同期コンデンサ市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析 ― 冷却タイプ別、無効電力定格別、タイプ別、開始方法別、最終用途別、地域別―世界市場の見通しと予測 2026-2035年

出版日: Mar 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

同期コンデンサ市場規模

2026―2035年の同期コンデンサ市場の規模はどれくらいですか?

同期コンデンサ市場に関する当社の調査レポートによると、市場は予測期間(2026―2035年)の間に複利年間成長率(CAGR)7.4%で成長すると予想されています。2035年には、市場規模は27億米ドルに達する見込みです。しかし、当社の調査アナリストによると、基準年の市場規模は13億米ドルでしました。

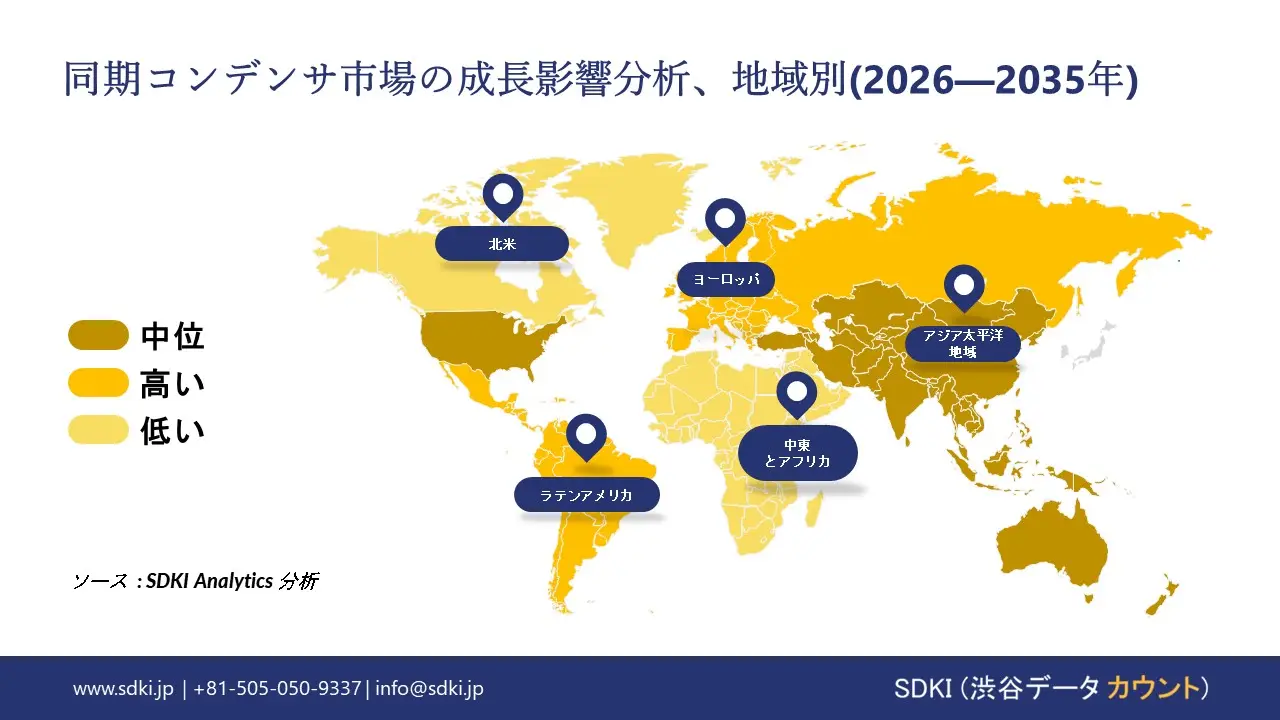

市場シェアの観点から、同期コンデンサ市場を支配すると予想される地域はどれですか?

同期コンデンサに関する当社の市場調査によると、北米市場は予測期間を通じて約32%の市場シェアを占め、最大のシェアを占めると予想されています。一方、アジア太平洋地域市場は8%という最も高いCAGRで成長し、今後数年間は有望な成長機会が見込まれています。この成長は主に、急速な工業化、都市化、再生可能エネルギープロジェクトにおける同期コンデンサの導入、送電網拡張計画、そして政府の取り組みによるものです。

同期コンデンサ市場分析

同期コンデンサとは何ですか?

同期コンデンサとは、機械的負荷なしで運転する過励磁モータのことを指し、主に電力網における動的電圧サポートと系統安定性の確保に使用されます。コンデンサまたはインダクタとして機能し、力率を改善し、系統の強度を高めます。

同期コンデンサ市場の最近の傾向は何ですか?

当社の同期コンデンサ市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています。

- 系統の安定性と拡張への投資 -

風力、太陽光発電、その他のインバータ発電の継続的な急増により、機械慣性と従来の電圧サポートが低下しています。一方、同期コンデンサ市場で利用可能なソリューションは、この技術的ギャップを埋め、短絡強度を向上させ、無効電力を強化するのに役立ちます。

このように、再生可能エネルギーの普及率の高まりは、このセクターの需要を押し上げています。その証拠として、国際エネルギー機関(IEA)の最近の調査報告書によると、再生可能エネルギーの発電容量は2025―2030年の間に約4,600GWに増加すると予想されています。

- 無効電力と電圧調整 -

無効電力をローカルで生成及び吸収する機能と、リアルタイムでの電圧レベルの調整機能により、同期コンデンサ市場で入手可能なツールはエネルギー業界で注目を集めています。

特に、大規模な連系システムでは、無効電力を長距離にわたって効率的に送電できるため、これらの機器の導入が不可欠となります。この要因は、2024年のNTPC調査報告書にも示されており、再生可能エネルギー導入時の系統安定性向上のために、同期コンデンサの大規模な有用性を強調しています。

同期コンデンサ市場は日本の市場プレーヤーにどのような利益をもたらすですか?

日本は、再生可能エネルギーの普及が拡大し、従来の同期発電が減少する中で、系統安定性の課題に直面しています。経済産業省のエネルギー需給統計によると、再生可能エネルギーは2023年に総発電量の22.9%を占め、前年比で増加しています。

当社の市場見通しによると、この状況は系統慣性及び電圧サポート技術の必要性を高めています。同期コンデンサは、重要な無効電力と慣性を提供し、系統の信頼性を高めると同時に、再生可能エネルギーの統合率向上を可能にします。これは、日本メーカーにとって市場見通しの重要な推進力となります。

2025年版エネルギー白書に明記されているように、日本のエネルギー政策は、脱炭素化の進展に伴い、多様化と安定性を重視しており、これは系統連系サービスに直接的な恩恵をもたらしています。また、日本では輸出機会への需要も高まっています。最近の調査報告書によると、政府の取り組みにより、周波数と電圧の変動を管理する同期コンデンサへの電力会社の関心が高まっていることが示されています。

同期コンデンサ市場に影響を与える主な制約は何ですか?

同期コンデンサ市場の成長を阻害する主な要因は、原材料の変動性とエネルギーコストです。当社の市場見通しによると、これらの要因はコンプレッサーメーカーとエンドユーザーの製造コストと運用コストの増加につながります。最近の市場調査レポートによると、この要因は市場見通しを複雑化し、価格戦略や投資判断にも影響を与えています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

同期コンデンサ市場レポートの洞察

同期コンデンサ市場の今後の見通しは何です?

SDKI Analyticsの専門家によると、同期コンデンサ市場の世界シェアに関連するレポートの洞察は以下の通りです。

|

レポートの洞察 |

|

|

2026―2035年のCAGR |

7.4% |

|

2025年の市場価値 |

13億米ドル |

|

2035年の市場価値 |

27億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

同期コンデンサ市場はどのようにセグメントに分割されていますか?

同期コンデンサ市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場は、冷却タイプ別、無効電力定格別、タイプ別、開始方法別、最終用途別にセグメントに分割されています。

同期コンデンサ市場は冷却タイプ別どのように分割されていますか?

冷却タイプ別セグメントの観点から見ると、同期コンデンサの市場展望では、このセグメントには、水素冷却、空冷式、水冷式と呼ばれる娘セグメントがあることが分割されています。

水素冷却は、予測期間中に55%の市場シェアを獲得し、市場をリードすると予想されています。その優れた冷却効率は、大容量設備に効果的であり、再生可能エネルギーの普及率が高い現代の電力系統の安定化に不可欠であることから、このリーダーシップは揺るぎないものとなっています。

このような状況において、市場を牽引する主要な要因は、再生可能エネルギーの普及率の高さ、大規模ユニットの優れた冷却効率、そして高度な系統システムとの統合です。当社の市場アナリストによると、2023年にはインバータベースの電源が米国の総発電容量の約22―25%を占めるようになると予想されており、電圧安定化のための同期コンデンサに対する需要が急務となっています。

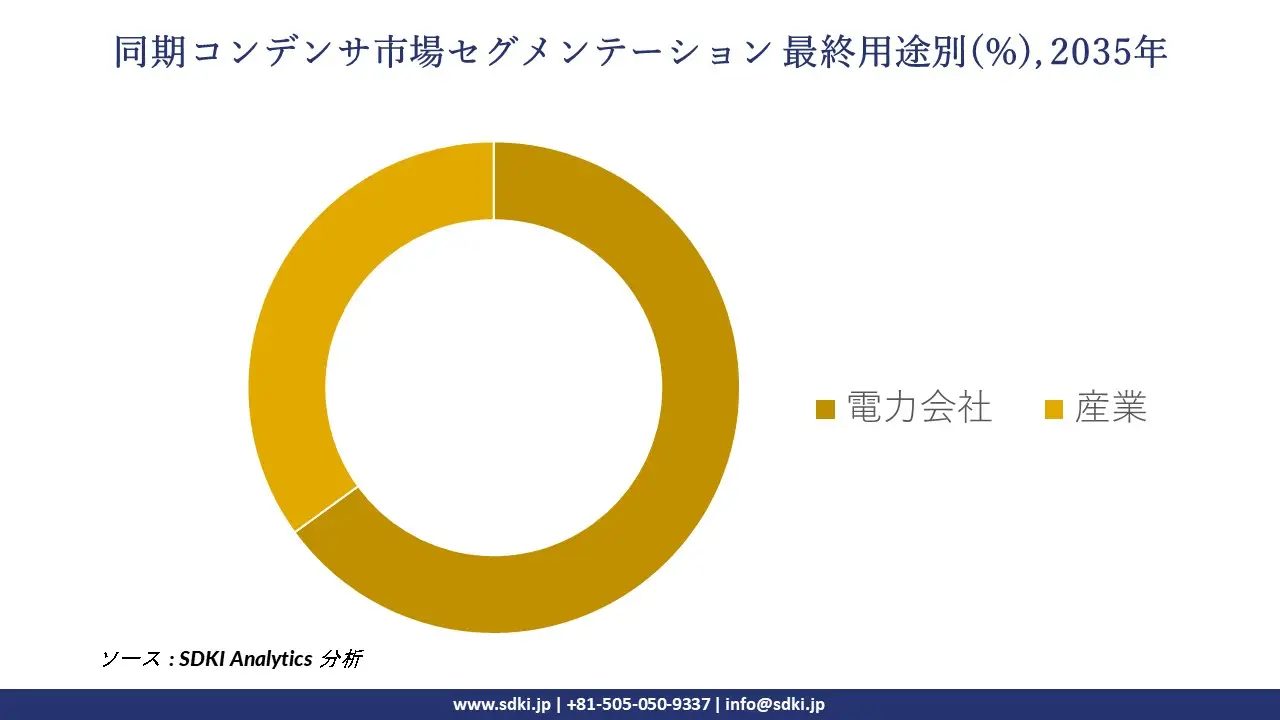

同期コンデンサ市場は最終用途別どのように分割されていますか?

同期コンデンサ市場調査レポートによると、最終用途別に基づいて、市場は電力会社、産業のサブセグメントに分割されています。

今後、当社の調査アナリストは、送電網及び配電網全体でグリッドの安定性、電圧調整、無効電力補償を確保するために同期コンデンサを導入する電力会社の最終用途が、次のセッションで市場をリードすると予測しています。

ここでは、政府の再生可能エネルギー目標と送電網の信頼性義務が市場の原動力となっており、IEAの報告書で述べられているように、2023年の電力部門における再生可能エネルギーの割合は30%で、2030年には46%に上昇すると予測されており、同期コンデンサによる安定性の要件を示しています。

以下は同期コンデンサ市場に該当するセグメントのリストです。

|

親セグメント |

サブセグメント |

|

冷却タイプ別 |

|

|

無効電力定格別 |

|

|

タイプ別 |

|

|

開始方法別 |

|

|

最終用途別 |

|

ソース: SDKI Analytics 専門家分析

同期コンデンサ市場傾向分析と将来予測:地域市場展望概要

同期コンデンサ市場の拡大を阻む主な制約要因は、設置コストと保守コストの上昇です。長期的なメリットがあるにもかかわらず、電力会社や系統運用者にとって導入を躊躇させる要因となっています。これは、特に予算が限られている地域において、市場見通しに影響を与えており、複数の調査報告書でも、コスト障壁が導入を阻害していることが指摘されています。

アジア太平洋地域の同期コンデンサ市場はどのように推移していますか?

アジア太平洋地域の同期コンデンサ市場は、予測期間中に8%のCAGRで成長し、最も高い成長率を維持すると予想されています。当社の市場見通しによると、再生可能エネルギーの急速な拡大により、系統安定化ソリューションの需要が高まっているため、この市場は活況を呈しています。

中国政府の公式報告書によると、再生可能エネルギーは2024年までに総設置電力容量の56%にまで増加する見込みです。これは、変動の大きい太陽光及び風力発電の導入による送電網統合の課題を反映しています。

SDKI Analyticsの専門家は、同期コンデンサ市場に関するこの調査レポートのために、以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東及びアフリカ |

|

ソース: SDKI Analytics 専門家分析

北米における同期コンデンサ市場のパフォーマンスはどうですか?

北米の同期コンデンサ市場は、予測期間中に32%という最大の市場シェアを維持しながら急速な成長が見込まれています。当社の市場見通しによると、この成長は再生可能エネルギーの普及率向上と系統安定性へのニーズによって支えられています。

米国政府のEIAの報告書によると、太陽光発電と風力発電を合わせたシェアは、2025年の18%から2027年までに21%近くまで急速に増加すると予想されています。これは、電力系統支援ソリューションが解決に役立つ、間欠性の課題の増大を強調しています。

同期コンデンサ調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

SDKI Analyticsの調査者によると、同期コンデンサの市場見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、分割されています。調査レポートでは、市場プレーヤーは、製品や技術の投入、戦略的パートナーシップ、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体の見通しにおいて競争優位性を獲得しようとしていると指摘されています。

同期コンデンサ市場で事業を展開している世界有数の企業はどこですか?

当社の調査レポートによると、世界の同期コンデンサ市場の成長に重要な役割を果たしている主な主要企業には、Siemens Energy、 GE Vernova (General Electric)、 ABB、 WEG、 Hyundai Electricなどが含まれています。

同期コンデンサ市場で競合している日本の主要企業はどこですか?

市場見通しによれば、日本の同期コンデンサ市場の上位5社は、Mitsubishi Electric、 Hitachi Energy Japan、 Toshiba Energy Systems、Fuji Electric, Meidensha Corporationなどです。

市場調査レポート研究には、世界的な同期コンデンサ市場分析調査レポートにおける主要企業の詳細な競合分析、企業プロファイル、最近の傾向、主要な市場戦略が含まれています。

同期コンデンサ市場の最新のニュースと傾向は何ですか?

- 2026 年 1 月 – ANDRITZ は、ブラジルの TAESA の全国相互接続システム向けに 300 MVAr 同期コンデンサ 6 台を供給する契約を AXIA Energia と締結したことを発表しました。

- 2024年4月 – Hitachi EnergyはイギリスのSP Energy Networksと提携し、STATCOMと同期コンデンサ技術を組み合わせて系統の耐性を強化し、スコットランドからイングランドへの再生可能エネルギーの流れを強化しました。

同期コンデンサ主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

同期コンデンサマーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能