米国のレンタカー市場(以下、調査対象市場と呼ぶ)は、予測期間(2020~2025年)に約5.7%のCAGRを記録すると予想されています><

米国のレンタカー市場(以下、調査対象市場と呼ぶ)は、予測期間(2020~2025年)に約5.7%のCAGRを記録すると予想されています><。

- 排出量削減に対する懸念と意識の高まりは、主にレンタカーと相乗りが道路上の車の数を大幅に減らすのに役立つレンタカーオプションの増加につながっています.

- 米国のレンタカー市場における主要な傾向の1つは、一部のレンタカーフリートにおける電気自動車の使用の増加です。これは、ユーザーが通勤習慣においてより環境にやさしいためのかなりのオプションを提供します。さらに、レンタカーは、車両所有に関連するコストを支払うことを心配することなく、モビリティを向上させるオプションも提供します.

- これらのサービスは、レンタカー市場の成長を助けているウェブサイトや他のオンラインプラットフォームを介して提供されています。しかし、消費者が高級車を選択するオプションを控え、より経済的で費用対効果の高い車両オプションを求めるようになるため、運用コストの増加は市場の成長を妨げています

主な市場動向

レンタカー市場を牽引する観光産業の台頭< />

北米は、米国が地域市場を支配していた主要な観光産業の1つです。ニューヨーク州は、米国の北東部に位置し、主要な観光スポットの一つです。ニューヨークは多数のレンタカー会社の存在によるレンタカーのための最も競争の激しい市場です。140000平方キロメートル以上に及ぶ州は、旅行者に多くの歴史的で風光明媚な観光地を提供し、レンタルサービスの需要を高めています

さらに、ニューヨークには25以上の注目すべき空港があり、年間総旅客数は5000万人を超えています。空港はまた、その通勤者にレンタカー サービス プロバイダーの幅広い選択を提供します。州は車を借りる最も高価な場所の 1 つで、1 日平均は約 76 米ドルです。これは、高級車の賃料の上昇や、都市間または州間旅行でのレンタカーの増加とともに増加する可能性があります。主要空港のオフィスとは別に、レンタカーも州内各地にあり、国内外の旅行者に対応しています

オンライン予約は、プラットフォームの他の予約タイプを支配しています

オンラインアクセスはレンタカーを予約する最も一般的な方法であり、続いてオフラインアクセスが続きます.

- インターネットウェブサイトやモバイルアプリケーション< />

- これらの中で、サイト経由での予約は、車を予約する最も一般的な方法です。オンライン予約では、遠く離れた場所からでも、その場所に物理的に存在することなく、車の予約が可能です.

- それは時間を節約するのに役立ち、車の賃借人と所有者の両方に非常に便利< />

現在、オンライン予約は、賃借人の書類の確認、車に関する賃借人への情報、特定の場所でのレンタカーのドロップとピックアップの能力、電子署名契約、キャッシュレス取引など、さまざまな目的にも役立ちます。これらは、過去数年間にレンタカー会社が競合他社よりも競争力を獲得するのに役立ちました

競争環境

米国のレンタカー市場は、エイビス・バジェット・グループ、エンタープライズ・レンタカー、ハーツ・グローバル・ホールディングスなどが大半を占めています。マーケットリーダーは、Dollar、Thrifty、National、Alamoなどの他の有名なブランドを買収することで、強力なプレゼンスを維持しようとしました。これらの企業はまた、グローバルなプレゼンスを維持するためにフランチャイズモデルを採用しようとしました。Hertzは145カ国以上でライセンスモデルで存在感を示しています。ハーツのドルとスリフティは、75カ国に1410以上の企業および金融拠点を誇っていました。エイビスグループは160カ国以上でライセンシーを獲得し、世界中のレンタカー会社の50%以上を占めています

米国のレンタカー会社もカーシェアリングモデルを採用し、新製品の提供や参入者との競争の源として機能しました。エンタープライズとハーツは、同国でCarShareとOnDemandサービスで最初の動きの優位性を持っていました.

このレポートを購入する理由:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

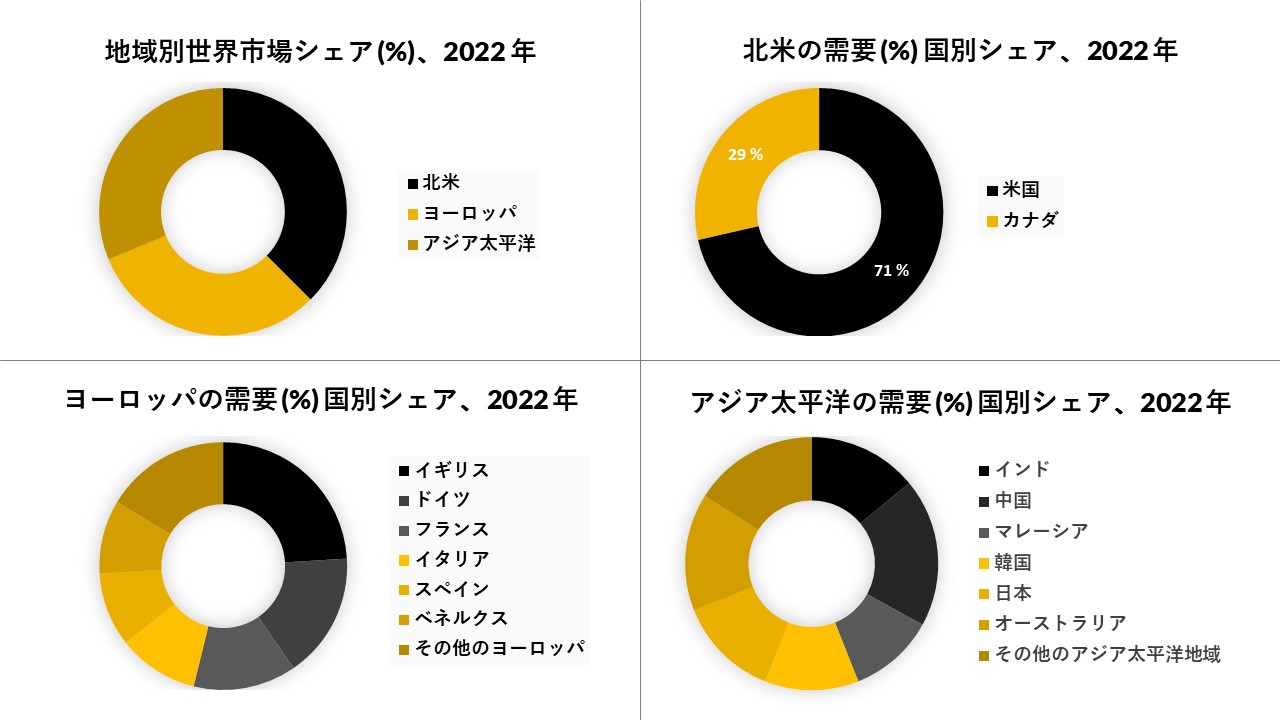

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ)