自律配送ロボット市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― ロボットタイプ別、アプリケーション別、最終用途別、技術別、積載量別、及び地域別―世界市場の見通しと予測 2026-2035年

出版日: Oct 2025

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

自律配送ロボット市場エグゼクティブサマリ

1) 自律配送ロボット市場規模

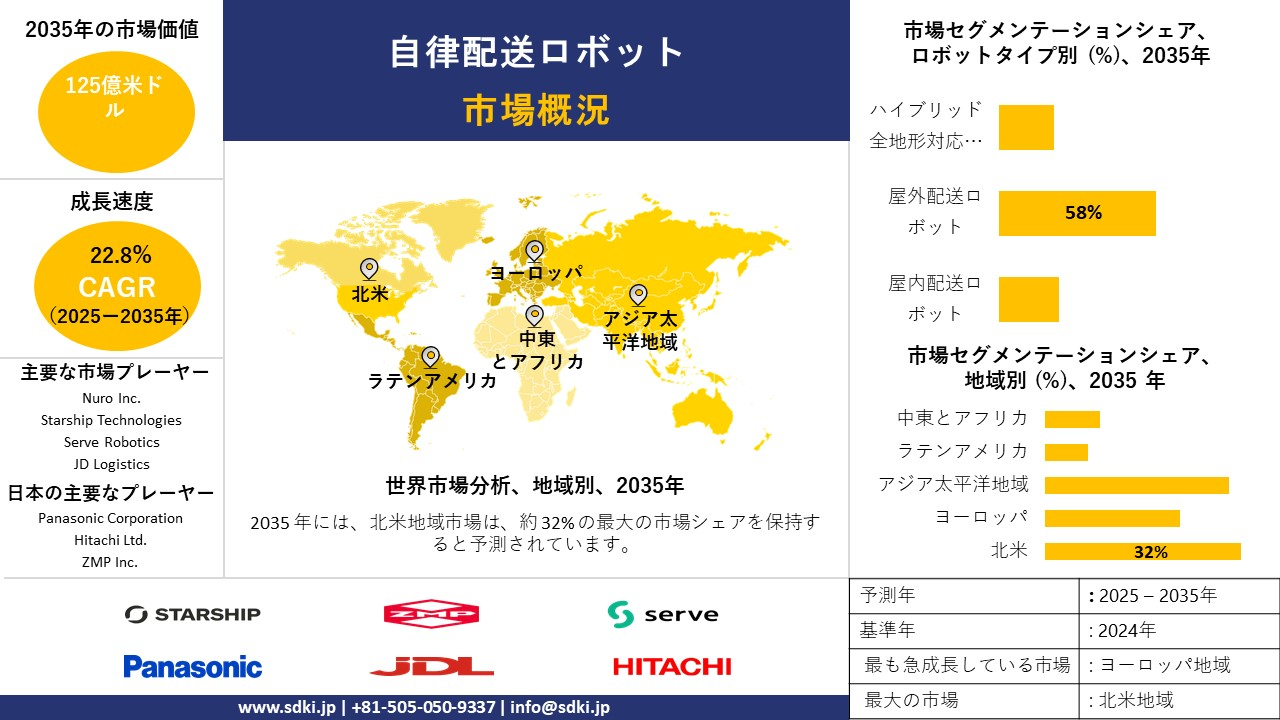

自律配送ロボット市場に関する弊社の調査レポートによると、市場は2025ー2035年の予測期間において複利年間成長率(CAGR)22.8%で成長すると予想されています。2035年には、市場規模は125億米ドルに達すると見込まれています。

しかし、弊社の調査アナリストによると、基準年の市場規模は16億米ドルでしました。人手不足の深刻化とラストマイル配送コストの上昇により、小売業及び食品サービス業界全体で自律配送ロボットの導入が進んでいます。

2) 自律配送ロボット市場の傾向 – 好調な推移を示す分野

SDKI Analyticsの専門家によると、予測期間中に予測される自律配送ロボット市場の傾向には、食品配達、Eコマース物流、ヘルスケア供給などの分野が含まれます。予測期間中に自律配送ロボット市場を牽引すると予想される主要な傾向について、以下に詳細をご紹介します:

|

市場セグメント |

主要地域 |

CAGR (2025-2035年) |

主要な成長要因 |

|---|---|---|---|

|

フードデリバリー |

北米 |

31.2% |

レストランとの提携拡大、都市部の消費者の利便性向上への需要、非接触型デリバリーの嗜好 |

|

Eコマース物流 |

アジア太平洋地域 |

29.8% |

当日配達への期待、小売業のデジタルトランスフォーメーション、サプライチェーンのレジリエンス要件 |

|

ヘルスケア用品 |

ヨーロッパ |

27.4% |

医療緊急対応、温度管理輸送、病院の自動化イニシアチブ |

|

小売在庫 |

北米 |

26.9% |

店舗補充の最適化、人件費削減、在庫精度の向上 |

|

コーポレートキャンパス |

アジア太平洋地域 |

25.7% |

社内物流の自動化、従業員向け利便性サービス、スマートオフィスの統合 |

ソース: SDKI Analytics 専門家分析

3) 市場の定義–自律配送ロボットとは何ですか?

自律配送ロボットは、人間の介入なしに商品を輸送できる自律走行ロボットシステムです。通常、道路や歩道に設置されます。さらに、これらの車両はセンサー、人工知能、GPSナビゲーションを活用して障害物を検知し、経路を辿り、ラストマイルの配送を完了します。

自律配送ロボット市場は、これらのロボットシステムの製造と運用に携わるメーカー、ソフトウェア開発者、サービスプロバイダーのエコシステムと関連しています。さらに、この市場には、主要な業界におけるラストマイル配送の自動化ソリューションを推進できるハードウェア販売、ソフトウェアプラットフォーム、そしてロボティクス・アズ・ア・サービス(ROS)モデルも含まれます。

4) 日本の自律配送ロボット市場規模:

日本の自律配送ロボットは、予測期間中に複利年間成長率(CAGR)23.9%で成長すると予測されています。深刻な労働力不足と人口動態の変化は、自律配送ロボット市場の主要な推進力となっています。例えば、労働力の減少により人手不足が深刻化する中で、ロボットは人手不足の解消に不可欠です。さらに、国や地方自治体は、試験導入や導入に関する規制を緩和する特区制度を通じて、自動化を積極的に推進しています。さらに、整備された歩道と集中化した生活パターンを持つ日本の人口密度の高い都市は、配送ルートの形成に有利な条件を備えています。この人口密度は、各ロボットの経済的実現可能性と運用範囲の拡大につながると予想されます。

- 日本の現地市場プレーヤーの収益機会:

日本の現地市場プレーヤーにとって、自律配送ロボット市場に関連するさまざまな収益機会は次のとおりです:

|

収益創出の機会 |

主要成功指標 |

主な成長要因 |

市場洞察 |

競争の激しさ |

|

都市部ラストマイル配送 |

東京、大阪におけるロボット導入密度の高さ |

高齢化、労働力不足、eコマースの急成長 |

日本の都市部は配送のボトルネックに直面しています。AMRは拡張可能なソリューションを提供 |

中程度 |

|

医療物流ロボット |

病院や高齢者介護施設への導入 |

人手不足、人口構成の高齢化、衛生基準遵守 |

2024年までに医療分野に1,500台以上のAMRを導入 |

低 |

|

小売流通自動化 |

ロボット処理能力(アイテム/時間)、稼働時間 |

小売業のデジタル化、非接触型配送の需要 |

AEON とSeven & i Holdingsはロボットを活用し、1時間あたり8,000点の商品を処理 |

高 |

|

医薬品クリーンルーム輸送 |

Mask |

|||

|

キャンパス及びホスピタリティ配送 |

||||

|

フリート管理ソフトウェアライセンス |

||||

|

メンテナンス及びアフターマーケットサービス |

||||

ソース: SDKI Analytics 専門家分析

- 日本の自律配送ロボット市場の都道府県別内訳:

以下は、日本における自律配送ロボット市場の都道府県別の内訳の概要です:

|

都道府県 |

CAGR (2025–2035年) (%) |

主な成長要因 |

|

東京 |

34.2% |

高い人口密度、スマートシティへの取り組み、旺盛なeコマースと小売需要 |

|

大阪 |

31.5% |

都市物流の革新、労働力の高齢化、堅牢な技術インフラ |

|

神奈川 |

29.8% |

東京への近接性、活発なロボット研究開発、医療自動化の拡大 |

|

愛知 |

Mask |

|

|

福岡 |

||

ソース: SDKI Analytics 専門家分析

自律配送ロボット市場成長要因

弊社の自動配送ロボット市場分析調査レポートによると、以下の市場傾向と要因が市場成長の主因となると予測されています。

-

配送ロボットの公道における運用に関する規制上の実証実験と正式化:

各国政府は、自律配送ロボットが公共インフラ上で運行することを可能にするための、試験的な運用期間から正式な承認及び規格の策定へと移行しており、これは大規模な運用開始に向けた重要な構造的促進要因となっています。例えば、日本の経済産業省は、複数の自動配送ロボットが公道での運行を開始したことを公表し、2025年2月に業界における実証実験を強調することで、より高性能な配送ロボットの将来的な展望を示しました。

さらに、シンガポールの情報通信メディア開発庁(IMDA)と陸運局(LTA)は、官民連携の実証実験を実施し、物流とラストマイルを優先的なユースケースとして位置付ける自動運転プログラムページを積極的に運用しています。イギリス運輸省は、歩道及び低速自動運転デバイスに関する規制アプローチを理解し、策定するための市民参加及び探索プログラムを実施しています。このように、これらの政府の動きは、実験的なパイロット事業を規制上の道筋へと転換し、事業者の承認手続きにおける摩擦を軽減し、自治体をまたいだ展開を可能にします。さらに、規制の明確化により、企業や自治体パートナーの市場投入までの時間(TTM)が大幅に短縮され、概念実証(POC)から有料の都市やキャンパスへの展開へと転換されることが期待されます。

-

Eコマースの取引量とラストマイルのコスト圧力:

ロボット経済への移行:Eコマースの持続的な成長と、オンラインチャネルを介した小売販売のシェア拡大は、コスト効率が高く繰り返し利用可能な配送方法に有利な、安定したラストマイルの取引量を生み出すと見込まれています。公式統計によると、米国の小売業におけるEコマースのシェアは約16.1%に達しており、ユーロスタットはオンライン購入の増加(EUのインターネット利用者の77%がオンライン購入を約束)を報告しています。これらの統計はいずれも2024年末までの推定値です。

これらのマクロな配送量により、キャンパス、近隣地域、都市部といった密集した配送クラスターが形成され、小型で低速な配送ロボットは、バンやバイクの宅配便に比べて経済的に有利になります。さらに、企業はすでにこの商業的論理を引用しており、Starship Technologiesは運用規模を公表しており(2025年4月時点で8百万件を超える自動配送)、キャンパスや都市部への展開を継続しています。

さらに、Amazonはラストマイルの代替手段としてScoutのフィールドテストを文書化しています。測定可能なeコマースの取引量とプロバイダーの運用マイルストーンを組み合わせることで、持続的な荷物の流れから、配送コストを削減し、収益化(サブスクリプションまたは配送ごとの料金)を可能にする、反復的で定型的なロボットサービスへの明確な道筋が示されています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

レポートの洞察 - 自律配送ロボット市場の世界シェア

SDKI Analyticsの専門家によると、自律配送ロボット市場の世界シェアに関するレポートの洞察は次のとおりです:

|

レポートの洞察 |

|

|

CAGR |

22.8% |

|

2024年の市場価値 |

16億米ドル |

|

2035年の市場価値 |

125億米ドル |

|

過去のデータ共有 |

過去5年間(2023年まで) |

|

将来予測 |

今後10年間(2035年まで) |

|

ページ数 |

200ページ以上 |

ソース: SDKI Analytics 専門家分析

自律配送ロボット市場セグメンテーション分析

自律配送ロボット市場の展望に関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場は、ロボットタイプ別、アプリケーション別、最終用途別、技術別、積載量別に分割されています。

ロボットタイプ別に基づいて、屋内配送ロボット、屋外配送ロボット、ハイブリッド全地形対応ロボットに分割されています。2035年までに、屋外配送ロボットはロボットタイプ別市場の58%を占めると予想されており、これは食品、小包、食料品のラストマイル配送における不可欠な存在であることによるものです。屋外配送ロボットは、耐候性ハードウェアと最先端のナビゲーション機能を備えており、都市部全体でスケーラブルかつ自律的なサービス提供を保証します。これらのロボットは、全天候型でLiDARとGPSにより障害物との衝突を回避し、積載量を増やすことで人への依存度を低減し、配送効率を向上させるため、屋外での作業に適しています。主要な成長機会は、都市化、スマートシティ、非接触型配送(COVID-19後、より一層のニーズが高まる)、そしてセンサーとAIコストの削減により、商業エリアと公共エリアの両方でより広範な利用が可能になることです。

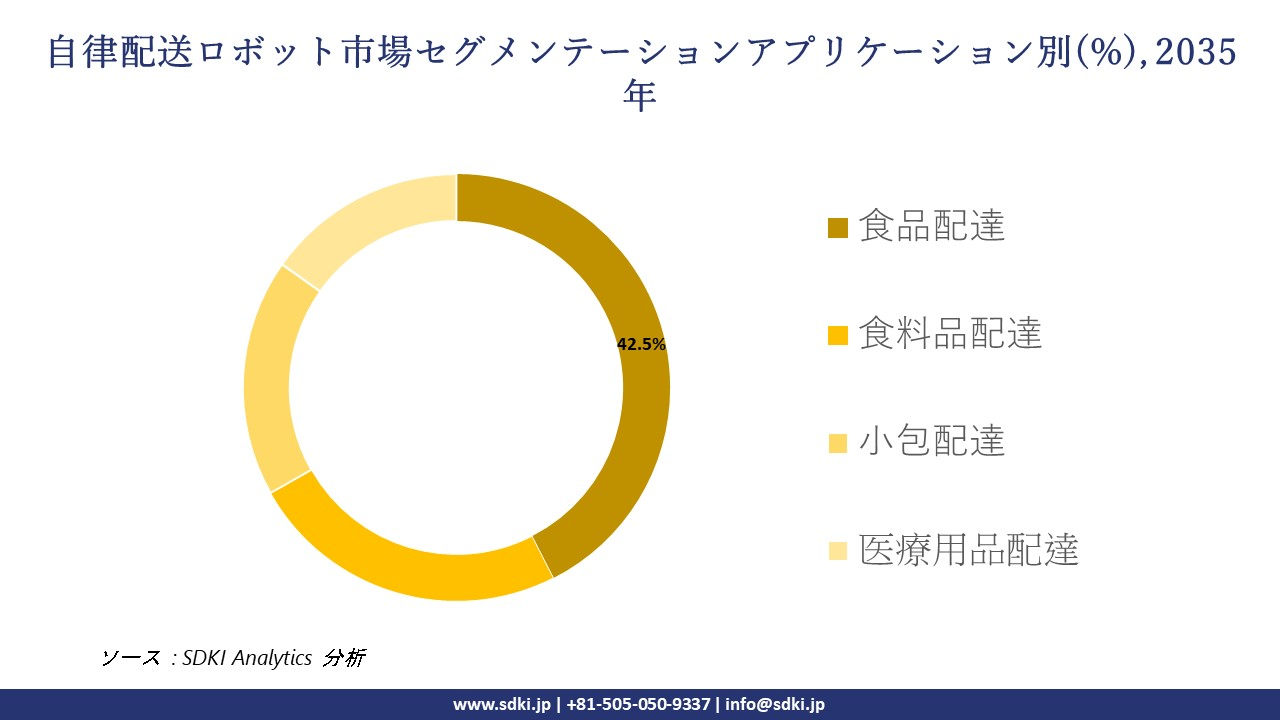

アプリケーション別に基づいて食品配達、食料品配達、小包配達、医療用品配達に分割されています。2035年までに、オンラインでの食品注文の増加とクラウドキッチンの普及に伴い、食品配達ロボットの利用はアプリケーション市場の42.5%に達すると予想されます。短距離で時間制限のあるロボットとして設計されたこれらのロボットは、断熱性、安全なコンパートメント、レストランシステムへの容易な統合により、顧客満足度とロイヤルティを高め、より迅速な非接触型サービスを提供します。また、食事配達の特定のニーズにも対応します。注文頻度が高いため、利用が安定し、労働力の不足と衛生的で自律的なソリューションへの嗜好も、急速な導入に貢献しています。レストランや食品販売店は、都市内での商品配達における効率性、信頼性、パフォーマンス向上を理由に、これらのロボットを導入し、引き続き主要な原動力となります。

以下は、自律配送ロボット市場に該当するセグメントのリストです:

|

セグメント |

サブセグメント |

|

ロボットタイプ別 |

|

|

アプリケーション別 |

|

|

|

|

技術別 |

|

|

積載量別 |

|

ソース: SDKI Analytics 専門家分析

世界の自律配送ロボット市場の調査対象地域:

SDKI Analyticsの専門家は、自律配送ロボット市場に関するこの調査レポートのために以下の国と地域を調査しました:

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

自律配送ロボット市場の制約要因

自律配送ロボットの世界的な市場シェアを阻害する大きな要因の一つは、複雑で予測不可能な都市環境におけるナビゲーションです。ロボットは地図上の経路では優れた性能を発揮しますが、工事現場、駐車車両、混雑した公共イベントなどの障害物に遭遇することがあります。さらに、こうした状況に対処するには人間の介入が必要となり、ロボットの自律性が損なわれます。そのため、このような動的な状況下での一貫したサービスは、普及率を低下させる可能性があります。

自律配送ロボット市場 歴史的調査、将来の機会、成長傾向分析

-

自律配送ロボットメーカーの収益機会

世界中の自律配送ロボットメーカーに関連する収益機会のいくつかは次のとおりです:

|

機会分野 |

対象地域 |

成長の原動力 |

|

ラストマイル小包配送 |

北米(米国、カナダ) |

eコマースの急増、労働力不足、都市部の渋滞緩和 |

|

キャンパス及びホスピタリティ配送 |

ヨーロッパ(ドイツ、フランス) |

スマートインフラ、観光技術の導入、大学のパイロットプログラム |

|

食品配送自動化 |

アジア太平洋地域(日本、韓国、中国) |

都市部の高密度化、非接触型配送の需要、技術に精通した消費者 |

|

医療物流ロボット |

Mask |

|

|

小売配送ロボット |

||

|

製薬クリーンルームロボット |

||

|

フリート管理ソフトウェア |

||

|

農業配送ロボット |

||

|

倉庫自動化 |

||

|

公共セグメント及び郵便配達 |

||

ソース: SDKI Analytics 専門家分析

-

自律配送ロボットの世界的なシェア拡大に向けた実現可能性モデル

弊社のアナリストは、世界中の業界専門家が信頼し、適用している有望な実現可能性モデルをいくつか提示し、自律配送ロボット市場の世界シェアを分析しました:

|

実現可能性モデル |

地域 |

市場成熟度 |

医療制度の構造 |

経済発展段階 |

競争環境の密度 |

適用理由 |

|

PESTLE分析 |

北米 |

成熟 |

混合型(公民連携) |

先進国 |

高 |

ロボット導入に不可欠な規制、技術、法的な傾向を捉えます |

|

ポーターの5つの力 |

ヨーロッパ |

成熟 |

国民皆保険 |

先進国 |

高 |

サプライヤーの力、参入障壁、配送技術プロバイダー間の競争を評価します |

|

SWOTフレームワーク |

アジア太平洋地域 |

新興から成熟へ |

混合型(公民連携) |

混合国 |

中ー高 |

急成長都市市場における内部の強みと外部の脅威を評価します |

|

費用便益分析(CBA) |

Mask |

|||||

|

技術準備状況評価 |

||||||

|

バリューチェーンマッピング |

||||||

|

シナリオプランニング |

||||||

|

ベンチマーキングモデル |

||||||

ソース: SDKI Analytics 専門家分析

市場傾向分析と将来予測:地域市場の見通しの概要

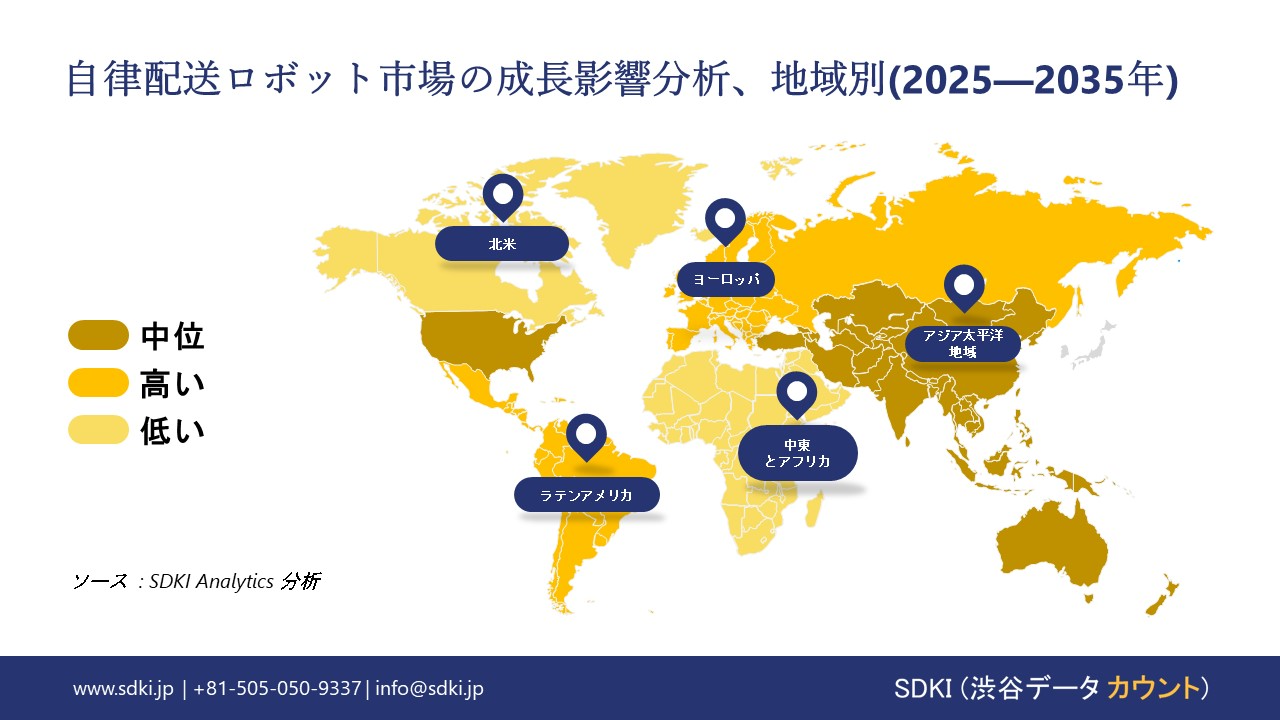

➤北米の自律配送ロボット市場規模:

SDKI市場調査アナリストの調査によると、北米地域市場は予測期間を通じて32%以上の圧倒的な市場シェアを獲得し、世界市場における主導的地位を確保すると予測されています。この地域市場の成長は、eコマースプラットフォームの拡大とラストマイル配送の需要の増加によって牽引されています。米国やカナダなどの国ではeコマースプラットフォームが急速に成長しており、これらの国では効率的なラストマイル配送ソリューションの需要が高まっています。迅速で信頼性の高い非接触型配送に対する消費者の期待に応えるため、自律型ロボットの導入が進んでいます。さらに、パンデミック後の非接触型配送への嗜好の高まりも、この地域市場の成長を牽引しています。パンデミック後、消費者は非接触型で衛生的な配送オプションへのシフトが進んでおり、食品、小売、医療分野の配送において安全で信頼性の高いソリューションを提供する自律配送ロボットの需要が加速しています。

- 北米の自律配送ロボット市場の強度分析:

|

カテゴリー |

米国 |

カナダ |

|

市場成長の可能性 |

非常に高い |

高 |

|

規制環境の複雑さ |

中程度 |

中ー高 |

|

価格体系 |

プレミアム |

中程度 |

|

熟練人材の確保 |

Mask |

|

|

標準及び認証フレームワーク |

||

|

イノベーション・エコシステム |

||

|

技術統合率 |

||

|

市場参入障壁 |

||

|

投資環境 |

||

|

サプライチェーンの統合 |

||

|

競争の激しさ |

||

|

顧客基盤の高度化 |

||

|

インフラ整備状況 |

||

|

貿易政策の影響 |

||

ソース: SDKI Analytics 専門家分析

➤ヨーロッパの自律配送ロボット市場規模:

ヨーロッパの自律配送ロボット市場は、世界の自律配送ロボット市場の中で最も急速に成長する地域市場になると予想されています。この地域市場は、予測期間を通じて22.8%のCAGRで成長すると予測されています。市場の成長は、持続可能性とグリーン物流の目標に支えられています。ヨーロッパ連合(EU)による厳格な環境規制と、カーボンニュートラル物流への圧力の高まりにより、排出量が少なくエネルギー効率の高い運用を実現する電動及び自律配送ロボットの導入が増加しています。さらに、市場の成長は、スマートシティや都市モビリティの取り組みによっても後押しされています。ヨーロッパ諸国では、IoT対応の歩道や交通システムなど、自律配送ロボットの安全で効率的な運用を促進するスマートインフラへの投資が増加しています。

- ヨーロッパの自律配送ロボット市場の強度分析:

ヨーロッパの自律配送ロボット市場に関連する国の市場強度分析は:

|

カテゴリー |

イギリス |

ドイツ |

フランス |

|

市場成長の可能性 |

高 |

高 |

中ー高 |

|

規制環境の複雑さ |

中 |

高 |

中 |

|

価格体系 |

プレミアム |

プレミアム |

中程度 |

|

熟練人材の確保 |

Mask |

||

|

標準及び認証フレームワーク |

|||

|

イノベーション・エコシステム |

|||

|

技術統合率 |

|||

|

市場参入障壁 |

|||

|

投資環境 |

|||

|

サプライチェーンの統合 |

|||

|

競争の激しさ |

|||

|

顧客基盤の高度化 |

|||

|

インフラ整備状況 |

|||

|

貿易政策の影響 |

|||

ソース: SDKI Analytics 専門家分析

➤アジア太平洋地域の自律配送ロボット市場規模:

アジア太平洋地域における自律配送ロボット市場の調査と分析によると、予測期間を通じて同地域市場が第2位の市場シェアを獲得すると予想されています。同地域市場の成長は、都市化とスマートシティの進展に支えられています。アジア太平洋諸国における急速な都市開発とスマートシティの取り組みは、自律配送ロボットが安全かつ効率的に運用するために必要なインフラを整備しています。主要都市では、ロボットの移動を支援するためにAIとIoT技術の導入が進んでいます。中国は、大規模な電子商取引エコシステム、高度なインフラ、スマートシティ、政府の支援策、そして戦略的な政策により、同地域市場で最大の市場シェアを確保すると予測されています。

- アジア太平洋地域の自律配送ロボット市場の強度分析:

アジア太平洋地域の自律配送ロボット市場に関連する国の市場強度分析は:

|

カテゴリー |

日本 |

中国 |

インド |

マレーシア |

韓国 |

|

市場成長の可能性 |

中程度 |

非常に高い |

高 |

中程度 |

高 |

|

規制環境の複雑さ |

高 |

中程度 |

中 |

中程度 |

高 |

|

価格体系 |

プレミアム |

競争力がある |

コスト重視 |

中価格帯 |

プレミアム |

|

熟練人材の確保 |

Mask |

||||

|

標準及び認証フレームワーク |

|||||

|

イノベーション・エコシステム |

|||||

|

技術統合率 |

|||||

|

市場参入障壁 |

|||||

|

投資環境 |

|||||

|

サプライチェーンの統合 |

|||||

|

競争の激しさ |

|||||

|

顧客基盤の高度化 |

|||||

|

インフラ整備状況 |

|||||

|

貿易政策の影響 |

|||||

ソース: SDKI Analytics 専門家分析

自律配送ロボット業界概要と競争ランドスケープ

自律配送ロボット市場のメーカーシェアを独占する世界トップ10の企業は次のとおりです:

|

会社名 |

本社所在地 |

自律型配達ロボットとの関係 |

|

Nuro Inc. |

米国(カリフォルニア州) |

専用自律型配達車両の開発企業。Kroger、Domino's Pizza、 FedEx、 Walmartと提携。 |

|

Starship Technologies |

米国及びエストニア |

歩道配達ロボットのパイオニア。20カ国以上で数百万件の配達実績。 |

|

Serve Robotics |

米国(カリフォルニア州) |

ポストメイツからスピンオフ、Uber Eats及び7-Elevenと提携し、都市部で歩道配達ロボットを運用。 |

|

JD Logistics (JD.com) |

Mask |

|

|

Ottonomy.IO |

||

|

Kiwibot |

||

|

Zipline |

||

|

Amazon (Scout) |

||

|

Alibaba (Cainiao Xiaomanlv) |

||

|

Yandex Rover |

||

ソース: SDKI Analyticsの専門家分析と企業のウェブサイト

自律配送ロボットの世界及び日本の消費者トップ10は:

| 主要消費者 | 消費単位(数量) | 製品への支出 – 米ドル価値 | 調達に割り当てられた収益の割合 |

|---|---|---|---|

| Rakuten Group, Inc. |

|

||

| Domino's Pizza, Inc. | |||

| XXXX | |||

| XXXXX | |||

| xxxxxx | |||

| xxxxxxxx | |||

| xxxxx | |||

| xxxxxxxx | |||

| xxxxxx | |||

| XXXXX | |||

日本における自律配送ロボット市場のメーカーシェアを独占するトップ10社は以下のとおりです:

|

会社名 |

事業形態 |

自律配送ロボットとの関係 |

|

Panasonic Corporation |

上場(東京証券取引所) |

屋内物流及び病院向け自律配送ロボットを開発し、スマートモビリティの実証実験に積極的に取り組んでいます。 |

|

Hitachi Ltd. |

上場(東京証券取引所) |

産業・医療物流向けAMRを構築し、AIとIoTを統合した車両管理を行っています。 |

|

ZMP Inc. |

非上場 |

自律型モビリティのパイオニアとして、東京のラストマイル配送向けにCarriRo Deliを開発しました。 |

|

Rakuten Group Inc. |

Mask |

|

|

Yamaha Motor Co., Ltd. |

||

|

TIS Inc. |

||

|

SoftBank Robotics |

||

|

NEC Corporation |

||

|

KDDI Corporation |

||

|

Kyocera Corporation |

||

ソース: SDKI Analyticsの専門家分析と企業のウェブサイト

自律配送ロボット 市場 包括的企業分析フレームワーク

市場内の各競合他社について、次の主要領域が分析されます 自律配送ロボット 市場:

- 会社概要

- リスク分析

- 事業戦略

- 最近の動向

- 主要製品ラインナップ

- 地域展開

- 財務実績

- SWOT分析

- 主要業績指標

自律配送ロボット市場最近の開発

世界的にも日本でも、自律配送ロボット市場に関連する最近の商業化と技術進歩のいくつかは以下のとおりです:

|

月と年 |

関係企業・機関 |

自律配送ロボット市場への接続 |

|---|---|---|

|

2025年9月 |

DoorDash |

DoorDashは、スケーラブルなローカルコマースを実現する自律配送プラットフォームと統合された、同社初の自社製自律配送ロボット「Dot」を発表しました。これは、都市部配送に特化したロボットの商用展開を示すものであり、自律配送ロボット市場の急速な発展を加速させます。 |

|

2025年2月 |

Rakuten Group, Inc. & Avride |

Rakutenは、Avrideの先進的なロボットを導入し、サービスエリアと店舗を拡大することで、東京での自律配送サービスを拡大しました。これは、ロボット物流における大規模な導入と国際的な連携を示すことで、自律配送ロボット市場の強化につながります。 |

ソース:企業プレスリリース

目次

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能