航空機座席市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析 ― クラス別、座席タイプ別、材料別、成分別、フィットメント別、最終用途別、地域別―世界市場の見通しと予測 2026-2035年

出版日: Jan 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

航空機座席市場規模

航空機座席市場に関する当社の調査レポートによると、市場は予測期間である2026―2035年の間に6.5%のCAGRで成長すると見込まれています。将来的には、市場規模は264億米ドルに達する見込みです。しかし、当社の調査アナリストによると、基準年の市場規模は141億米ドルと記録されています。航空機座席に関する当社の市場調査によると、アジア太平洋地域は予測期間を通じて約32%の主要市場シェアを維持し、中流階級人口の増加と急速な都市化、航空機の近代化プログラム、航空会社による積極的な航空機発注の結果として、今後数年間は有望な成長機会を示すと予想されます。

航空機座席市場分析

ある航空機座席デザイナーは、混雑した滑走路を見つめ、摩擦から生まれるビジネスチャンスを思いつきました。世界中で、窮屈な客室、乗客の期待の高まり、そして航空会社による燃料消費削減への圧力が、航空機座席市場の成長を最も促進する課題となっています。最近の市場見通しにまとめられ、業界調査レポートにも反映されている世界的なデータと事実は、軽量素材、モジュール式レイアウト、そしてよりスマートな快適機能への明確なシフトを示しており、改修型及び次世代の座席ソリューションへの需要を生み出しています。

日本を取り巻く状況は急速に変化しており、国内航空会社とメーカーは空港スペースの逼迫と旅行者の高齢化に直面しています。これは、人間工学、支援機能、そして効率的な通路計画の改善への関心の高まりを示しています。同じ調査レポートに掲載されている日本のデータとデータは、オーダーメイドの乗客中心の設計と現地供給パートナーシップへの顕著な傾向を強調しています。さらに、不快感や運用コストに関する苦情のたびに生じる過密状態や座席の非効率性に関する問題は、この分野におけるイノベーションの原動力となります。こうした進歩の波は、これらの問題を解決できる企業にとって有利な市場展望をさらに形作っていくです。

航空機の座席とは、乗客と乗務員のために飛行機に座席を配置したもので、通常は列状に並んでいます。これらは主に安全性、快適性、そしてスペース効率を高めるために設計されており、従来の航空機と現代の航空機ではそのデザインが大きく異なります。当社の航空機座席市場分析調査レポートによると、以下の市場傾向と要因が市場成長の主因となると予測されています。

- 増加する世界の航空旅客輸送量 –

国際航空運送協会(IATA)によると、世界中で毎年12.5百万人以上が航空機で旅客輸送されています。さらに、航空輸送行動グループ(ATAG)によると、2023年だけで世界中で35.3百万便以上の商業便が離陸しました。

航空会社の保有機材と運航便数の拡大により、航空会社は新しい座席設備への投資を迫られています。この成長は、インド、中国、日本、韓国といった新興の航空ハブにおいて特に顕著です。これらの地域では、可処分所得の増加と観光客の拡大が旅行活動を加速させています。さらに、長距離国際線の増加も相まって、航空会社は競争力維持のため客室内装の刷新を迫られています。

- プレミアム旅行とビジネスツーリズムの成長 –

プレミアムクラス、ビジネスクラス、ファーストクラスの航空旅行体験の人気が高まるにつれ、高価値な航空機の座席配置に対する需要が大きく高まっています。これはまた、企業の国際旅行再開を促し、プライバシー、快適性、そして機内生産性の向上を実現するプレミアムキャビンへのアップグレードの需要を高めています。

一方、航空旅行サービス事業者は、この傾向を捉え、フルフラットシート、パーソナルスイート、充実したアメニティを導入することで、高収益の乗客を惹きつけています。さらに、プレミアムキャビンによる高い利益率確保の可能性は、航空会社に差別化された座席への投資を促しています。これは、商品全体の業界価値を高めるだけでなく、デザイン、部品、そして座席内エンターテイメントにおけるイノベーションを促進することにもつながります。

日本の現地企業にとって、航空機座席市場の収益創出ポケットとは何ですか?

日本国内の現地企業は、国内でのプレゼンスの強化、政府支援の重視、そして客室内装品のパイプライン構築を通じて、航空機座席輸出の継続的な拡大を支えており、好立地にあります。これは、経済複雑性観測所(OEC)によると、2025年8月の日本における航空機部品の出荷額が前年比で輸出が26%、輸入が19%増加したことからも明らかです。

これは、シートメーカーが活用できる確立された供給基盤と輸出チャネルを反映しています。特に、経済産業省(METI)の航空宇宙戦略とサプライチェーン強化イニシアチブは、サプライヤーによるグローバルバリューチェーンへの参入、海外現地生産の支援、研究開発及びパートナーシッププログラムの提供を明確に奨励しており、シートメーカーが輸出契約を獲得するための参入障壁を低減しています。

日本航空機整備株式会社(JAMCO)をはじめとする客室内装専門企業をはじめとする国内大手企業は、プレミアムシートや軽量シートといったソリューションへの製品ラインアップの見直しを進め、国際的なOEMや航空会社の顧客獲得に努めており、業界全体の輸出拡大に向けた勢いを示しています。輸入の観点から見ると、日本は依然として航空機システム及び部品の大規模な純輸入国であり、国内シートメーカーが輸出可能な競争力へと転換できる現地での下請けや技術移転の機会が維持されています。

現実的な市場見通しでは、こうした政策支援、国内供給網の変化、そして企業によるプレミアムシート分野への再参入の動きが相まって、日本は海外における改造・OEMシートの受注獲得能力を高めています。業界関係者が最近の調査報告書や貿易統計を参照する際、共通して挙げているのは、政府の支援、能力向上、そして戦略的な海外提携という3つの促進要因です。これらは、日本企業が世界の航空機座席市場で輸出を拡大し、より高い価値を獲得するための主要なチャネルです。さらに、航空機座席における軽量素材やモジュール設計の導入は、このセクターにとって進歩的な環境を確保しています。

市場の制約

世界の航空機座席市場における大きな制約の一つは、複雑な規制承認プロセスであり、これが製品開発のタイムラインを長期化させています。当社の最近の調査レポートで指摘されているように、メーカーは厳格な安全要件と認証要件を満たす必要があり、これが設計の遅延や制約につながっています。これはイノベーションのスピードを阻害するだけでなく、次世代の軽量スマートシートソリューションの市場全体の見通しにも影響を与えています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

航空機座席市場レポートの洞察

SDKI Analyticsの専門家によると、航空機座席市場の世界シェアに関連するレポートの洞察は以下のとおりです。

|

レポートの洞察 |

|

|

2026―2035年のCAGR |

6.5% |

|

2025年の市場価値 |

141億米ドル |

|

2035年の市場価値 |

264億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

航空機座席市場セグメンテーション

航空機座席市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場をクラス別、座席タイプ別、材料別、成分別、フィットメント別、最終用途別にセグメントに分割されています。

座席タイプ別 –

座席タイプ別の航空機座席市場予測によると、標準固定バックもたれシートは予測期間中に市場シェアの35%を占め、市場を牽引すると予想されています。これは、乗客密度の向上とコスト効率の改善において、これらのシートが重要な役割を果たしていることを反映しています。当社の調査によると、これらのシートは、手頃な価格と規制遵守のバランスを取る上で、エコノミークラスの座席配置の基盤となっています。

業界調査報告書によると、座席タイプ分野では、軽量素材の使用や人間工学に基づいた改良が進み、安全性と乗客の快適性を確保しながら、高密度座席配置を優先する傾向が強まっています。市場予測では、長距離路線ではプレミアムシートの需要が高まっているものの、短距離路線においては固定式背もたれシートが依然として不可欠であることが示されています。

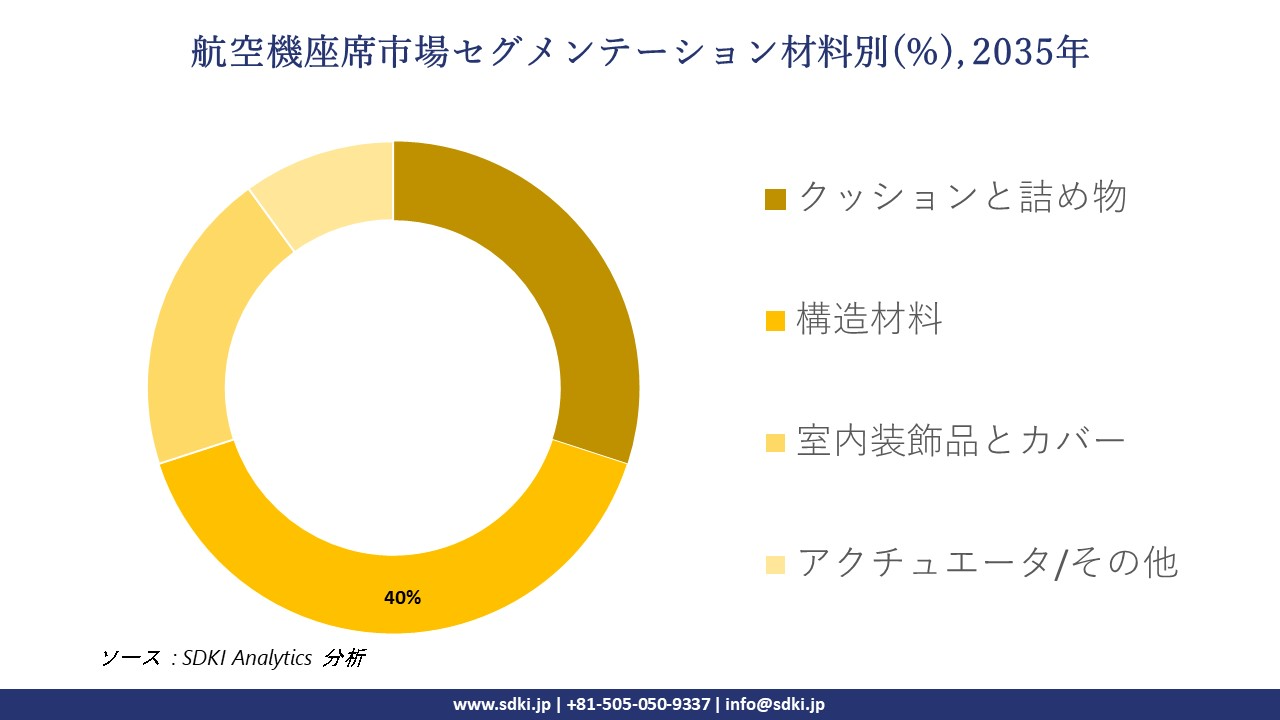

材料別 -

材料セグメントにおける市場見通しによると、構造材料は、先進複合材料や軽量合金の採用に牽引され、予測期間中に40%の市場シェアを獲得し、市場をリードすると予想されています。これらの材料は、航空機の燃費、耐久性、そして厳格な安全基準への適合に直接影響を与えます。

当社の調査レポートで強調されているように、航空会社とOEMは、運航コストと炭素排出量の削減を目指し、構造革新を優先しています。さらに、市場見通しは、特に航空業界において持続可能性が重要な焦点となるにつれて、高強度で軽量な座席構造に対する需要の高まりに焦点を当てており、この需要は今後も増加し続けるです。

航空機座席市場に該当するセグメントのリストです。

|

親セグメント |

サブセグメント |

|

クラス別 |

|

|

座席タイプ別 |

|

|

材料別 |

|

|

成分別 |

|

|

フィットメント別 |

|

|

最終用途別 |

|

ソース: SDKI Analytics 専門家分析

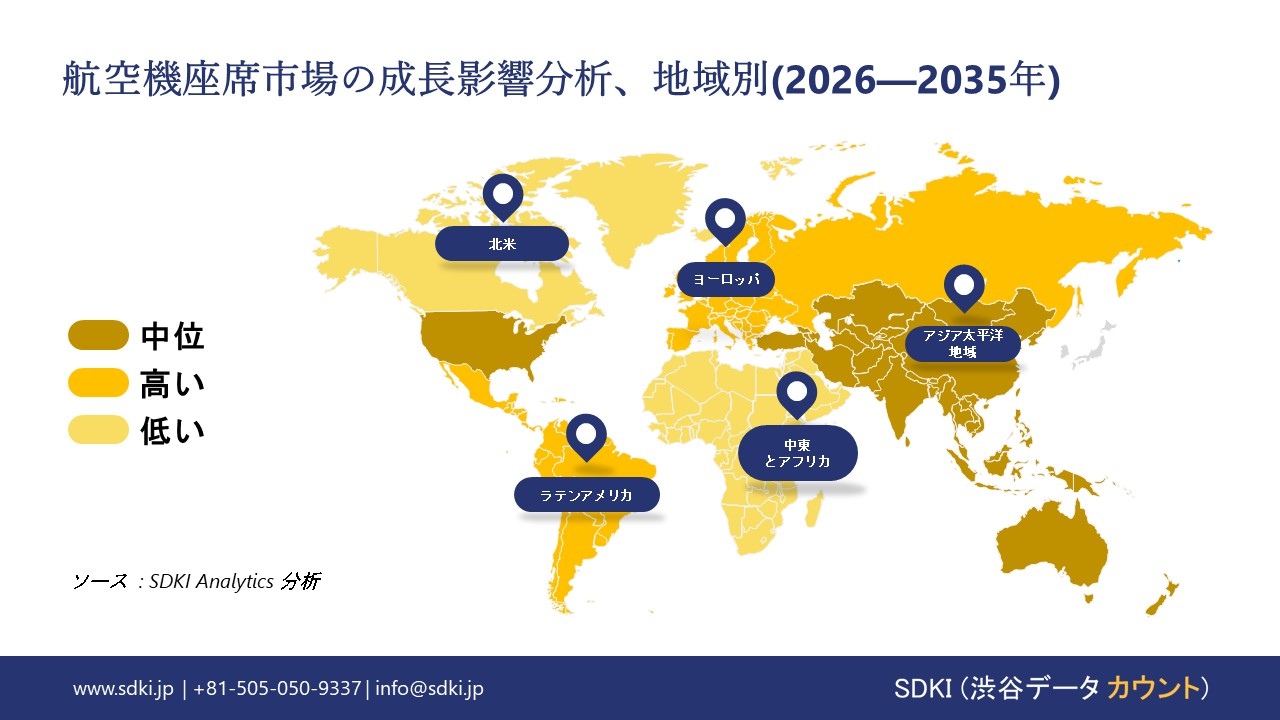

航空機座席市場傾向分析と将来予測:地域市場展望概要

航空機座席市場は、中国、インド、東南アジア全域での航空旅行の増加に伴う航空機の急速な拡大に支えられ、32% の最大の市場シェアを維持し、予測期間内に 7.2% の CAGR で最も急速に成長する市場となり、力強い勢いを見せています。

当社の最新調査レポートによると、中国は客室内装のアップグレードと長距離路線向けワイドボディ機の拡充に多額の投資を行っています。さらに、韓国でも需要が高まっており、国際線での競争力強化のため、プレミアムキャビンの改修を優先しています。当社の市場見通しで強調されているように、この地域の力強い経済成長と継続的な空港近代化の取り組みは、アジアの成長をさらに後押しするです。

日本の航空機座席市場は、主要航空会社による着実な機材近代化計画と、プレミアムキャビンへの継続的な投資(複利年間成長率6.5%)の影響を受けています。当社の市場見通しで述べたように、日本の航空会社は燃費性能と乗客の快適性を向上させるため、高効率で軽量なシートに注力しており、カスタマイズシートの需要も高まっています。

SDKI Analyticsの専門家は、航空機座席市場に関するこの調査レポートのために、以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東及びアフリカ |

|

ソース: SDKI Analytics 専門家分析

北米の航空機座席市場は、堅調な機材更新プログラムと米国及びカナダにおける航空旅行の急速な回復に支えられ、着実な成長を続けると予想されています。当社の調査レポートによると、この地域の主要航空会社のほとんどが、人間工学の向上、軽量化、そして客室の柔軟性向上を実現した次世代の座席ソリューションに注力しています。

さらに、長距離国際路線の成長は、プレミアムキャビンシート、特にフルフラットシートのビジネスクラスとプレミアムエコノミークラスへの投資を促進しています。当社の市場見通しで強調されているように、LCCネットワークの持続的な成長も、高密度で省スペースな座席設計の採用を促進しています。

航空機座席調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

SDKI Analyticsの調査者によると、航空機座席市場の見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートでは、市場プレーヤーは、製品や技術の投入、戦略的パートナーシップ、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体における競争優位性を獲得しようとしていると指摘されています。

当社の調査レポートによると、世界の航空機座席市場の成長において重要な役割を果たしている主要企業には、Safran Seats、 Collins Aerospace (RTX)、 RECARO Aircraft Seating、 STELIA Aerospace (Airbus の子会社)、 Thompson Aero Seatingなどが含まれます。さらに、市場展望によると、日本の航空機座席市場における上位5社は、JAMCO Corporation、 Toyota Boshoku Corporation、 ANA Trading Co. Ltd.、 Japan Aviation Electronics Industry (JAE)、 Yokohama Rubber Co. Ltdなどです。本市場調査レポートには、これらの主要企業の詳細な競合分析、企業概要、最近の傾向、主要な市場戦略が含まれています。

航空機座席市場ニュース

- 2023年11月、Emiratesはサフラン航空と総額12億米ドルに上る複数の大型契約を締結したことを発表しました。契約の最大の部分は、Emirates航空が今後導入するエアバスA350型機とボーイング777X-9型機に搭載されるサフラン社の最新鋭機用シートです。

- Toyota Boshokuは2023年4月、ボーイング737 MAXファミリー向けシートが「提供可能製品」としてBoeingより正式に承認されたことを発表しました。これにより、航空会社はBoeing737 MAXの新規発注時にToyota Boshokuのシートを選択できるようになります。

航空機座席主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

航空機座席マーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能