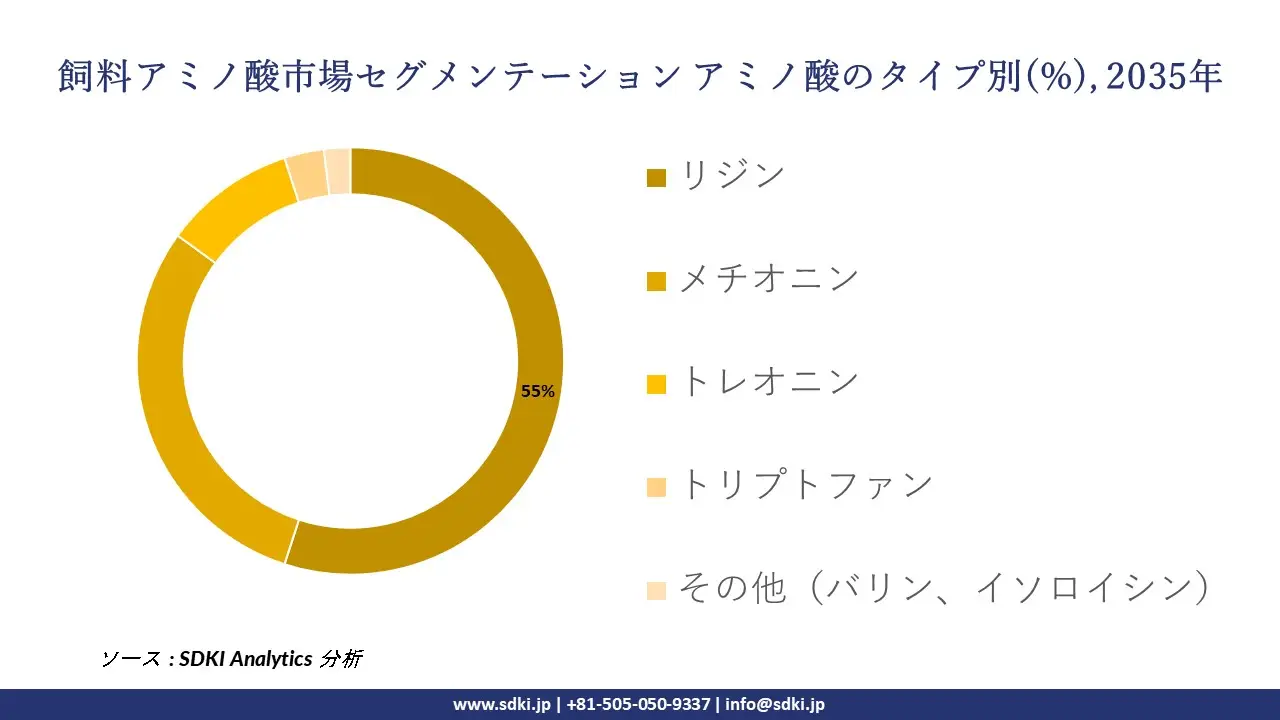

飼料アミノ酸市場セグメンテーション分析

飼料アミノ酸市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場を家畜別、アミノ酸のタイプ別、形態別に分割されています。

家畜別に基づいて、市場は家禽類、豚、水産養殖、反芻動物、その他(ペット、馬)に分割されています。これらの中で、家禽類サブセグメントは市場をリードしており、予測期間中に世界市場シェアの45%を占めると予想されています。世界市場におけるタンパク質需要の高まり、持続可能性への要求、そして効率性への圧力により、家禽類における飼料アミノ酸のアプリケーションが拡大しています。世界人口の増加と発展途上国における購買力の向上は、動物性タンパク質の消費量を押し上げています。飼料アミノ酸の導入は、生産コストの抑制と原材料の変動性管理に役立ちます。これらに加え、持続可能性に向けた規制上の要求事項は栄養素の排泄に焦点を当てており、市場は合成アミノ酸と適切に調和した低タンパク質飼料の採用を迫られています。

アミノ酸のタイプ別に基づいて、リジンが、メチオニン、トレオニン、トリプトファン、その他(バリン、イソロイシン)などに分割されています。リジンは予測期間中に世界市場シェアの55%を占めると予測されています。単胃動物の生産、持続可能性を促進する要因、そして低コスト製剤の採用の増加は、リジンの採用率を押し上げています。家禽及び豚の生産拡大は、リジン消費量の増加に自動的に影響を与えています。弊社の調査アナリストの観察によると、合成リジン1kgの導入は、約50kgの大豆粕の節約につながり、飼料の環境フットプリントの削減につながります。これは、リジンの市場採用率を環境規制に合わせて拡大するものがあります。

以下は、飼料アミノ酸市場に該当するセグメントのリストです:

|

サブセグメント |

|

|

家畜別 |

|

|

アミノ酸のタイプ別 |

|

|

形態別 |

|

ソース: SDKI Analytics 専門家分析

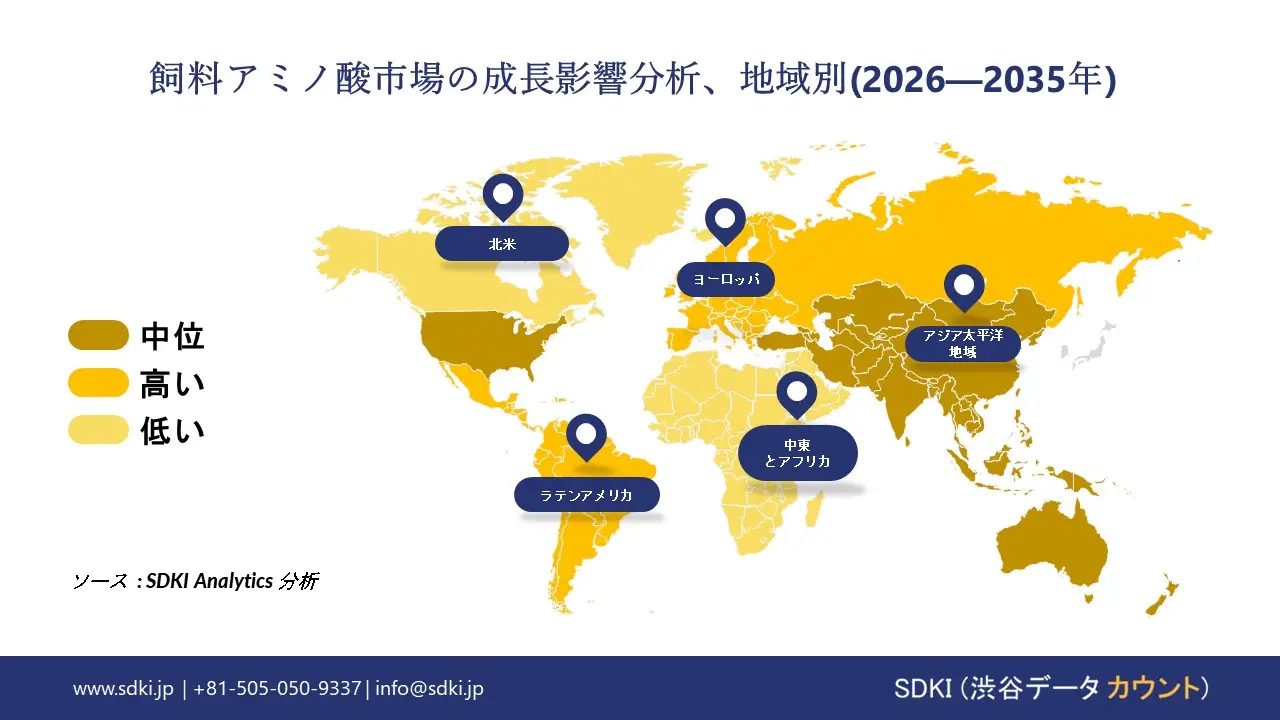

世界の飼料アミノ酸市場の調査対象地域:

SDKI Analyticsの専門家は、飼料アミノ酸市場に関するこの調査レポートのために、以下の国と地域を調査しました:

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

飼料アミノ酸市場の制約要因

飼料アミノ酸市場における世界的なシェア拡大を阻害する主な要因の一つは、原料価格の高騰です。飼料原料の発酵に必要なサトウキビ、糖蜜、トウモロコシなどの農産物価格は、収穫量、天候、バイオ燃料政策などによって変動し続けます。この変動は、リスクの増大とサプライチェーンの混乱を招き、市場の成長を鈍化させます。さらに、農家はアミノ酸よりも安価なタンパク質源を好む傾向があるため、市場の成長をさらに阻害しています。

飼料アミノ酸市場 歴史的調査、将来の機会、成長傾向分析

飼料アミノ酸製造業者の収益機会

世界中の飼料アミノ酸製造業者に関連する収益機会の一部を以下に示します:

|

機会領域 |

対象地域 |

成長要因 |

|

特殊と機能性アミノ酸(例:免疫、ストレス、腸内環境改善のためのブレンド) |

ヨーロッパ |

抗生物質不使用で福祉志向の畜産に対する規制と消費者の圧力が高まり、機能性栄養ソリューションの需要が高まっています |

|

精密配合飼料サービス(ソフトウェア+プレミックス) |

北米 |

強力なデジタルインフラと、飼料インテグレーターによる配合分析のアウトソーシングへの意欲 |

|

養殖業向けアミノ酸ライン |

アジア太平洋地域 |

東南アジア、中国、インドにおける水産養殖業の急速な拡大により、種に合わせたアミノ酸サプリメント(グルタミン酸、バリンなど)の需要が高まっています |

|

発展途上市場における輸入代替/現地生産 |

Mask |

|

|

中東とアフリカにおけるプレミアム飼料強化 |

||

|

ティア2/農村部向け飼料工場とのパートナーシップ |

||

|

バイオベース/再生可能原料アミノ酸 |

||

|

インテグレーター向け受託研究開発+カスタムブレンド |

||

ソース: SDKI Analytics 専門家分析

飼料アミノ酸の世界シェア拡大のための実現可能性モデル

弊社のアナリストは、飼料アミノ酸市場の世界シェアを分析するために、世界中の業界専門家が信頼し、適用している有望な実現可能性モデルをいくつか提示しました:

|

実現可能性モデル |

地域 |

市場成熟度 |

医療システムの構造 |

経済発展段階 |

競争環境の密度 |

適用理由 |

|

現地インテグレーターとの合弁事業 |

ラテンアメリカ |

新興 |

ハイブリッド |

新興国 |

中 |

地域の飼料統合業者ネットワークと、現地のライセンスと規制に関する知識を活用します |

|

グリーンフィールド生産 + 輸出拠点 |

中東とアフリカ |

新生 |

主に公共/補助金付き |

発展途上国 |

低 |

輸入依存と物流コストを克服するために、現地生産体制を確立することで、地域の需要を喚起できます |

|

精密製剤サービス + サブスクリプションモデル |

北米 |

成熟 |

主に民間 |

先進国 |

高 |

顧客は、成熟した競争の激しい市場環境において、差別化されたデータ主導のサービスに対して対価を支払う意思があります |

|

ライセンス / 受託製造パートナーシップ |

Mask |

|||||

|

マルチモーダル流通 + マイクロプレミックス剤 |

||||||

|

共同開発と研究開発コラボレーション |

||||||

ソース: SDKI Analytics 専門家分析

市場傾向分析と将来予測:地域市場の見通しの概要

➤北米の飼料アミノ酸市場規模:

北米は2035年まで複利年間成長率4.8%で成長すると予測されています。米国とカナダでは、粗タンパク質を減らし、アミノ酸バランスを調整した飼料を用いたブロイラー、七面鳥、豚、乳製品の大規模生産が、コスト圧力と環境目標による成長を支えています。米国の家禽市場では、2023年の674億米ドルに対して2024年の売上高は702億米ドルとなり、年間を通じて飼料とタンパク質の需要が健全であったことを示しています。政府の報告によると、家禽と豚肉の生産は良好で、飼料穀物の供給も安定しており、これはアミノ酸の継続的な使用によるパフォーマンスの向上と粗タンパク質比率の低減を支えています。飼料効率の漸進的な向上と、商業用製粉所におけるアミノ酸の使用の標準化は、拡張された普及プログラムと栄養モデリングツールによって促進されています。

- 北米の飼料アミノ酸市場の市場強度分析:

北米の飼料アミノ酸市場に関連する国の市場強度分析は次のとおりです:

|

カテゴリー |

米国 |

カナダ |

|

市場の成長ポテンシャル |

非常に高 |

高 |

|

規制環境の複雑さ |

複雑性 |

複雑 |

|

主要アプリケーションと畜産への注力 |

家禽(ブロイラー、採卵鶏)、豚、水産養殖(育成)、乳製品 |

豚、乳製品、鶏肉、牛肉 |

|

主要アミノ酸とその傾向 |

Mask |

|

|

価格感度と製剤戦略 |

||

|

サプライチェーンと輸入依存度 |

||

|

競争環境 |

||

|

主要な推進要因と未充足ニーズ |

||

ソース: SDKI Analytics 専門家分析

➤ヨーロッパの飼料アミノ酸市場規模:

ヨーロッパは、予測期間中に4.5%の複利年間成長率(CAGR)を記録すると予想されています。この成長は、ドイツ、スペイン、フランス、オランダ、イギリスにおける豚、家禽、及び特殊種におけるアミノ酸の使用増加によって促進されます。これは主に、栄養管理とタンパク質効率目標に関する政策によるものがあります。

OECD-FAO農業展望2024-2033(2024年7月2日発行)は、ヨーロッパの飼料及び畜産分野が、粗タンパク質の投入量を削減しながら生産性を維持するために合成アミノ酸の使用を奨励する、新たな厳格な窒素及び環境政策の圧力に直面していると指摘しています。これらの政策的要請と、インテグレーター及び技術諮問グループの強力な存在が相まって、アミノ酸の着実な導入と処方変更を促進しています。

- ヨーロッパの飼料アミノ酸市場の市場強度分析:

ヨーロッパの飼料アミノ酸市場に関連する国の市場強度分析は次のとおりです:

|

カテゴリー |

イギリス |

ドイツ |

フランス |

|

市場の成長ポテンシャル |

高 |

非常に高 |

非常に高 |

|

規制環境の複雑さ |

複雑 |

複雑性 |

複雑性 |

|

主要アプリケーションと畜産への注力 |

家禽、豚、乳製品 |

豚(主に)、鶏、乳製品 |

家禽、豚、乳製品 |

|

主要アミノ酸とその傾向 |

Mask |

||

|

価格感度と製剤戦略 |

|||

|

サプライチェーンと輸入依存度 |

|||

|

競争環境 |

|||

|

主要な推進要因と未充足ニーズ |

|||

ソース: SDKI Analytics 専門家分析

➤アジア太平洋地域の飼料アミノ酸市場規模:

アジア太平洋地域は、2035年までに飼料アミノ酸市場の49%のシェアを獲得し、市場をリードすると予測されています。この急速な成長は、中国、インド、ベトナム、東南アジアにおける大規模な養鶏と養豚システムと精密栄養の導入拡大によって上回られています。2024年9月、中国農業農村部は、国内の養鶏生産量が年間約5.7%増加し、アミノ酸サプリメントなどの飼料投入物の需要が着実に増加すると報告しました。

これは、畜産と食事摂取における地域の絶え間ない進歩を浮き彫りにしています。飼料配合においても、飼料変換効率の向上と窒素損失の削減を目的として、リジン、メチオニン、スレオニン、トリプトファンの配合が主流となっています。統合飼料製粉及びプレミックス生産能力の継続的な成長により、単胃動物及び養殖飼料における結晶性飼料アミノ酸の仕様に基づいた消費への依存度が高まっています。

- アジア太平洋地域の飼料アミノ酸市場の市場強度分析:

アジア太平洋地域の飼料アミノ酸市場に関連する国の市場強度分析は次のとおりです:

|

カテゴリー |

日本 |

韓国 |

中国 |

インド |

|

市場の成長ポテンシャル |

中程度 |

高 |

極めて高 |

非常に高 |

|

規制環境の複雑さ |

複雑 |

複雑 |

複雑かつ進化しています |

複雑性 |

|

主要アプリケーションと畜産への注力 |

家禽、豚、水産養殖 |

家禽、豚、水産養殖 |

家禽(優勢)、豚、水産養殖、反芻動物 |

家禽(主要)、水産養殖(最も急成長)、酪農、豚 |

|

主要アミノ酸とその傾向 |

Mask |

|||

|

価格感度と製剤戦略 |

||||

|

サプライチェーンと輸入依存度 |

||||

|

競争環境 |

||||

|

主要な推進要因と未充足ニーズ |

||||

ソース: SDKI Analytics 専門家分析

飼料アミノ酸業界概要と競争ランドスケープ

飼料アミノ酸市場のメーカーシェアを独占する世界トップ10の企業は次のとおりです:

|

会社名 |

本社所在地 |

飼料アミノ酸との関係 |

|

ADM |

米国 |

飼料アミノ酸及びプレミックスを含む、幅広い動物栄養製品を製造しています。 |

|

CJ CheilJedang |

韓国 |

飼料グレードのリジン、スレオニン、トリプトファンの主要生産者である、世界有数のバイオ企業があります。 |

|

Evonik Industries AG |

ドイツ |

動物栄養用必須アミノ酸(MetAMINO®(メチオニン)、Biolys®(リジン)、ThreAMINO®(スレオニン)、TrypAMINO®(トリプトファン))の世界有数の生産者がいます。 |

|

Global Bio-Chem Technology Group |

Mask |

|

|

Bluestar Adisseo Co., Ltd. |

||

|

Novus International, Inc. |

||

|

Meihua Holdings Group Co., Ltd. |

||

|

Kemin Industries |

||

|

Prinova Group |

||

|

BASF SE |

||

ソース: SDKI Analytics 専門家分析及び企業ウェブサイト

飼料アミノ酸の世界及び日本の消費国上位10社は次のとおりです:

| 主要消費者 | 消費単位(数量) | 製品への支出 – 米ドル価値 | 調達に割り当てられた収益の割合 |

|---|---|---|---|

| Cargill, Incorporated |

|

||

| Zen-Noh (全国農業協同組合連合会) | |||

| XXXX | |||

| XXXXX | |||

| xxxxxx | |||

| xxxxxxxx | |||

| xxxxx | |||

| xxxxxxxx | |||

| xxxxxx | |||

| XXXXX | |||

日本の飼料アミノ酸市場メーカーシェアを独占する上位10社は次のとおりです:

|

会社名 |

事業状況 |

飼料アミノ酸との関係 |

|

Ajinomoto Co., Inc. |

日本発祥 |

アミノ酸科学の世界的リーダーとして、「AjiPro®」ブランドのもと、リジン、スレオニン、トリプトファンをはじめとする飼料アミノ酸全般を製造と販売しています。 |

|

Kyowa Hakko Bio Co., Ltd. |

日本発祥 |

キリングループの中核企業であり、日本を代表するバイオケミカルメーカーとして、動物栄養用飼料アミノ酸の製造と販売を行っています。 |

|

Mitsui & Co., Ltd. |

日本発祥 |

飼料添加物及びアミノ酸の輸入、販売、流通を日本国内で展開する大手商社があります。 |

|

Sumitomo Corporation |

Mask |

|

|

Marubeni Corporation |

||

|

Sojitz Corporation |

||

|

DSM-Firmenich |

||

|

Alltech Inc. |

||

|

Nutreco N.V. (Trouw Nutrition) |

||

|

Cargill, Incorporated |

||

ソース: SDKI Analytics 専門家分析及び企業ウェブサイト

飼料アミノ酸 市場 包括的企業分析フレームワーク

市場内の各競合他社について、次の主要領域が分析されます 飼料アミノ酸 市場:

- 会社概要

- リスク分析

- 事業戦略

- 最近の動向

- 主要製品ラインナップ

- 地域展開

- 財務実績

- SWOT分析

- 主要業績指標

飼料アミノ酸市場最近の開発

世界及び日本における飼料アミノ酸市場に関連する最近の商業的発売及び技術の進歩の一部を以下に示します:

|

日付(月と年) |

関係企業/機会 |

飼料アミノ酸市場とのつながり |

|---|---|---|

|

2024年1月 |

飼料教育研究機関(IFEEDER) |

IFEEDERは、ビタミン及びアミノ酸のサプライチェーンに関する戦略的分析を行うための提案募集を開始しました;これにより、サプライチェーンのレジリエンスが強化され、飼料用必須栄養素への確実なアクセスが確保されます。 |

|

2025年2月 |

ITOCHU Corporation & Sumitomo Chemical |

ITOCHUは、住友化学が生産するメチオニンの全量を2025年4月以降に供給する包括的パートナーシップを発表しました;これにより、家畜の栄養と成長効率に不可欠なアミノ酸であるメチオニンの世界的な供給拡大が期待されます。 |

ソース:各社プレスリリース

目次

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能