レドックスフロー電池市場調査レポート、規模とシェア、成長機会、および傾向洞察分析―タイプ別、製品別、アプリケーション別、および地域別―世界市場の見通しと予測 2025―2037年

出版日: Sep 2024

- 2020ー2024年

- 2025―2037年

- 必要に応じて日本語レポートが入手可能

レドックスフロー電池市場規模

レドックスフロー電池市場に関する当社の調査レポートによると、市場は2025-2037年の予測期間中に約14%のCAGRで成長すると予想されています。将来の年には、市場は約900百万米ドルの価値に達する見込みです。しかし、当社の調査アナリストによると、基準年の市場規模は約200百万米ドルと記録されています。レドックスフロー電池の市場見通しによれば、アジア太平洋地域の市場は、予測期間中に約 45% の圧倒的な市場シェアを保持すると予想していますが、北米市場は今後数年間で有望な成長の機会を示す準備が整っています。これは主に、世界中で再生可能プロジェクトの数が急増した結果です。

レドックスフロー電池市場分析

リチウムイオンや鉛酸などの従来の電池は拡張性に限界があることが知られており、容量を増やすには物理的に大きな電池や直列/並列構成のセルの数が必要になることがよくあります。レドックスフロー電池は、貯蔵と電力変換を分離しているため、容易な拡張性が可能となり、その需要を促進します。エネルギー貯蔵容量は電解質タンクのサイズによって決まりますが、出力はセルのサイズと数によって決まります。これはレドックスフロー電池では大幅にアップグレードされています。

- 当社の調査報告書によると、バナジウムレドックスフロー電池システムは数キロワットから数メガワットまで拡張可能で、最大のシステムでは設置によっては最大 200 MW に達します。

さらに、従来の電池は深放電と高いサイクル数で劣化するため、耐用年数と信頼性が制限されます。レドックスフロー電池は電解液が液体であるため、電極や活物質の劣化が少なくサイクルが長いです。性能を大幅に低下させることなく深放電に対応できます。この問題は日本では非常に一般的であったため、従来の電池はすぐにレドックスフロー電池に置き換えられました。

- 当社のレドックスフロー電池市場の見通しによると、一般的なリチウムイオン電池の 2000-5000 サイクルと比較して、バナジウムレドックスフロー電池は最小限の容量損失で 10,000 サイクル以上を達成できます。

このような問題により、世界中および日本においてレドックスフロー電池の導入が顕著になっています。

当社のレドックスフロー電池市場分析調査レポートによると、次の市場傾向と要因が市場成長に貢献すると予測されています:

- 急速に進む再生可能エネルギーの統合―太陽光や風力などの再生可能資源の採用の増加は、レドックスフロー電池市場の見通しにとって主要な成長原動力です。これらのリソースは断続的であるため、エネルギー出力を安定化できる信頼性の高いエネルギー貯蔵ソリューションの需要が高まっています。レドックスフロー電池、特にバナジウムレドックスフロー電池(VRFB)は、放電持続時間が長く、劣化することなく頻繁なサイクルに対応できるため、再生可能エネルギーによって生成されたエネルギーを貯蔵するのに最適です。

- 当社の調査報告書によると、世界の再生可能エネルギー容量は 2028 年までに 7,300 GW に達すると予想されており、エネルギー貯蔵はその統合において重要な役割を果たしています。

- 政府の支援政策と規制によるサポート-世界中の政府は、炭素排出量の削減とクリーン エネルギーの促進を目的とした政策を実施しており、レドックスフロー電池などの先進的なエネルギー貯蔵ソリューションの需要が高まっています。多くの国が規制を導入し、エネルギー貯蔵技術の導入を支援するための奨励金を提供しています。

- 当社の調査者による市場見通しによると、米国政府の 2022 年インフレ抑制法 (IRA) には、長期にわたるエネルギー導入を加速する条項が含まれています。

レドックスフロー電池市場は日本の市場参加者にどのような利益をもたらしますか?

レドックスフロー電池市場は、いくつかの要因により、日本の市場プレーヤーにとって大きなチャンスをもたらします。日本の再生可能エネルギー貯蔵ソリューションへの強い重点は、レドックスフロー電池の機能とよく一致しています。「エネルギー戦略計画」と「革新的なエネルギー貯蔵システム」などの政府の取り組みにより、エネルギー貯蔵技術の進歩が促進されています。これに加えて、日本の二酸化炭素排出量削減への取り組みは、市場関係者の立場をさらに強化します。全国の企業もレドックスフロー電池の進歩において非常にうまくいっています。

- たとえば、Sumitomo Electric Industriesによるバナジウムレドックスフロー電池技術の開発します。同社は VRFB システムで大幅なプロセスを実現し、高いパフォーマンスとコスト効率を実現しました。同社のレドックスフロー電池技術は、この種のものとしては世界最大級の日本の60MWh VRFBシステムなど、いくつかの大規模エネルギー貯蔵プロジェクトに導入されています。この進歩は、レドックスフロー電池技術の限界を押し上げるSumitomo Electricの役割を浮き彫りにします。そして、大規模なエネルギー貯蔵用途への実現可能性を実証し、前向きな市場見通しにプラスの側面を示しています。

これらの要因が相まって、日本の市場関係者にいくつかの有利な機会をもたらす準備が整っています。

市場課題

バナジウムはレドックスフロー電池の主要成分であるため、バナジウム価格の変動は市場の見通しに大きな影響を与える可能性があります。さらに、バナジウムの価格は、需要と供給の変動、地政学的要因、合金元素としてバナジウムを利用する鉄鋼業界との競争により、非常に不安定です。

- 当社の調査報告書によると、鉄鋼製造におけるバナジウムの利用率が高いため、2023 年の見かけのバナジウム消費量は 2022 年より 30% 増加しており、市場関係者の VRFB への投資に明らかに影響を与える可能性があります。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

レドックスフロー電池市場レポートの洞察

|

レポートの洞察 |

|

|

CAGR |

14% |

|

2024 年の市場価値 |

約200百万米ドル |

|

2037 年の市場価値 |

約900百万米ドル |

レドックスフロー電池市場セグメンテーション

当社は、レドックスフロー電池市場の見通しに関連するさまざまなセグメントにおける需要と機会を説明する調査を実施しました。当社は、タイプ別、製品別、およびアプリケーション別ごとに市場を分割しました。

レドックスフロー電池市場は、タイプに基づいて、バナジウムレドックスフロー電池、ハイブリッドレドックスフロー電池に分割されています。これらのうち、バナジウムレドックスフロー電池セグメントは、バナジウムが世界中で入手可能で豊富であるため、予測期間中に最大の市場シェアを約70%保持すると予想されます。レドックスフロー電池の重要な成分であるバナジウムは、リチウムイオン電池で使用されるコバルトやニッケルなどの他の重要な電池材料と比較して、地殻で容易に入手できます。

- 当社のレドックスフロー電池市場の見通しによれば、2023 年の世界のバナジウム生産量は 120千トン以上に達します。この豊富さにより、材料不足や価格高騰のリスクが軽減されます。

レドックスフロー電池の市場は、アプリケーションに基づいて、公共サービス、再生可能エネルギー統合、UPS、その他に分割されています。これらのうち、公共サービスセグメントは、予測期間中に約40% のより大きな市場シェアを保持するはずです。これは、再生可能エネルギーの統合に対する需要が高まっているためです。再生可能エネルギー源への世界的な移行が進む中、電力会社は風力発電や太陽光発電への投資を増やしており、これが市場見通しが明るい主な理由です。

|

タイプ |

|

|

製品 |

|

|

アプリケーション |

|

レドックスフロー電池市場傾向分析と将来予測:地域市場見通しの概要

レドックスフロー電池の市場は、アジア太平洋地域で最も収益性が高く、有利な機会となると予想されており、また、この地域の再生可能エネルギーへの巨額投資により、同地域の市場が約45%を超えるシェアでリードすると予想されています。地方政府は自国に多額の投資を行っており、レドックスフロー電池などのエネルギー貯蔵ソリューションに対する強い需要を生み出しています。

- 市場の見通しによると、2025 年までにアジア太平洋地域が世界の再生可能エネルギー増加量の60% 以上を占めると予想されています。太陽光や風力などの再生可能エネルギー源は断続的であるため、RFB はエネルギー貯蔵と送電網の安定性の課題に効果的に対処できます。

日本は炭素排出量を削減し、より持続可能なエネルギー貯蔵システムへの移行に取り組んでおり、レドックス電池は従来の電池と比較して環境に優しいエネルギー貯蔵ソリューションを提供します。

- 当社の市場調査報告書によると、日本は 2050 年までに温室効果ガス排出実質ゼロを達成することを約束しており、RFB は極めて重要な要素となっています。

|

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

レドックスフロー電池の市場は、北米地域の持続可能性への取り組みと化石への依存の削減により、北米地域で大幅に成長すると予想されています。その結果、地域の政府は、市場の見通しを積極的にサポートするレドックスフロー電池を含む透明なエネルギー源に多額の投資を行っています。

レドックスフロー電池調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

レドックスフロー電池業界の概要と競争のランドスケープ

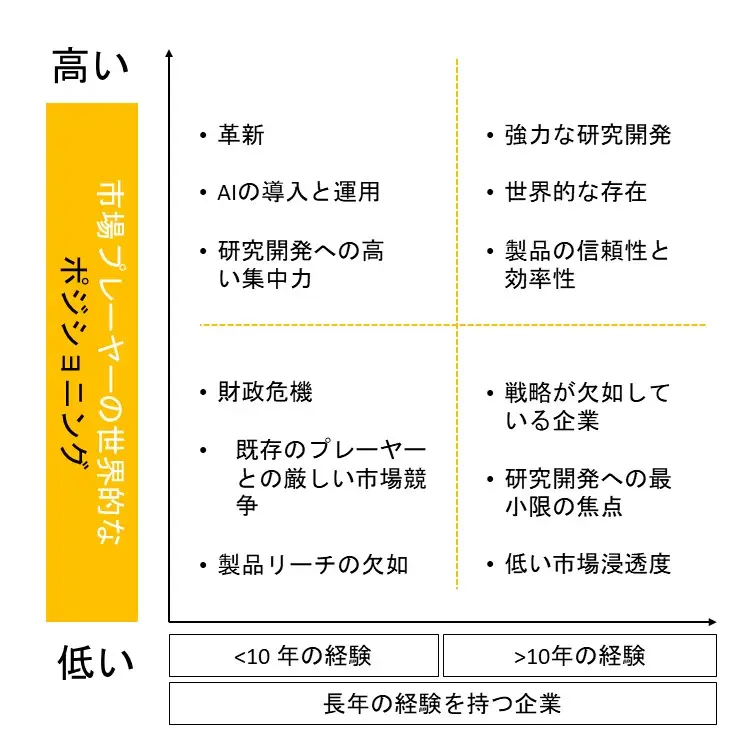

SDKI Analyticsの調査者によると、レドックスフロー電池市場見通しは、大企業と中小規模の組織といったさまざまな規模の企業間の市場競争により細分化されています。調査報告書では、市場関係者は製品や技術の発売、戦略的パートナーシップ、コラボレーション、買収、拡張など、あらゆる機会を利用して市場全体の見通しでの競争優位性を獲得しています。

当社の調査レポートによると、世界のレドックスフロー電池市場の成長に重要な役割を果たす主要な主要企業には、Enerox GmbH、HydraRedox、Invinity Energy Systems、Largo Inc.、Lockheed Martin Corporationなどが含まれます。 さらに、市場見通しによると、日本のレドックスフロー電池市場のトップ5プレーヤーは、LE SYSTEM CO., Ltd.、Sumitomo Electric Industries, Ltd.、Renaissance Energy Research Co., Ltd.、Japan Metals & Chemicals Co., Ltd.、NIPPON STEEL CORPORATIONなどです。この調査には、世界のレドックスフロー電池市場分析調査レポートにおける詳細な競合分析、企業概要、最近の動向、およびこれらの主要企業の主要な市場戦略が含まれています。

レドックスフロー電池市場ニュース

- 2024 年 7 月、KIER は、バナジウムに代わる「ビオロゲン レドックスフロー電池」を開発し、業界での進歩を遂げました。

- 2024年1月、AGCは、フッ素系イオン交換膜「FORBLUE Sシリーズ」の新たな製造設備を建設することを決定しました。北九州拠点にあるグリーン水素製造に適した設備です。

レドックスフロー電池主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

レドックスフロー電池マーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2025―2037年

- 必要に応じて日本語レポートが入手可能