電子契約アセンブリ市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― 活動タイプ別、最終用途産業別、サービスタイプ別、及び地域別―世界市場の見通しと予測 2025-2035年

出版日: Nov 2025

- 2020ー2024年

- 2025-2035年

- 必要に応じて日本語レポートが入手可能

電子契約アセンブリ市場エグゼクティブサマリ

1) 電子契約アセンブリ市場規模

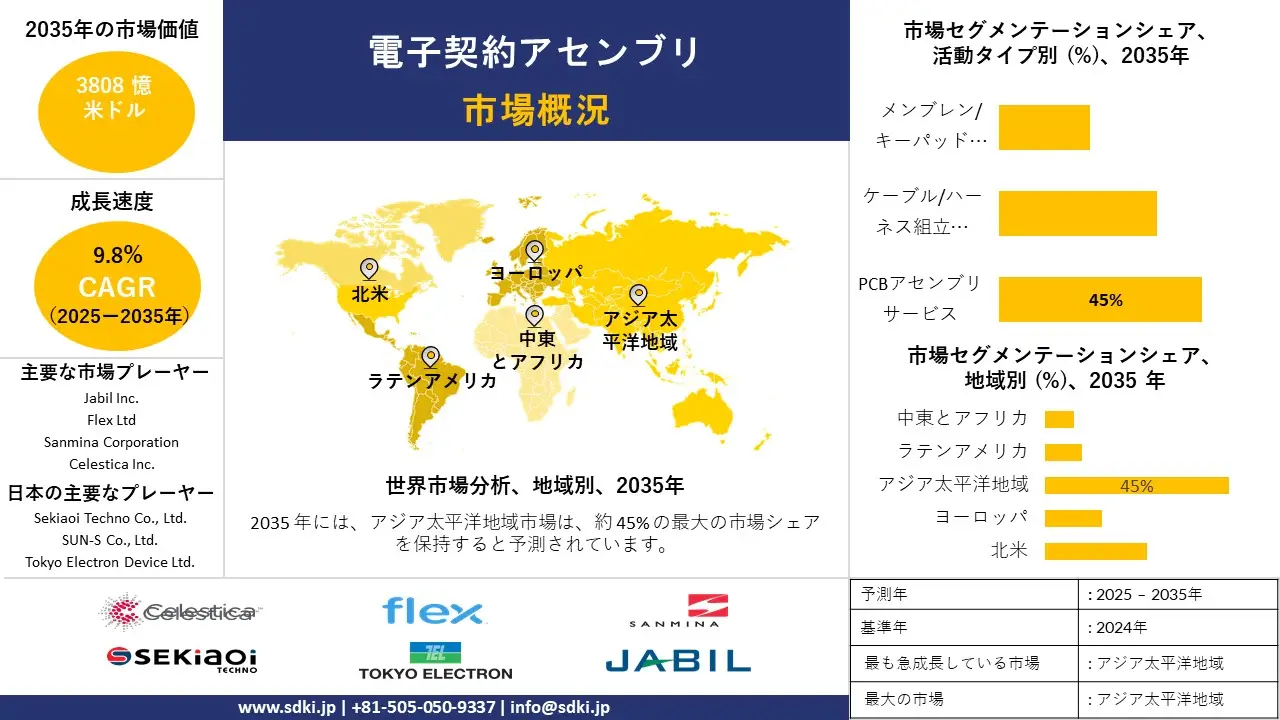

電子契約アセンブリ市場に関する弊社の調査レポートによると、市場は2025―2035年の予測期間中に9.8%の年平均成長率(CAGR)で成長すると予測されています。将来的には、市場規模は3,808億米ドルに達すると予想されています。

しかしながら、弊社の調査アナリストによると、基準年の市場規模は1,733億米ドルがありました。消費者向け電子機器の需要の高まりとスマート製造の導入により、電子契約アセンブリ市場は世界的に拡大傾向にあります。

2) 電子契約アセンブリ市場傾向 – 好調な軌道を辿るセクション

SDKI Analyticsの専門家によると、予測期間中に予測される電子契約アセンブリ市場の傾向には、PCBアセンブリサービス、ケーブル/ハーネスアセンブリ、メンブレンスイッチなどの分野が含まれます。予測期間中に電子契約アセンブリ市場をリードすると予想される主要な傾向について、以下に詳細をご紹介します。:

|

市場セグメント |

主要な地域 |

CAGR (2025–2035年) |

主要な成長要因 |

|

PCBアセンブリサービス |

アジア太平洋地域 |

6.1% |

IoTの拡大、小型化、フレキシブルエレクトロニクス |

|

ケーブル/ハーネスアセンブリ |

北米 |

5.2% |

自動車の電動化、航空宇宙分野の需要、安全性への重点 |

|

メンブレンスイッチ |

ヨーロッパ |

4.8% |

産業オートメーション、医療機器、触覚インターフェース |

|

試験サービス |

日本 |

5.4% |

品質保証、老朽化するインフラ、規制要件 |

|

ボックスビルドアセンブリ |

ラテンアメリカ |

5.0% |

民生用電子機器の成長、コスト効率の高い労働力、輸出 |

ソース: SDKI Analytics 専門家分析

3) 市場定義 – 電子契約アセンブリは何ですか?

ソフトウェア駆動型アセンブリシステムを通じて実行される電子契約のための構造化されたフレームワークは、電子契約アセンブリと呼ばれます。自動化されたソフトウェア駆動型プラットフォームは、事前定義された条項、条件付きロジック、および適切なデータ入力を、契約の最終文書に組み込むことができます。

このプラットフォームは、契約アセンブリプロセスを統合するための法的文書テンプレートを提供し、ビジネスルールと規制を示します。これにより、一貫性が維持され、人的ミスが削減され、ビジネス環境におけるサイクル内での契約の締結が保証されます。

4) 日本の電子契約アセンブリ市場規模:

日本の電子契約アセンブリ市場は、2035年までに年平均成長率(CAGR)5.4%で成長し、463億米ドルの市場規模に達すると予測されています。労働力不足と自動車および産業機器分野における需要の拡大が、日本の電子契約アセンブリ市場を牽引しています。

先進的な電子機器製造は、日本において自動車産業を電気自動車および自動運転車による革命へと導く主要な要因です。産業環境におけるインダストリー4.0の導入は、自動化の統合範囲を拡大し、電子契約アセンブリに対する市場需要を増大させています。例えば、日本は世界周辺地域における産業用ロボットの主要生産国であり、2022年には市場生産額が66億米ドルに達しました。

日本の統計局によると、労働人口は2040年までに68.66百万人に減少すると予測されています。労働力不足は、日本で業務効率化を実現するECMプロバイダーへのアウトソーシングを加速させています。これが関連市場の成長を後押しし、将来的に力強い拡大が期待されています。

|

収益創出の機会 |

主要成功指標 |

主な成長要因 |

市場洞察 |

競争の激しさ |

|

表面実装技術(SMT)サービス |

高いスループット効率、不良率の低減 |

部品の小型化、自動化需要、コンシューマーエレクトロニクスの成長 |

小型で高性能なデバイスと自動化された生産ラインへの移行により、SMTの採用がますます増加しています。 |

高 |

|

車載電子機器組立 |

自動車規格への準拠、トレーサビリティシステム |

EVの普及、ADASの統合、OEMアウトソーシングの動向 |

自動車OEMは、複雑性と信頼性の基準の高まりに対応するため、電子機器の組立をアウトソーシングしています。 |

中 |

|

医療機器PCB組立 |

ISO 13485認証、クリーンルーム設備 |

高齢化、ウェアラブルヘルステクノロジー、規制遵守 |

医療用電子機器は精度と信頼性が求められるため、認定された委託組立パートナーの需要が高まっています。 |

中 |

|

通信モジュール統合 |

Mask |

|||

|

産業オートメーションシステム組立 |

||||

|

フレキシブルPCB組立 |

||||

|

試験・品質保証サービス |

||||

|

ハイブリッド組立(手作業+自動) |

||||

ソース: SDKI Analytics 専門家分析

- 日本の電子契約アセンブリ市場の都道府県別内訳:

以下は、日本の電子契約アセンブリ市場の都道府県別の内訳の概要です。:

|

都道府県 |

CAGR (%) |

主要な成長要因 |

|

東京都 |

5.6% |

ハイテク研究開発拠点、高齢化社会のニーズ、政府補助金 |

|

大阪府 |

5.1% |

産業オートメーション、ヘルスケアエレクトロニクス、熟練労働力 |

|

神奈川県 |

5.3% |

通信インフラ、ロボット技術の導入、都市技術の統合 |

|

愛知県 |

5.7% |

自動車エレクトロニクス、スマートファクトリー、輸出志向型生産 |

|

福岡県 |

5.0% |

地域イノベーションセンター、スタートアップエコシステム、デジタルサービス |

ソース: SDKI Analytics 専門家分析

電子契約アセンブリ市場成長要因

弊社の電子契約アセンブリ市場分析調査レポートによると、以下の市場動向と要因が市場成長の中核的な原動力として貢献すると予測されています。:

-

デジタルトランスフォーメーションの成長:

ハイブリッドワークモードとデジタルトランスフォーメーションの実践は、電子契約アセンブリ市場の需要を急上昇させている現在の世界的な傾向です。紙中心の契約は、電子契約アセンブリのデジタル化と自動化によって移行しています。これにより、サイクルタイムが短縮され、取引コストが抑制され、市場の普及率が高まっています。

デジタル署名とクラウドCLMは、リモートコラボレーションとクラウドSaaSの手頃な価格のサービスにより、成長傾向となっています。条項ライブラリ、構造化データ、ルールエンジン、CLMオーケストレーションなど、多くのサービスが企業の業務効率を向上させ、手作業の削減を促進しています。販売の遅延が削減され、コンプライアンス漏れも抑制され、エンドユーザーにプラスの影響を与えています。

弊社の調査アナリストの観察によると、電子契約アセンブリの影響は、パンデミック以前と比較してオフィスへの出勤率が32%未満に低下し、ハイブリッドワークモードに依存していることです。リモート契約締結ツールの導入は、世界の周辺地域で市場を活性化させると予想されます。

-

クラウドおよびAPIエコシステムの導入拡大:

クラウドプラットフォームとSaaSの導入拡大により、世界プラットフォームにおけるAPIエコノミーは急速に拡大しています。弊社の調査レポートによると、2024年には世界のクラウド投資額は約180百万米ドルを超えると予測されています。これにより、企業のワークフローに契約書作成機能を組み込む余地が生まれています。

自動化機能は、クラウドとSaaSの柔軟なコンピューティングに依存しています。APIの実装により、売買契約、電子署名フローなど、必要な業務を実行するために必要な契約書作成エンジンがコモディティ化されました。

ゲートウェイとセキュリティシステムの収益化、そしてSaaSプラットフォームを通じて提供される事前開発されたテンプレートとコネクタは、CRMプラットフォームと連携し、企業の自動化機能の中で必要なサービスの提供を実現します。

クラウドおよびAPIエコシステムの導入拡大に伴い、電子契約書作成の市場導入率を押し上げる3つの必須要素は、高度な統合、APIトラフィックのセキュリティ、そして信頼性です。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

レポートの洞察 - 電子契約アセンブリ市場の世界シェア

SDKI Analyticsの専門家によると、電子契約アセンブリ市場の世界シェアに関するレポートの洞察は次のとおりです。:

|

レポート洞察 |

|

|

CAGR |

9.8% |

|

2024年の市場価値 |

1,733億米ドル |

|

2035年の市場価値 |

3,808億米ドル |

|

過去のデータ共有対象 |

過去5年間(2023年まで) |

|

将来予測対象 |

今後10年間(2035年まで) |

|

ページ数 |

200ページ以上 |

ソース: SDKI Analytics 専門家分析

電子契約アセンブリ市場セグメンテショーン分析

電子契約アセンブリ市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場は、活動タイプ別、最終用途産業別、サービスタイプ別に分類されています。

活動タイプ別に基づいて、PCBアセンブリサービス、 ケーブル/ハーネス組立サービス、 及び メンブレン/キーパッドスイッチアセンブリに分割されています。これらの中で、PCB組立サービスは市場をリードしており、2035年までに世界市場シェアの45%を占めると予想されています。PCBは、電子機器受託組立市場の基盤と考えられています。スマートフォン、ノートパソコン、その他の産業機器などのデバイスは、接点組立システムの開発にPCBを必要としています。

大量生産に対応できる高い性能と小型電子機器への対応力により、世界市場におけるPCB組立サービスの採用率が拡大しています。効果的な精度と自動化技術との互換性により、OEMにとって不可欠な性能が保証され、費用対効果が高く高品質な結果が得られます。

イノベーションサイクルの範囲、受託組立プロジェクトの複雑な性質、そして現在の世界市場におけるその他多くの要因により、PCB組立サービスは企業業績において必須となっています。設計の柔軟性と業界横断的な関連性により、このサブセグメントは世界的に成長することが期待されます。

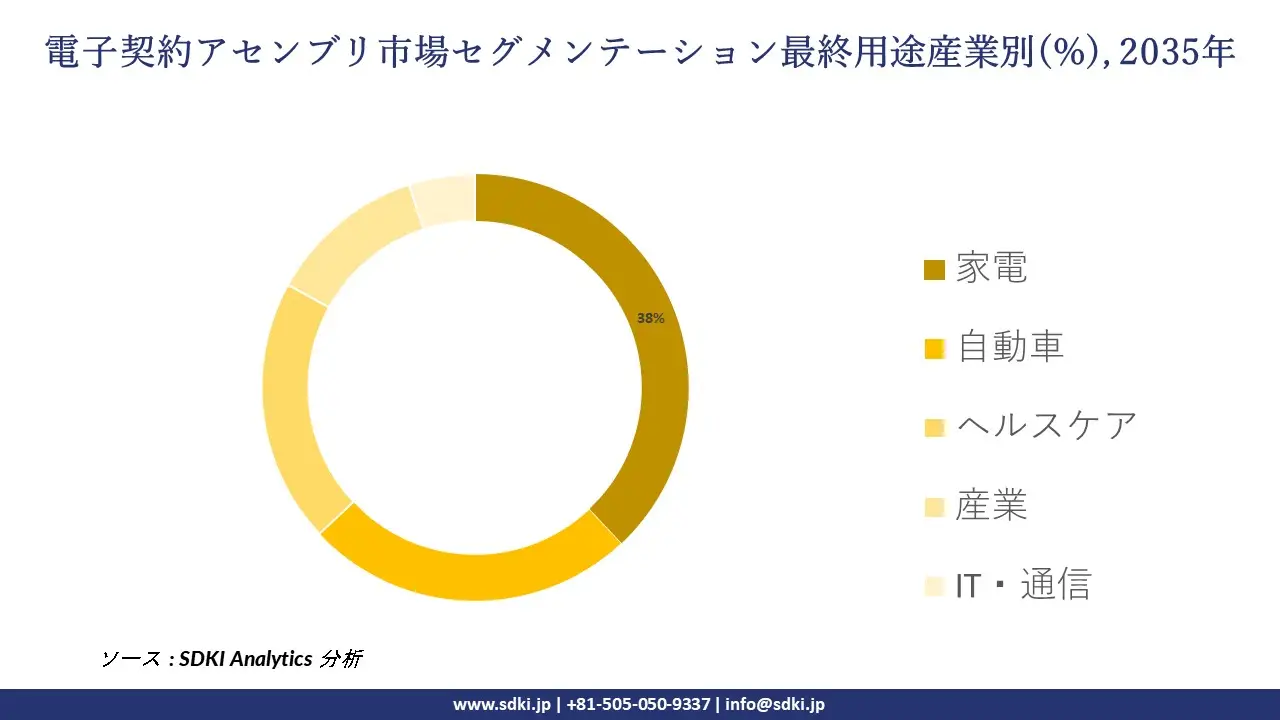

最終用途産業別に基づいて、家電、自動車、 ヘルスケア、 産業、 IT・通信に分割されています。予測期間中、民生用電子機器は38%の市場シェアを獲得すると予測されています。消耗品電子機器には、タブレット、スマートフォン、ゲーム機、ホームオートメーションなど、様々なデバイスが含まれます。電子契約アセンブリにおける迅速なプロトタイピングとコスト最適化の側面は、OEMが市場での地位を確立する上で重要な要素となっています。

世界市場での製品発売は非常に頻繁に行われ、家電製品では季節的な需要の急増が見られるため、高品質なパフォーマンスと高速生産ラインの構築を確保するために、電子契約アセンブリの適用が求められます。これはまた、世界市場における消耗品電子機器の価格設定と納期のベンチマークとなっています。

高生産量、低利益率、急速なイノベーションサイクルの範囲、そしてブランドへの関心の高さは、関連するサブセグメントが電子契約アセンブリを採用する要因となっています。世界市場における透明性と倫理的なサプライチェーン管理の世界的な潮流の高まりにより、多層調達の管理における電子契約アセンブリの利用も拡大しています。

以下は、電子契約アセンブリ市場に該当するセグメントのリストです。:

|

サブセグメント |

|

|

活動タイプ別 |

|

|

最終用途産業別 |

|

|

サービスタイプ別 |

|

|

技術別 |

|

ソース: SDKI Analytics 専門家分析

世界の電子契約アセンブリ市場の調査対象地域:

SDKI Analyticsの専門家は、電子契約アセンブリ市場に関するこの調査レポートのために以下の国と地域を調査しました。:

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

電子契約アセンブリ市場抑制要因

電子契約アセンブリ市場における世界的なシェア拡大を阻害する主な要因の一つは、規制上のハードルです。弊社の調査レポートによると、世界市場における厳格な規制要件が、電子契約アセンブリ市場の承認を遅らせています。世界市場の多様な規制枠組みは、個別の申請書類と追加の現地データを必要とし、試験コストの増大と新規市場への参入にかかる時間の増加を招いています。

さらに、新興経済国における規制の不統一は、手続きの複雑さと複雑な文書化ルールをもたらし、メーカーの商業的普及を遅らせています。一部の国では審査期間が短縮されていますが、現地の要件と償還ポリシーとの整合性が承認プロセスを遅らせ、市場の自由な成長を制限しています。

電子契約アセンブリ市場 歴史的調査、将来の機会、成長傾向分析

電子機器受託組立メーカーの収益機会

世界中の電子機器受託組立メーカーに関連する収益機会のいくつかは次のとおりです。:

|

機会分野 |

対象地域 |

成長の原動力 |

|

自動車電子機器組立 |

北米 |

EVおよびADASシステムの需要増加により、OEMの委託先企業へのアウトソーシングが促進される |

|

医療機器PCB製造 |

ヨーロッパ |

厳格な規制遵守により、認定された委託組立パートナーの参入が促進される |

|

消費者向けウェアラブル機器組立 |

アジア太平洋地域 |

ウェアラブル技術の普及と部品の小型化が急増 |

|

産業IoTデバイス統合 |

Mask |

|

|

通信インフラ組立 |

||

|

フレキシブルプリンテッドエレクトロニクス |

||

|

航空宇宙サブシステム組立 |

||

|

スマートホームデバイス組立 |

||

ソース: SDKI Analytics 専門家分析

電子契約締結シェアの世界的拡大に向けた実現可能性モデル

弊社のアナリストは、世界中の業界専門家が信頼し、適用している有望な実現可能性モデルのいくつかを提示し、電子契約アセンブリ市場の世界シェアを分析しました。:

|

実現可能性モデル |

地域 |

市場成熟度 |

医療システムの構造 |

経済発展段階 |

競争環境の密度 |

適用理由 |

|

OEMパートナーシップモデル |

北米 |

成熟 |

ハイブリッド |

先進国 |

高 |

OEMの存在感が強く、拡張性に優れた認定組立委託パートナーの需要が高い |

|

規制遵守モデル |

ヨーロッパ |

成熟 |

公的 |

先進国 |

中 |

高い規制基準により、認定を受けた専門の委託製造業者が優遇される |

|

コスト効率の高いアウトソーシングモデル |

アジア太平洋地域 |

新興 |

ハイブリッド |

新興国 |

高 |

人件費の優位性と迅速な技術導入が、大規模なアウトソーシングを後押しする |

|

現地組立ハブモデル |

Mask |

|||||

|

インフラ主導型モデル |

||||||

|

垂直統合モデル |

||||||

|

イノベーションクラスターモデル |

||||||

|

リモートモニタリング拡張モデル |

||||||

ソース: SDKI Analytics 専門家分析

市場傾向分析と将来予測:地域市場の見通しの概要

➤北米の電子契約アセンブリ市場規模:

北米の電子契約アセンブリ市場は、2035年には世界第2位の市場シェアを占めると予測されています。5Gの展開拡大と持続可能な取り組みにより、北米の関連市場は拡大しており、デバイスはより高速なデータスループット、より低遅延、より高性能なワイヤレス接続を実現しています。

電子廃棄物の発生とその管理手順に関する規制措置の強化により、市場は法的整合性を確保するために電子契約アセンブリを採用するよう促されています。例えば、米国はリサイクル技術の導入で先行しており、2022年には13.4百万米ドルの政府資金が投資されることが確実です。これは、リサイクル機器における電子契約アセンブリ市場の需要を高めています。

同様に、米国は5Gネットワークの導入で優位に立っており、2028年までに大幅な成長が見込まれています。これは、通信分野におけるスマート製造の確保に対する関連市場の需要を高めています。

- 北米の電子契約アセンブリ市場の市場強度分析:

北米の電子契約アセンブリ市場に関連する国の市場強度分析は、:

|

カテゴリー |

米国 |

カナダ |

|

市場成長の可能性 |

強 |

中程度 |

|

規制環境の複雑さ |

複雑 |

標準 |

|

価格体系 |

市場主導型 |

ハイブリッド |

|

熟練人材の確保 |

Mask |

|

|

標準および認証フレームワーク |

||

|

イノベーション・エコシステム |

||

|

技術統合率 |

||

|

市場参入障壁 |

||

|

投資環境 |

||

|

サプライチェーンの統合 |

||

|

競争の激しさ |

||

|

顧客基盤の高度化 |

||

|

インフラ整備状況 |

||

|

貿易政策の影響 |

||

ソース: SDKI Analytics 専門家分析

➤ヨーロッパの電子契約アセンブリ市場規模:

EUの電子契約アセンブリ市場は、技術動向と産業需要により、着実な成長が見込まれています。

EUチップ法により、ヨーロッパでは半導体製造が拡大しています。製造能力の増強とEMSエコシステムの強化のため、430億ユーロ規模のパッケージが導入されています。ドイツはIoT導入において国をリードしており、電子コンテンツ組立市場への需要が大幅に拡大しています。

業界における自動化の傾向は、EUにおける関連市場を拡大させています。弊社の調査レポートによると、電気自動車の登録台数は2023年に1.4百万台を超え、EU市場における電子契約アセンブリ市場への需要が高まっています。

- ヨーロッパの電子契約アセンブリ市場の市場強度分析:

ヨーロッパの電子契約アセンブリ市場に関連する国の市場強度分析は、:

|

カテゴリー |

イギリス |

ドイツ |

フランス |

|

市場成長の可能性 |

中程度 |

強 |

中程度 |

|

半導体に対する政府の優遇措置 |

中 |

高 |

中 |

|

製造能力 |

限定 |

高度 |

中程度 |

|

設計およびIP能力 |

Mask |

||

|

パッケージングおよびテストインフラ |

|||

|

人材の確保 |

|||

|

研究開発における連携 |

|||

|

サプライチェーンのレジリエンス |

|||

|

エネルギーおよびサステナビリティの実践 |

|||

|

世界競争力 |

|||

|

規制の複雑さ |

|||

|

クラスターの強み |

|||

ソース: SDKI Analytics 専門家分析

➤アジア太平洋地域の電子契約アセンブリ市場規模:

アジア太平洋地域は、2035年までに45%の市場シェアを獲得し、世界の電子契約アセンブリ市場をリードする地域になると予想されています。産業・自動車セクター、そして半導体製造の成長が、市場を年平均成長率11.2%で牽引し、世界の周辺地域の中で最も急速に成長する地域として浮上しています。

中国で導入された国内代替政策は、市場の半導体製造能力の向上を促しています。「中国製造2025」により、中国は2024年には前年比18%の成長率を達成し、半導体の主要製造国となる見込みです。これは、契約組立サービスへの投資を押し上げています。中国における電気自動車(EV)普及率は2024年に約28%に達し、PCBおよび組み込み電子契約アセンブリ市場の需要が拡大しています。

- アジア太平洋地域の電子契約アセンブリ市場の市場強度分析:

アジア太平洋地域の電子契約アセンブリ市場に関連する国の市場強度分析は、:

|

カテゴリー |

日本 |

南韓国 |

マレーシア |

中国 |

インド |

|

ファブ生産能力(WSPM) |

中 |

高 |

中 |

高 |

低 |

|

テクノロジーノードリーダーシップ |

高度 |

高度 |

成熟 |

高度 |

成熟 |

|

輸出量 |

中 |

高 |

高 |

高 |

中 |

|

自動車チップ製造 |

Mask |

||||

|

家電需要 |

|||||

|

AI/データセンターチップ生産能力 |

|||||

|

政府インセンティブ |

|||||

|

サプライチェーンの深さ |

|||||

|

研究開発エコシステムの強さ |

|||||

|

市場参入障壁 |

|||||

ソース: SDKI Analytics 専門家分析

電子契約アセンブリ業界概要と競争ランドスケープ

電子契約アセンブリ市場メーカーシェアを独占する世界トップ10社は以下のとおりです。:

|

会社名 |

本社所在地 |

電子契約アセンブリに関する関係 |

|

Jabil Inc. |

米国 |

PCBおよびボックスビルドを含むフルサービスのEMSプロバイダー |

|

Flex Ltd. |

米国/シンガポール |

設計から納品まで一貫した世界EMS |

|

Sanmina Corporation |

米国 |

通信・医療向け高度PCBおよびシステム組立 |

|

Celestica Inc. |

Mask |

|

|

Benchmark Electronics |

||

|

Plexus Corp. |

||

|

Season Group |

||

|

Compulink Cable Inc. |

||

|

Connect Group NV |

||

|

SFO Technologies |

||

ソース: SDKI Analytics 専門家分析 と会社ウェブサイト

電子契約アセンブリの世界および日本の消費者トップ10は:

| 主要消費者 | 消費単位(数量) | 製品への支出 – 米ドル価値 | 調達に割り当てられた収益の割合 |

|---|---|---|---|

| Apple Inc. |

|

||

| Dell Technologies Inc. | |||

| XXXX | |||

| XXXXX | |||

| xxxxxx | |||

| xxxxxxxx | |||

| xxxxx | |||

| xxxxxxxx | |||

| xxxxxx | |||

| XXXXX | |||

日本の電子契約アセンブリ市場メーカーシェアを独占するトップ10社は以下のとおりです。:

|

会社名 |

事業状況 |

電子契約アセンブリ関連 |

|

Sekiaoi Techno Co., Ltd. |

原産地:日本 |

医療機器およびPCB組立向けEMS |

|

SUN-S Co., Ltd. |

原産地:日本 |

半導体および電子部品組立 |

|

Tokyo Electron Device Ltd. |

原産地:日本 |

EMSおよび半導体設計サービス |

|

Hirakawa Hewtech Corp. |

Mask |

|

|

Yamashita Electric Co., Ltd. |

||

|

Advantest Corporation |

||

|

TMEIC Corporation |

||

|

Tokyo Electron Ltd. |

||

|

Hagiwara Electric Co., Ltd. |

||

|

SIIX Corporation |

||

ソース: SDKI Analytics 専門家分析 と会社ウェブサイト

電子契約アセンブリ 市場 包括的企業分析フレームワーク

市場内の各競合他社について、次の主要領域が分析されます 電子契約アセンブリ 市場:

- 会社概要

- リスク分析

- 事業戦略

- 最近の動向

- 主要製品ラインナップ

- 地域展開

- 財務実績

- SWOT分析

- 主要業績指標

電子契約アセンブリ市場最近の開発

電子契約アセンブリ市場に関連する最近の商業化と技術の進歩のいくつかは、世界と日本の両方で見られます。:

|

打ち上げ予定日 |

会社名 |

詳細 |

|

2024年5月 |

Flex Ltd. |

自動車、ヘルスケア、産業分野のお客様の製品開発を加速し、生産規模を拡大するために設計された包括的なデジタル製造ソリューションスイートであるOrbit Flexプラットフォームを発表しました。このプラットフォームは、データ分析、ファクトリーオートメーション、サプライチェーン管理ツールを統合し、リアルタイムの可視性と制御を提供することで、お客様の市場投入までの時間を短縮することを目指しています。 |

|

2025年7月 |

Astemo |

電気自動車向けの新しい統合型熱管理モジュールを発表。Astemoは、バッテリー電気自動車(BEV)向けに、熱交換器、冷媒冷却器、チラーを一体化したコンパクトなモジュールを開発しました。この革新的なモジュールにより、部品とコネクタの数を削減し、組み込み制御システムとセンサーの高度な電子組立工程を削減します。このモジュールは、バッテリー温度を管理することで超急速充電をサポートし、自動車分野における高信頼性電子組立の用途拡大を象徴しています。 |

ソース: 企業プレスリリース

目次

関連レポート

よくある質問

- 2020ー2024年

- 2025-2035年

- 必要に応じて日本語レポートが入手可能