5G市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析 ― ネットワークタイプ別、エンドユーザー別、アプリケーション別、成分別、スペクトラムバンド別、地域別―世界市場の見通しと予測 2026-2035年

出版日: Jan 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

5G市場エグゼクティブサマリ

1) 5G市場規模

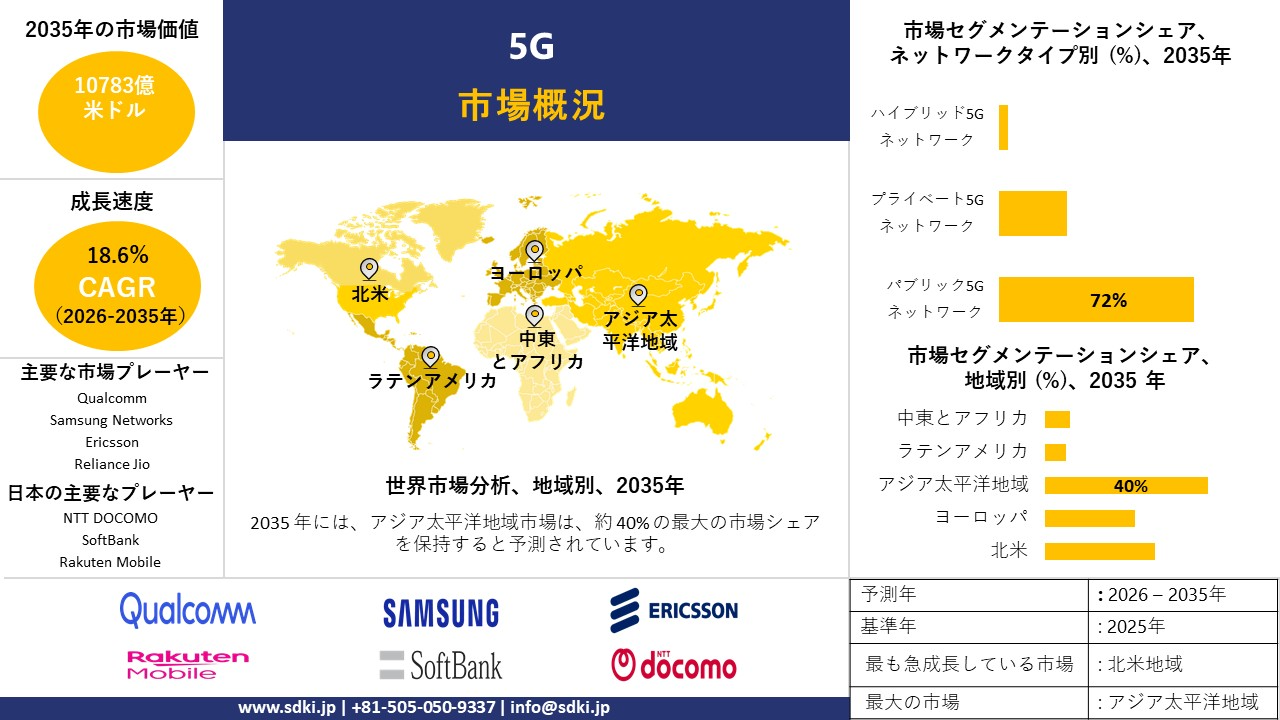

当社の5G市場調査レポートによると、市場は予測期間(2026―2035年)において複利年間成長率(CAGR)18.6%で成長すると予想されています。2035年には、市場規模は10783億米ドルに達すると見込まれています。

しかし、当社の調査アナリストによると、基準年の市場規模は1,954億米ドルに達しました。スタンドアロン5G及びミリ波導入へのネットワーク投資の増加、そしてURLLC、プライベート5G、エッジコンピューティングを導入した製造、自動車、ヘルスケア分野における企業のデジタルトランスフォーメーションが、世界市場の主要な成長推進要因となっています。

2) 5G市場の傾向 – 好調な推移を示す分野

SDKI Analyticsの専門家によると、予測期間中に予測される5G市場の傾向には、 eMBB 、FWA、プライベート5Gなどの分野が含まれます。予測期間中に5G市場を牽引すると予想される主要な傾向について、以下に詳細をご紹介します。

|

市場セグメント |

主要地域 |

CAGR(2026―2035年) |

主要な成長推進要因 |

|---|---|---|---|

|

eMBB (消費者向け) |

アジア太平洋地域 |

18.5% |

密集した都市での展開、デバイスのアップグレードサイクル、ビデオストリーミングの需要 |

|

FWA(固定無線) |

北米 |

19.2% |

光ファイバーの代替、郊外エリアの拡大、ARPUの向上 |

|

プライベート5G(産業用) |

ヨーロッパ |

19.0% |

工場自動化、企業向けスペクトルポリシー、OT-IT融合 |

|

URLLCアプリケーション |

アジア太平洋地域 |

19.3% |

ロボットの精度、遠隔医療の信頼性、自律システム |

|

mMTC IoT |

ヨーロッパ |

18.2% |

スマートグリッド、物流追跡、自治体のデジタル化 |

ソース: SDKI Analytics 専門家分析

3) 市場定義 – 5G とは何ですか?

5Gは第5世代のモバイルネットワーク技術であり、モバイル通信システムにおける重要な発展を示すものです。IMT-2020イニシアチブの一環として、国際電気通信連合(ITU)と共同で、第3世代パートナーシッププロジェクト(3rd Generation Partnership Project)によって構築されることが決定されました。5Gネットワークは、超高速接続、低遅延、そしてIoTデバイスからスマート技術まで、幅広いスマート技術を接続する能力を提供するように設計されています。

4) 日本の5G市場規模:

日本の5G市場は、2026―2035年の予測期間を通じて複利年間成長率(CAGR)17.2%で成長すると見込まれています。この市場成長は、5Gネットワークカバレッジの拡大によって支えられています。CMS Lawの報告書によると、日本の5G人口カバレッジは2024年に98.1%に達し、これはNTT DocomoやKDDIなどの通信事業者によるインフラ導入の増加を物語っています。5Gネットワークカバレッジの拡大により、都市部と地方の両方で高速かつ低遅延のネットワークへのアクセスが確保され、消費者の5G導入と企業のイノベーションが促進され、日本の5Gエコシステムがデジタル成長の原動力となることが期待されます。

- 日本の現地市場プレーヤーの収益機会:

日本の現地市場プレーヤーにとって、5G市場に関連するさまざまな収益機会は次のとおりです。

|

収益創出の機会 |

主要成功指標 |

主な成長推進要因 |

市場洞察 |

競争の激しさ |

|

スマート製造業向けのプライベート5Gネットワーク |

大手工場での高い採用率、信頼性の高い稼働時間 |

産業オートメーションの需要、エッジコンピューティングの統合、インダストリー4.0に対する政府の支援 |

メーカーは、ロボット工学とマシンビジョンの安全で確定的な接続を優先しており、調達は接続性、セキュリティ、分析を含むバンドル ソリューションへと移行しています。 |

高い |

|

企業や住宅団地向けの固定無線アクセス(FWA) |

高い顧客満足度、強力なサービス継続性 |

都市の高密度化、迅速な展開の需要、光ファイバー代替の必要性 |

FWA は、ファイバーが限られている場合の柔軟なオプションとして位置付けられており、予測可能なインストールとサービスの移植性を重視する不動産管理者や企業にとって魅力的です。 |

中 |

|

メディア、ゲーム、コンテンツ配信のための 5G エッジ プラットフォーム |

一貫した低レイテンシ、高いプラットフォーム利用率 |

没入型コンテンツの成長、ライブストリーミングの拡大、OTTプロバイダーとの提携 |

メディア企業は、透過的な監視とスケーラブルなサービス モデルを採用することで、トラフィックのピーク時にユーザー エクスペリエンスを安定させるために、メトロ エッジ サイトにワークロードを共存させています。 |

中 |

|

スマートシティの5Gインフラ(交通、安全、公共サービス) |

Mask |

|||

|

自動車向け5G(V2X、テレマティクス、無線アップデート) |

||||

|

ヘルスケア5G(遠隔医療、遠隔診断、医療ロボット) |

||||

|

エンタープライズ ネットワーク スライシングと SLA に基づく接続 |

||||

|

5G NR を活用した産業用 IoT (IIoT) センサー ネットワーク |

||||

ソース: SDKI Analytics 専門家分析

- 5G市場の都道府県別内訳:

日本の5G市場の都道府県別の内訳の概要です。

|

県 |

複利年間成長率(%) |

主な成長要因 |

|---|---|---|

|

東京 |

17.8% |

エンタープライズ向けプライベート5Gパイロット、エッジデータセンター、スマートモビリティコリドー |

|

大阪 |

17.2% |

製造業の改修、物流拠点、自治体のスマートサービス |

|

神奈川 |

17.0% |

高度な医療システム、港湾自動化、都市IoTの高密度化 |

|

愛知 |

Mask |

|

|

福岡 |

||

ソース: SDKI Analytics 専門家分析

5G市場成長要因

当社の5G市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています。

-

大規模なインフラ投資と周波数割り当てが世界的な5G拡大を推進:

インフラと周波数帯への大規模な投資が、世界的な5G導入を牽引しています。これは、政府や通信事業者が有線、低帯域幅、中帯域幅、ミリ波といった戦略を推進した結果であり、5Gの利用可能性を高め、遅延を低減し、スタンドアロン5G、ネットワークスライシング、エッジコンピューティングといった技術の利用を可能にすることが期待されます。当社の分析によると、 2025年には世界の5G加入者数は30億人に達し、モバイル接続全体の3分の1を占めると予測されています。 各国間の周波数帯の調和と3GPP規格の導入により相互運用性が向上し、ベンダーエコシステムの共有によりコスト削減が実現しました。デジタル経済の拡大には、5Gから5G Advanced、そして6Gへの移行に依然として大規模な投資が必要となります。

産業用IoT(IIoT)と自動化は、ロボット、自律型マシン、予知保全に瞬時に接続するための極めて信頼性が高く低遅延な接続を求めており、世界的な5G導入の主力となっています。5Gを活用した自律型ロボットは、生産時間を25%短縮します。 製造業、物流センター、鉱業会社が構築するプライベート5Gネットワークは、コスト削減だけでなく、生産性向上や労働環境の改善にも貢献します。3GPP規格とエッジAIに支えられた5G技術は、スマートファクトリーや自律型サプライチェーンと同等の規模にまで浸透しています。産業界はまもなく5G-Advancedや6Gへと移行していくでしょうが、IIoTは依然として5Gの戦略的成長を支える長期的な主役であり続けるです。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

レポートの洞察 - 5G市場の世界シェア

SDKI Analyticsの専門家によると、5G市場の世界シェアに関連するレポートの洞察は以下のとおりです。

|

レポートの洞察 |

|

|

2026―2035年のCAGR |

18.6% |

|

2025年の市場価値 |

1954億米ドル |

|

2035年の市場価値 |

10783億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

5G市場セグメンテーション分析

5G市場の展望に関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場をネットワークタイプ別、エンドユーザー別、アプリケーション別、成分別、スペクトラムバンド別にセグメントに分割されています。

ネットワークタイプ別に基づいて、市場はパブリック5Gネットワーク、プライベート5Gネットワーク、ハイブリッド5Gネットワークに分割されています。当社の調査によると、パブリック5Gネットワークは2035年にはネットワークタイプセグメントの72%を占め、市場を牽引すると予想されています。パブリック5Gネットワークは、消費者と企業を網羅しているため、世界的に普及範囲が広く、市場に影響を与えています。

パブリックネットワークは、大衆市場を網羅するように設計されており、マクロセルと共有スペクトルを活用して数百万の加入者にサービスを提供することで、プライベートネットワークでは広域サービスでは実現できないビット単価の経済性を実現します。2023年には世界の5G接続数は15億に達し、その大部分はパブリック5Gネットワークによってカバーされます。今後、高速ネットワークのニーズが高まるにつれて、パブリックネットワークの数は増加し、このサブセグメントの市場シェアが拡大すると予想されます。

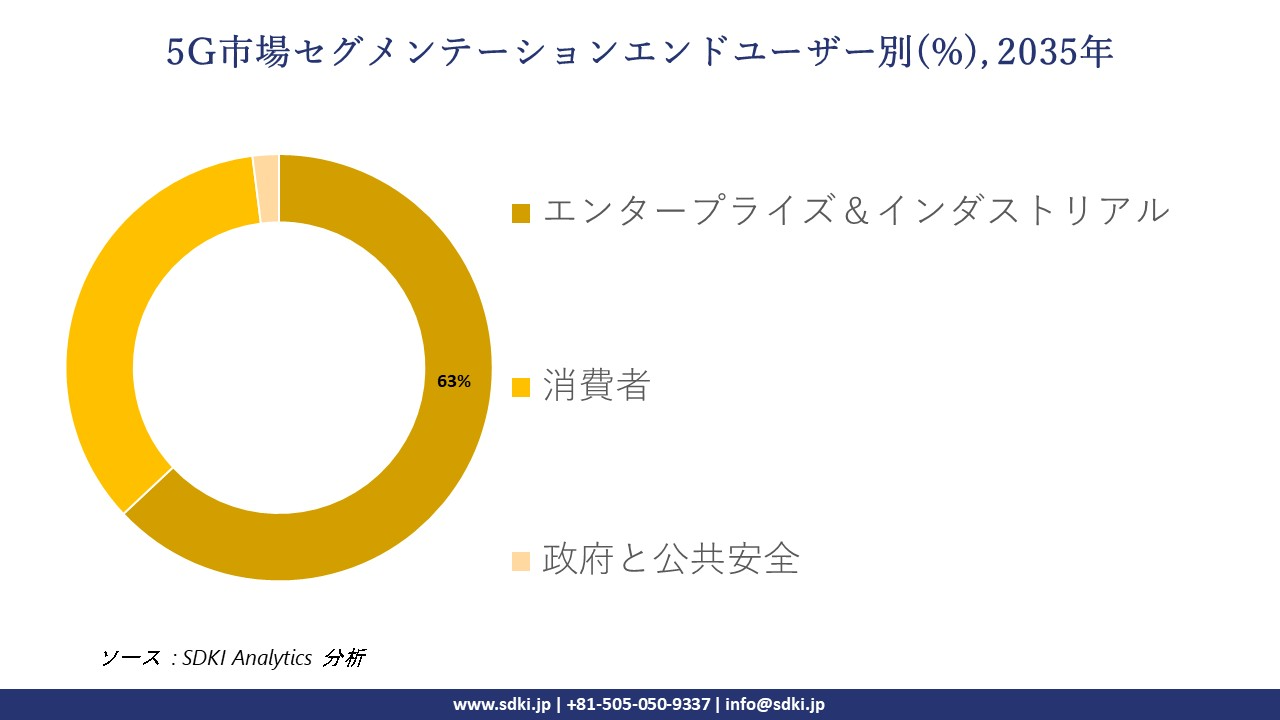

エンドユーザー別に基づいて、エンタープライズ&インダストリアル、消費者、政府と公共安全の3つに分割されています。市場調査では、産業界における5Gの積極的な活用により、エンタープライズ&インダストリアル分野が2035年には63%のシェアを占めると予測されていますこれは、組織が5Gを導入し、デジタルトランスフォーメーション、自動化、そして新たな運用モデルを実現する上で役立ちます。

当社の観察によると、世界のトップ5G市場では、2025年からの過去5年間で、平均ダウンリンクスループットが4倍以上増加しました。製造、物流、医療、公共事業における5Gの需要の増加は、5Gアプリケーションにプラスの影響をもたらしています。

以下は5G市場に該当するセグメントのリストです。

|

親セグメント |

サブセグメント |

|

ネットワークタイプ別

|

|

|

エンドユーザー別

|

|

|

アプリケーション別

|

|

|

成分別

|

|

|

スペクトラムバンド別

|

|

ソース: SDKI Analytics 専門家分析

世界の5G市場における調査対象地域:

SDKI Analyticsの専門家は、この5G市場に関する調査レポートのために以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東及びアフリカ |

|

ソース: SDKI Analytics 専門家分析

5G市場の制約要因

5Gの世界的な市場シェア拡大を阻む大きな要因の一つは、厳格な規制とコンプライアンスのハードルです。各地域の規制当局はそれぞれ異なる通信規制を施行しており、通信事業者はデータのプライバシー、セキュリティ、そしてサービス品質に関する厳格なコンプライアンス要件を満たすことが求められています。これらの規制上の障壁は、特に官僚的な手続きが煩雑な市場において、運用コストを増大させ、イノベーションのスピードを鈍化させます。

5G市場 歴史的調査、将来の機会、成長傾向分析

5Gメーカーの収益機会

5Gメーカーに関連する収益機会の一部は次のとおりです。

|

機会エリア |

対象地域 |

成長の原動力 |

|

高度な製造業とロボット工学のためのプライベート5G |

アジア太平洋地域 |

強力な産業デジタル化アジェンダと工場近代化プログラムにおける決定論的ワイヤレスの優先 |

|

オープンRAN無線及びソフトウェアエコシステム |

ヨーロッパ |

国内通信事業者間のベンダー多様化と相互運用性に向けた政策推進 |

|

mmWave固定無線アクセス機器 |

北米 |

密集した都市市場と企業の継続性ニーズによって促進される迅速なラストマイル代替手段の需要 |

|

メディアとゲーム向けの5Gエッジコンピューティングプラットフォーム |

Mask |

|

|

車載グレードの5GモジュールとV2Xインフラストラクチャ |

||

|

都市回廊向け小セル高密度化ソリューション |

||

|

5Gコアのスタンドアロンアップグレードとネットワークスライシングの有効化 |

||

|

5G NRを活用した産業用IoTデバイスエコシステム |

||

ソース: SDKI Analytics 専門家分析

5Gシェアの世界的拡大に向けた実現可能性モデル

当社のアナリストは、5G市場の世界シェアを分析するために、世界中の業界専門家が信頼し、適用している有望な実現可能性モデルをいくつか提示しました。

|

実現可能性モデル |

地域 |

市場成熟度 |

医療システムの構造 |

経済発展段階 |

競争環境の密度 |

適用理由 |

|

産業用プライベートネットワークインテグレーターモデル |

アジア太平洋地域 |

成熟した |

ハイブリッド |

発展した |

高い |

デバイス、クラウド、システム統合にわたるエコシステム パートナーとのプライベート ネットワークを採用している定着した製造業クラスターに適しています。 |

|

オープンRANコンソーシアムの展開モデル |

ヨーロッパ |

成熟した |

公共 |

発展した |

中 |

標準化団体と事業者が、多様なサプライチェーンに対するマルチベンダーの相互運用性とポリシーサポートについて連携します。 |

|

都市FWA拡張モデル |

北米 |

成熟した |

プライベート |

発展した |

高い |

企業や消費者が光ファイバーに加えて迅速な展開と多様なラストマイルオプションを重視する密集した市場で効果的です。 |

|

メトロエッジメディア配信モデル |

Mask |

|||||

|

コネクテッドカープラットフォーム共同開発モデル |

||||||

|

スモールセル・アズ・ア・サービス・モデル |

||||||

|

スタンドアロンコアモダナイゼーションモデル |

||||||

|

産業用IoTデバイスの認証とライフサイクルモデル |

||||||

ソース: SDKI Analytics 専門家分析

市場傾向分析と将来予測:地域市場の見通しの概要

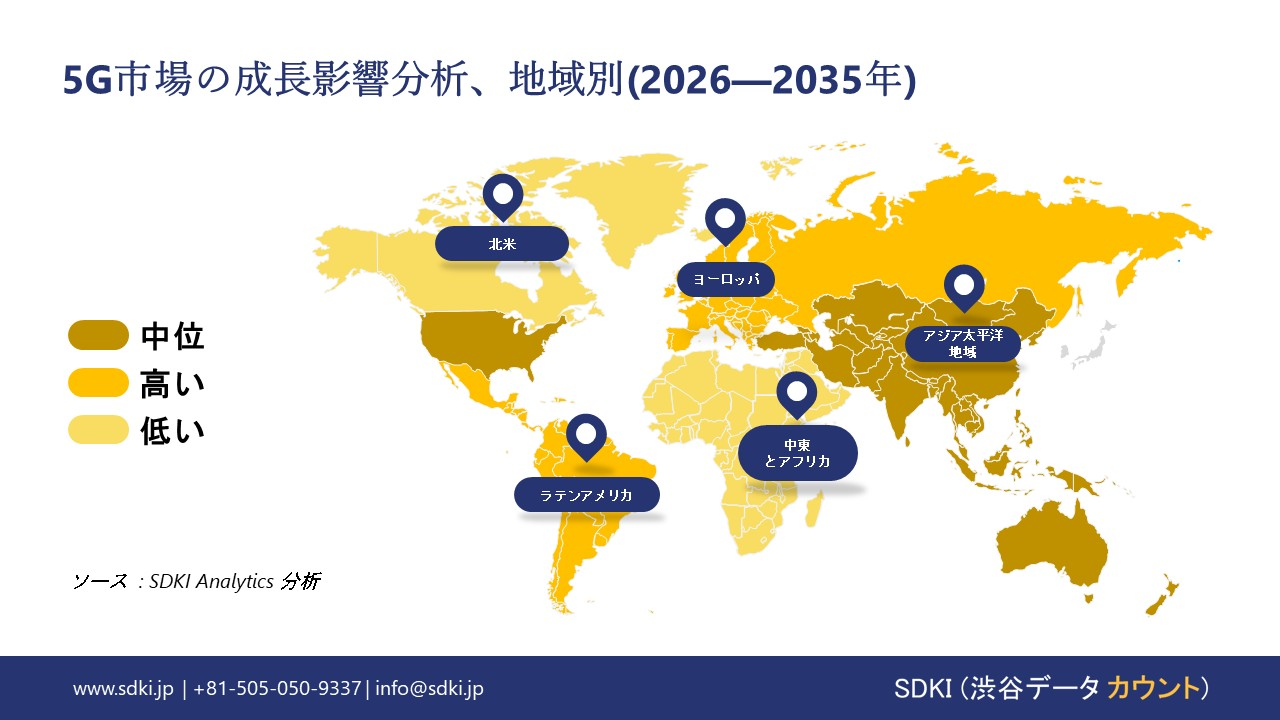

➤ 北米の5G市場規模:

製造、物流、ヘルスケア、エネルギーなど、さまざまな分野の企業による積極的なデジタルトランスフォーメーションが、北米における5G市場の成長を支えています。この成長傾向を踏まえ、当社の市場アナリストは、予測期間中に市場が18.8%という最速の成長率を達成すると予測しています。5Gの超低遅延、高い信頼性、そして大規模なIoT接続は、産業オートメーション、リアルタイムのリモートモニタリング、従業員のトレーニングやメンテナンスのための拡張現実(AR)といった重要なアプリケーションを可能にします。2021年2月に発表されたセルラー電気通信工業会(CTIA)のレポートによると、5Gの導入により4.6百万人の雇用が創出され、今後数年間でGDPは1.4―1.7兆米ドルに増加すると予想されています。

- 北米の5G市場の強度分析:

|

米国 |

カナダ |

|

|

市場の成長可能性 |

強い |

適度 |

|

規制環境の複雑さ |

複雑な |

標準 |

|

価格体系 |

市場主導型 |

ハイブリッド |

|

熟練した人材の可用性 |

Mask |

|

|

標準及び認証フレームワーク |

||

|

イノベーションエコシステム |

||

|

技術統合率 |

||

|

市場参入障壁 |

||

|

投資環境 |

||

|

ネットワークインフラストラクチャの統合 |

||

|

競争の激しさ |

||

|

エンタープライズ顧客の洗練度 |

||

|

デジタルインフラの準備 |

||

|

貿易政策の影響 |

||

ソース: SDKI Analytics 専門家分析

➤ ヨーロッパの5G市場規模:

SDKI市場調査アナリストの調査によると、ヨーロッパの5G市場は世界市場において大幅な成長が見込まれています。予測期間を通じて、ヨーロッパ市場は複利年間成長率(CAGR)18.5%で成長すると見込まれています。この市場成長は、5Gネットワークの普及拡大に牽引されています。国際移動通信システム協会(GSMA)のレポートによると、2024年にはヨーロッパのモバイル接続の30%(約2億人のユーザーに相当)を5Gが占め、2030年には約80%に達し、地域経済に1,640億ユーロの押し上げ効果をもたらすと予想されています。これは、消費者の旺盛な普及、企業のデジタル化への需要の高まり、そして支援的な規制枠組みが、5Gサービスへの投資と商業化を促進していることを示しています。

- ヨーロッパの5G市場の強度分析:

ヨーロッパの5G市場に関連する国の市場強度分析は次のとおりです。

|

カテゴリ |

イギリス |

ドイツ |

フランス |

|

市場の成長可能性 |

非常に高い |

強い |

非常に高い |

|

規制環境の複雑さ |

適度 |

高い |

適度 |

|

価格体系 |

競争力 |

プレミアム |

バランスの取れた |

|

熟練した人材の可用性 |

Mask |

||

|

標準及び認証フレームワーク |

|||

|

イノベーションエコシステム |

|||

|

技術統合率 |

|||

|

市場参入障壁 |

|||

|

投資環境 |

|||

|

サプライチェーン統合 |

|||

|

競争の激しさ |

|||

|

顧客基盤の高度化 |

|||

|

インフラの準備 |

|||

|

貿易政策の影響 |

|||

ソース: SDKI Analytics 専門家分析

➤ アジア太平洋地域の5G市場規模:

アジア太平洋地域の5G市場は、予測期間中に40%のシェアを占め、複利年間成長率(CAGR)18.7%を記録すると予想されています。中国、韓国、日本、インドが5Gの導入に注力し、より多くの産業が5Gを採用しているため、市場は急速に発展しています。GSMAのレポートによると、5G技術の導入が加速する中、モバイル産業がアジア太平洋地域の経済にもたらす貢献は、2030年までに1.5兆米ドルを超えると予想されています。この地域は、スモールセルネットワーク、光ファイバーバックホール、ミッドバンドスペクトルへの巨額の投資によって繋がれています。

プライベート5Gネットワークは、製造業、物流、スマートシティプロジェクトで広く利用されており、スマートフォンの普及率向上も、より多くの消費者をその方向に引きつけています。アジア太平洋地域は、政府の強力な支援と企業の大規模なデジタル変革により、5Gのイノベーションと商業化において世界で最も先進的な地域になりつつあります。

- アジア太平洋地域の5G市場の強度分析:

アジア太平洋地域の5G市場に関連する国の市場強度分析は次のとおりです。

|

カテゴリ |

日本 |

中国 |

インド |

マレーシア |

韓国 |

|

市場の成長可能性 |

高い |

非常に高い |

非常に高い |

適度 |

高い |

|

規制環境の複雑さ |

適度 |

高い |

高い |

適度 |

低い |

|

価格体系 |

プレミアム |

競争力 |

低い |

適度 |

プレミアム |

|

熟練した人材の可用性 |

Mask |

||||

|

標準及び認証フレームワーク |

|||||

|

イノベーションエコシステム |

|||||

|

技術統合率 |

|||||

|

市場参入障壁 |

|||||

|

投資環境 |

|||||

|

サプライチェーン統合 |

|||||

|

競争の激しさ |

|||||

|

顧客基盤の高度化 |

|||||

|

インフラの準備 |

|||||

|

貿易政策の影響 |

|||||

ソース: SDKI Analytics 専門家分析

5G業界概要と競争ランドスケープ

5G市場のメーカーシェアを独占する世界トップ10の企業は次のとおりです。

|

会社名 |

本社所在地国 |

5Gとの関係 |

|

Qualcomm |

米国 |

シリコンとプラットフォーム: 5Gモデム、RFシステム、RANプラットフォーム |

|

Samsung Networks |

韓国 |

ネットワーク機器: 5G RAN、コア、 mmWave 、Open RAN |

|

Ericsson |

スウェーデン |

ネットワーク機器とサービス: 5G RAN、コア、SA/NSAソリューション |

|

Nokia |

Mask |

|

|

Verizon |

||

|

AT&T |

||

|

Telstra |

||

|

Reliance Jio |

||

|

Vodafone |

||

|

Maxis |

||

ソース: SDKI Analytics 専門家分析と企業ウェブサイト

の5G消費者トップ10は次のとおりです。

| 主要消費者 | 消費単位(数量) | 製品への支出 – 米ドル価値 | 調達に割り当てられた収益の割合 |

|---|---|---|---|

| Walmart |

|

||

| DHL | |||

| XXXX | |||

| XXXXX | |||

| xxxxxx | |||

| xxxxxxxx | |||

| xxxxx | |||

| xxxxxxxx | |||

| xxxxxx | |||

| XXXXX | |||

日本5G市場のメーカーシェアを独占する上位10社は次のとおりです。

|

会社名 |

事業状況 |

5Gとの関係 |

|

NTT DOCOMO |

日本原産 |

オペレーター: 5G サービス、デバイス、エンタープライズ ソリューション |

|

KDDI (au) |

日本原産 |

事業者: 5Gコンシューマー、エンタープライズ/プライベート5G |

|

SoftBank |

日本原産 |

事業者: 5Gネットワーク、エンタープライズソリューション、プライベート5G |

|

Rakuten Mobile |

Mask |

|

|

NEC Corporation |

||

|

Fujitsu |

||

|

Sony (Xperia) |

||

|

Sharp (AQUOS) |

||

|

Hitachi |

||

|

Panasonic |

||

ソース: SDKI Analytics 専門家分析と企業ウェブサイト

5G 市場 包括的企業分析フレームワーク

市場内の各競合他社について、次の主要領域が分析されます 5G 市場:

- 会社概要

- リスク分析

- 事業戦略

- 最近の動向

- 主要製品ラインナップ

- 地域展開

- 財務実績

- SWOT分析

- 主要業績指標

5G市場最近の開発

及び日本における5G 市場に関連する最近の商用化及び技術進歩の一部は次のとおりです。

|

日付 |

会社名 |

発売の詳細 |

|

2025年11月 |

Qualcomm |

Qualcomm Technologiesは、PLC、高度なHMI、エッジコントローラー、パネルPC、ボックスPC向けに設計された次世代産業グレードプロセッサであるQualcomm Dragonwing IQ-Xシリーズの発売を発表しました。 |

|

2025年11月 |

NTT Docomo |

NTT DOCOMOは、第6世代移動通信システム(6G)向けAIを活用した無線技術を搭載したリアルタイム送受信システムを用いた世界初の屋外実証実験に成功したと発表しました。この実証実験は、NTT、ノキアベル研究所、SKTelecom Co., Ltd.と共同で実施しました。 |

ソース:名社プレスリリース

目次

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能