自動車シャーシ市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― 材質タイプ別、シャーシタイプ別、車両タイプ別、システムタイプ別及び地域別―世界市場の見通しと予測 2026-2035年

出版日: Jan 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

自動車シャーシ市場規模

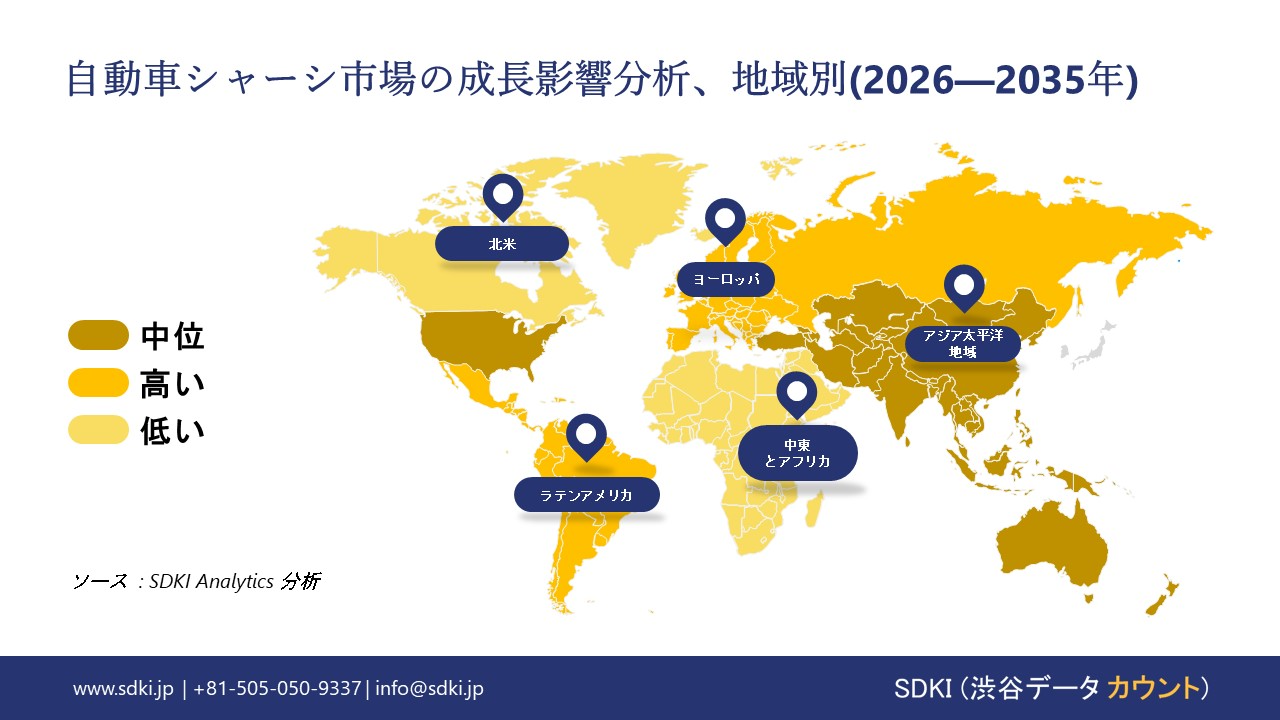

当社の自動車シャーシ市場調査レポートによると、市場は予測期間(2026-2035年)において年平均成長率(CAGR)8.9%で成長すると予測されています。2035年には、市場規模は1,678億米ドルに達する見込みです。しかし、当社の調査アナリストによると、基準年の市場規模は653億米ドルでしました。当社の自動車シャーシ市場調査によると、市場シェアが最大規模であるアジア太平洋地域は、予測期間を通じて約50%のシェアを占めると予想されます。ヨーロッパは、最も高いCAGRで成長すると予想されており、統合シャーシ制御を必要とする先進運転支援システムを義務付ける「ビジョンゼロ」安全イニシアチブの施行、そしてドイツとハンガリーにおけるEV製造拠点の急速な拡大により、今後数年間は有望な成長機会が見込まれます。

自動車シャーシ市場分析

現在、自動車のシャーシ業界は、技術革新と車両の成熟という大きな局面を迎えています。米国では、2025年に軽自動車の平均車齢が過去最高の12.8年に達し、車両の安全性と走行性能を確保するために必要なアフターマーケットのシャーシ部品の需要が旺盛です。車両の老朽化により、メーカーは従来型部品の製造と最先端の新車両システムのバランスを取る必要に迫られています。一方、日本市場は、依然として経済の柱であり続ける国内生産量の多さに牽引されています。2024年には、日本の自動車生産台数は約8.23百万台に達すると報告されています。市場の見通しは、この安定した量産体制がシャーシサプライヤーに強固な基盤を与え、世界的な電気自動車の大型化に伴い、車両重量の増加に対応できる堅牢で頑丈なシャーシ設計が求められていることを示しています。調査報告書で強調されている重要な点は、EVの耐久性と老朽化したICE車両の耐用年数という2つの要求に適応できないことで、従来型のサプライヤーが市場シェアを失う可能性があるということです。

自動車のシャーシとは、車体、エンジン、その他の部品を搭載する車の内部構造を指します。フレーム、サスペンション、ステアリングシステム、車軸などから構成されます。シャーシは車両の荷重を支え、路面状況によるストレスを吸収し、車両の安全性と安定性を確保します。当社の自動車シャーシ市場分析調査レポートによると、以下に示す市場傾向と今後の展望が、市場成長の原動力となることが期待されます。

- 大型車両基準-

シャーシ市場を牽引する重要な規制要因の一つは、米国環境保護庁(EPA)が2024年4月に採択した大型車両の温室効果ガス排出基準「フェーズ3」です。この品質基準は2027-2032年モデルも対象としており、業務用トラックやトラクターの排出量(トンマイルあたり)を大幅に削減することが求められています。この規制により、シャーシメーカーは、新しい排出ガス制御システムやバッテリーパックの重量に対抗するため、軽量素材や空力ボディの採用など、創意工夫を凝らす必要があります。当社の分析によると、この規制によって必要となる追加費用と技術向上が、大型車両シャーシ部門の価値向上の原動力となる可能性があります。市場の観点から見ると、この規制の推進力は、北米の物流業界におけるゼロエミッションシャーシプラットフォームへの移行を促進すると予想されます。

- 強力な世界的な電気自動車需要 –

市場の変動にもかかわらず、電気自動車(EV)の需要はシャーシ革新を推進する強力な原動力となっています。2025年第1四半期には、20カ国以上で4百万台以上の電気自動車が販売され、これは2024年同期比で35%増加しています。この継続的なブームは、バッテリーパックがフロア構造に直接組み込まれるスケートボード型のような、特殊なシャーシプラットフォームが業界にとって不可欠であることを示しています。これらの特殊なEVシャーシは、設計の自由度と室内空間を向上させるだけでなく、ギガキャスティングなどの最新の製造方法を採用しています。当社のアナリストの見解では、2025年初頭に記録された高い販売実績は、電動化シャーシアーキテクチャへの移行が減速するどころか、加速していることを示しています。これは、当社のグローバルプラットフォーム戦略に関する調査レポートにおける傾向の一つです。

自動車シャーシ市場において、日本の現地企業は自動車シャーシの輸出に関してどのような利益を得るのですか?

日本の自動車シャーシ市場における既存企業は、良好な貿易インフラと高品質な生産体制の確立を背景に、輸出機会を活かす好位置に立っています。2024年の日本の自動車部品・アクセサリー輸出額は約3.91兆円と予測されており、この分野はトランスミッションシステムやサスペンションモジュールといったシャーシ関連部品の比率が高い分野です。この高い輸出率は、日本のサプライヤーが大手OEMのグローバルサプライチェーンに深く関わっていることを示しています。これらの主要部品を米国、中国、タイの組立工場に移管することで、日本企業はこれらの企業に収益基盤を保証し、単一市場の崩壊リスクを軽減しています。

さらに、「ソフトウェア定義車両」(SDV)への技術革新は、高付加価値の新たな輸出機会を生み出しています。Astemoやアイシン精機といった日本のサプライヤーも、先進的なセンサーと制御ソフトウェアを組み込んだシャーシシステムを輸出しています。スマートシャーシシステム市場が世界的に拡大するにつれ、海外の自動車メーカーは、自動運転機能と統合可能な安全でハイテクなソリューションの提供を日本に求めています。EUの一般安全規則(GSR2)など、世界各国の安全基準の強化に伴い、日本における精密工学とセンサーを内蔵したシャーシ部品の需要が高まり、輸出収益性が向上することが市場機会として示唆されています。

最後に、日本のシャーシメーカーの輸出競争力は、政府の支援策を通じて直接的に強化されています。経済産業省は、海外生産展示会への補助金やサプライチェーンの強靭化支援を通じて、業界を支援しています。この財政支援により、日本企業は輸出重視の生産設備を建設・近代化し、コスト効率を高めつつ最新技術を導入することが可能になります。調査報告書によると、このような政府政策と企業の事業拡大の連携が、自動車シャーシ業界における日本の輸出主導の地位に貢献してきた理由の一つとなっています。

市場の制約

より高い安全基準を求める厳格な規制枠組みは、自動車シャーシ市場における主要な制約要因の一つとして取り上げられています。シャーシは自動車産業の構造的バックボーンの一部とみなされ、耐衝突性、燃費、そして安全性の基準に影響を与えるため、厳しい規制が課せられています。これには認証と規制承認が必要であり、その条件は地域法に基づいて異なります。例えば、日本国内の車検では、車両の改造に対して厳しい規制が課されており、これはアフターマーケットや、更新された規制形式に基づく非標準シャーシに大きな打撃を与えています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

自動車シャーシ市場レポートの洞察

SDKI Analyticsの専門家によると、自動車シャーシ市場の世界シェアに関連するレポートの洞察は以下のとおりです。

|

レポートの洞察 |

|

|

2026-2035年のCAGR |

8.9% |

|

2025年の市場価値 |

653億米ドル |

|

2035年の市場価値 |

1,678億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

自動車シャーシ市場セグメンテーション

自動車シャーシ市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場を材質タイプ別、シャーシタイプ別、車両タイプ別、システムタイプ別にセグメント化しました。

システムタイプ別に基づいて、市場はさらにアクティブ/アダプティブシステム(AKC、アダプティブサスペンション)、セミアクティブシステム(可変バルブ付きパッシブダンパーなど)、パッシブシステム(従来の固定ジオメトリ)に分割されています。これらのうち、アクティブ/アダプティブシステムが主導しており、予測期間中に世界市場シェアの50%を占めると予想されています。電気自動車の普及と高性能車の需要により、自動車シャーシの市場採用率が高まっています。IEAのレポートによると、 2024年には17百万台のEVが販売され、環境の脅威の高まりにより堅調な成長が見込まれています。EV製造においては、バッテリーの重量を補正し、マルチモーターシステム内でトルク配分を行うアクティブシャーシシステムが強く求められています。これは、EVの安定性を高めるとともに、抗力を制御するのに役立ちます。

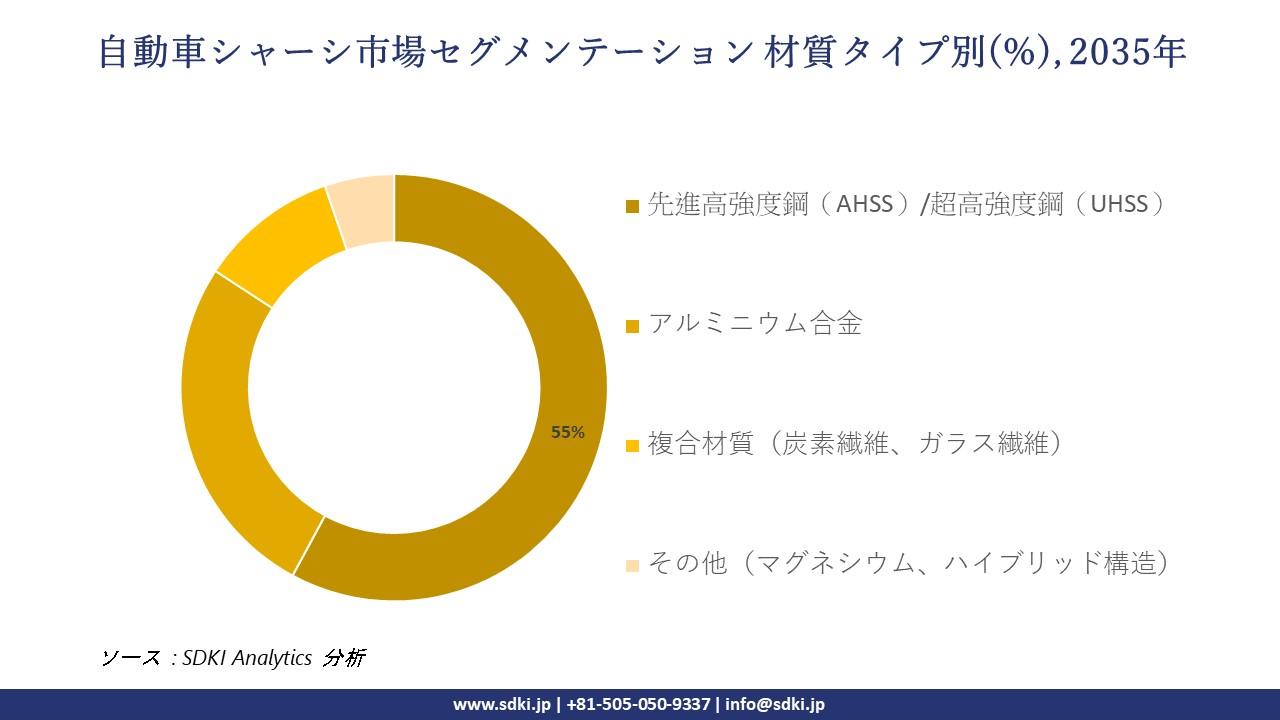

材質タイプ別では、先進高強度鋼(AHSS)/超高強度鋼(UHSS)、アルミニウム合金、複合材質(炭素繊維、ガラス繊維)、その他(マグネシウム、ハイブリッド構造)です。これらの中で、先進高強度鋼はリードしており、予測期間中、世界市場シェアの55%を占めます。世界的な安全規制、量販EVにおけるコスト圧力により、AHSS材質タイプの自動車シャーシの需要が加速しています。手頃な価格のEVのバッテリーコストを管理することは非常に困難です。先進高強度鋼を使用することで、EVのコストを抑制し、世界市場における車両の普及率を加速させることができます。

自動車シャーシ市場に該当するセグメントのリストです。

|

サブセグメント |

|

|

材質タイプ別 |

|

|

シャーシタイプ別 |

|

|

車両タイプ別 |

|

|

システムタイプ別 |

|

ソース: SDKI Analytics 専門家分析

自動車シャーシ市場の傾向分析と将来予測:地域市場展望概要

当社のアナリストによると、こうした政策と中国、日本、インドといった主要経済国における生産増加は、自動車メーカーや部品サプライヤーに対し、より多くの車両を現地生産し、工場を拡張し、シャーシ部品の域内調達を増やすよう促すため、アジア太平洋地域全体の市場成長につながると予測されています。中国、日本、インドが製造規模を拡大するにつれ、新規ベンダーが市場に参入し、金型や先進的なシャーシ設計への投資が流入しています。

日本のモビリティDX戦略は、自動車メーカーとサプライヤーに電動化とソフトウェアを中心とした車両の再設計を促しています。当社の分析によると、これはバッテリー、センサー、電子制御ユニット、コネクテッドカー向けハードウェアを搭載できる新しいタイプのシャーシの需要を直接的に増加させ、市場の堅調な成長につながると考えられます。

SDKI Analyticsの専門家は、自動車シャーシ市場に関するこの調査レポートのために、以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

当社の調査レポートによると、ヨーロッパの自動車シャーシ市場は予測期間中に年平均成長率(CAGR)6.8%で力強い成長を示すと予想されています。ゼロエミッション車の義務化とEUのCO₂基準強化により、加盟国全体でシャーシの設計と調達が活発に再収益化され、EV専用シャーシアーキテクチャに対する持続的な需要が生まれています。Eurostatは、2024年の自動車販売生産額が7,070億ユーロに達すると報告しており、Destatisはドイツが2024年に3.4百万台の自動車を輸出したと記録しており、これはEU規制の対象となる大規模な製造規模を示しています。

アナリストの見解では、これらの規制と高い生産レベルにより、ヨーロッパの自動車メーカーはプラットフォームのアップグレードとEV対応シャーシ部品の調達を迫られています。これにより、地域全体の需要がさらに高まり、ヨーロッパの自動車シャーシ市場の継続的な成長が促進されます。

自動車シャーシ調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

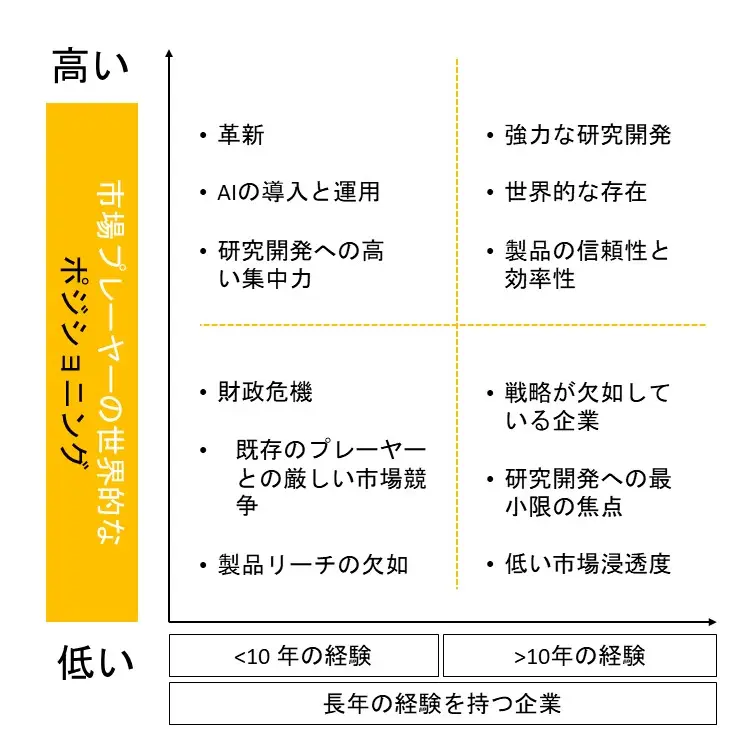

SDKI Analyticsの調査者によると、自動車用シャーシ市場の見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートでは、市場プレーヤーが市場全体の見通しにおいて競争優位性を獲得するために、製品・技術の投入、戦略的パートナーシップ、協業、買収、事業拡大など、あらゆる機会を活用していると指摘されています。

当社の調査レポートによると、世界の自動車シャーシ市場の成長において重要な役割を果たしている主要企業には、ZF Friedrichshafen AG、Continental AG、Magna International Inc.、Benteler International AG、Schaeffler AGなどが含まれます。さらに、市場展望によると、日本の自動車シャーシ市場における上位5社は、Aisin Corporation、Astemo, Ltd. (旧Hitachi Astemo)、Toyota Motor Corporation、Honda Motor Co., Ltd.、Nissan Motor Co., Ltd.などです。本市場調査レポートには、これらの主要企業の詳細な競合分析、企業プロファイル、最近の傾向、主要な市場戦略が含まれています。

自動車シャーシ市場ニュース

- 2025 年 9 月、ZF Friedrichshafen AG は IAA Mobility ショーで「Chassis 2.0」コンセプトを発表しました。これは、車両のダイナミクスを最適化し、次世代の電気自動車の自動運転機能とシームレスに統合するように設計された、完全にネットワーク化されたソフトウェア定義のシャーシ システムです。

- 2025年10月、Aisinは、シャーシ駆動系の重要部品である新開発のeAxleがトヨタ自動車の最新電気自動車「bZ4X」に採用され、統合電動シャーシソリューションの量産化に向けた大きな一歩を踏み出したと発表しました。

自動車シャーシ主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

自動車シャーシマーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能