ポリフッ化ビニリデン(PVDF)市場調査―タイプ別(α相、β相、γ相、δ相、ε相)、製品タイプ別(ペレット、パウダー、ラテックスエマルション、フィルム)、アプリケーション別(配管・チューブ、ワイヤー・ケーブル、太陽電池フィルム、膜 、リチウムイオン電池、エネルギー・電子機器用コーティング、その他)、および地域別ー予測2026-2035年

出版日: Oct 2025

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

ポリフッ化ビニリデン(PVDF)市場規模

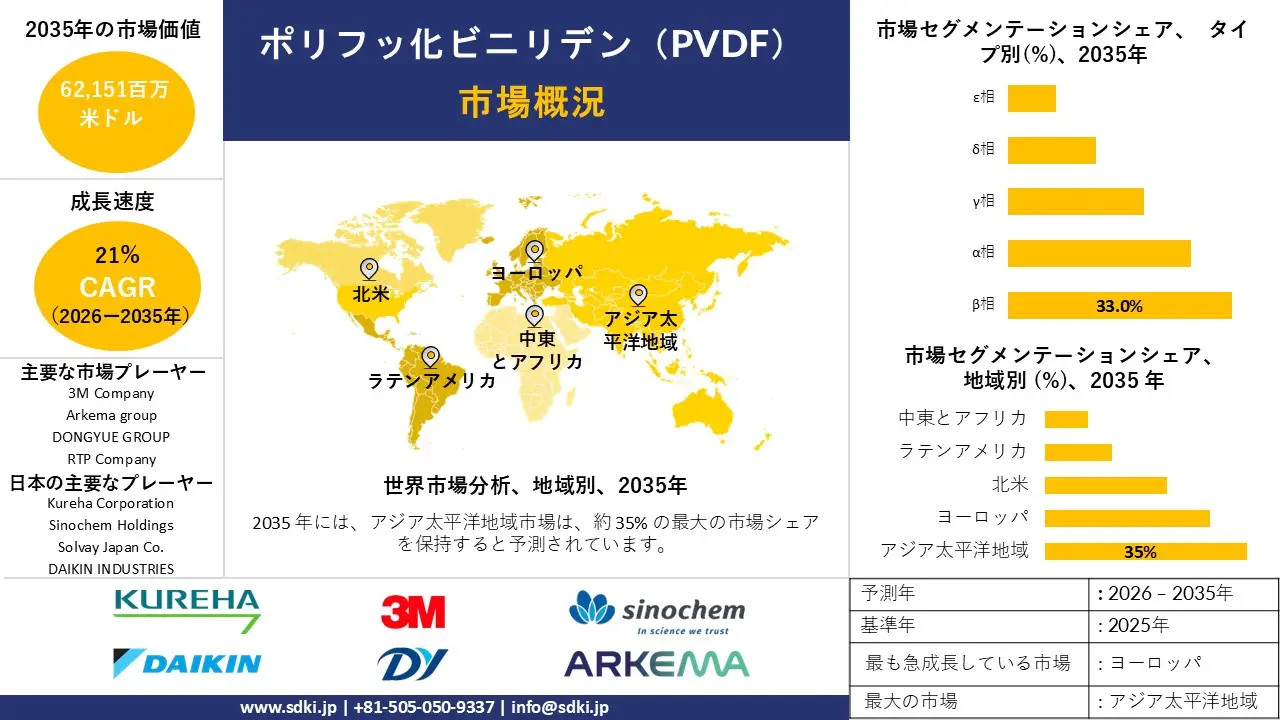

ポリフッ化ビニリデン(PVDF)市場の収益は、2025 年に約 37,266百万米ドルに達しました。さらに、当社のポリフッ化ビニリデン(PVDF)市場に関する洞察によると、市場は予測期間中に約 21% の CAGR で成長し、2035 年までに約 62,151百万米ドルの価値に達すると予想されています。

ポリフッ化ビニリデン(PVDF)市場分析

市場の定義

ポリ二フッ化ビニリデンが重合すると、ポリフッ化ビニリデン (PVDF) またはポリ二フッ化ビニリデン (PVDF) として知られる熱可塑性フッ素ポリマーが生成されます。 PVDF は非常に非反応性の材料です。化学形態では (C2H2F2)n です。

ポリフッ化ビニリデン(PVDF)市場の成長要因

以下は、ポリフッ化ビニリデン(PVDF)市場の主な成長要因の一部です。

- リチウムイオン電池における PVDF の需要の増加– ポリフッ化ビニリデン (PVDF) は、塗料、膜、リチウムイオン電池などのさまざまな用途に使用できる高性能のフッ素化ポリマーです。 PVDF 市場の成長を促進する最も重要な要因の 1 つは、リチウムイオン電池の需要の増加です。リチウムイオン電池市場の成長は、電気自動車と再生可能エネルギーシステムの需要の拡大によって引き起こされ、それがPVDFの需要の増加につながります。 2022 年の自動車用リチウムイオン電池需要は、2021 年の約 335 ギガワット時と比較して、約 70% 増加して 555 ギガワット時となりました。これは主に、2021―2022 年に電気自動車の販売台数が増加し、新規登録台数が 60% 増加したためです。

- 電子・電気産業からの需要の増加– ポリフッ化ビニリデン PVDF は、柔軟性、軽量、低熱伝導率、高い耐薬品性、耐熱性を備えているため、エレクトロニクス産業の電線絶縁材としてよく使用されています。高性能半導体アプリケーションにおける PVDF の広範な使用が、PVDF 市場を牽引してきました。

最新の開発

- 2025 年 8 月に: Solvay Groupは、長期パートナーである Agru と PVDF 樹脂を供給する数百万ドルの契約を締結したと発表しました。

- 2022 年 1 月に: Arkemaは、以前発表した中国Changshu siteの PVDF 生産能力 35% を修正し、50% に引き上げたと発表しました。

課題

ポリフッ化ビニリデン(PVDF)市場の成長に対する主な障害の1つは、自動車生産の減少によるものです。 PVDF は、不浸透性、耐薬品性、電気抵抗率、耐久性などの多くの利点を備えているため、自動車産業で使用されており、特に電線絶縁、プラスチック光ファイバー、燃料移送システム、またはコーティングに魅力的です。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

ポリフッ化ビニリデン(PVDF)市場レポートの洞察

|

レポートの洞察 |

|

|

CAGR |

21% |

|

予測年 |

2026―2035年 |

|

基準年 |

2025年 |

|

予測年の市場価値 |

62,151百万米ドル |

ポリフッ化ビニリデン(PVDF)市場セグメント

当社は、ポリフッ化ビニリデン(PVDF)市場に関連するさまざまなセグメントにおける需要と機会を説明する調査を実施しました。当社はタイプ、製品タイプ、アプリケーションに基づいて市場を分割しました。

タイプに基づいて、ポリフッ化ビニリデン(PVDF)市場は、α相、β相、γ相、δ相、ε相に分割されています。これらのサブセグメントのうち、β 相セグメントは市場で重要な位置を占めており、2035 年までに市場総収益に最大 33% の貢献を果たします。「β 相」セクションで説明されている PVDF ポリマー タイプは、その高い結晶性と優れた機械的品質によって特徴付けられます。このセクションは、コーティング、フィルム、パイプラインなどの用途で頻繁に利用されます。 β 相 PVDF は、圧電、蛍光体、強誘電体などの優れた電気特性を備えています。

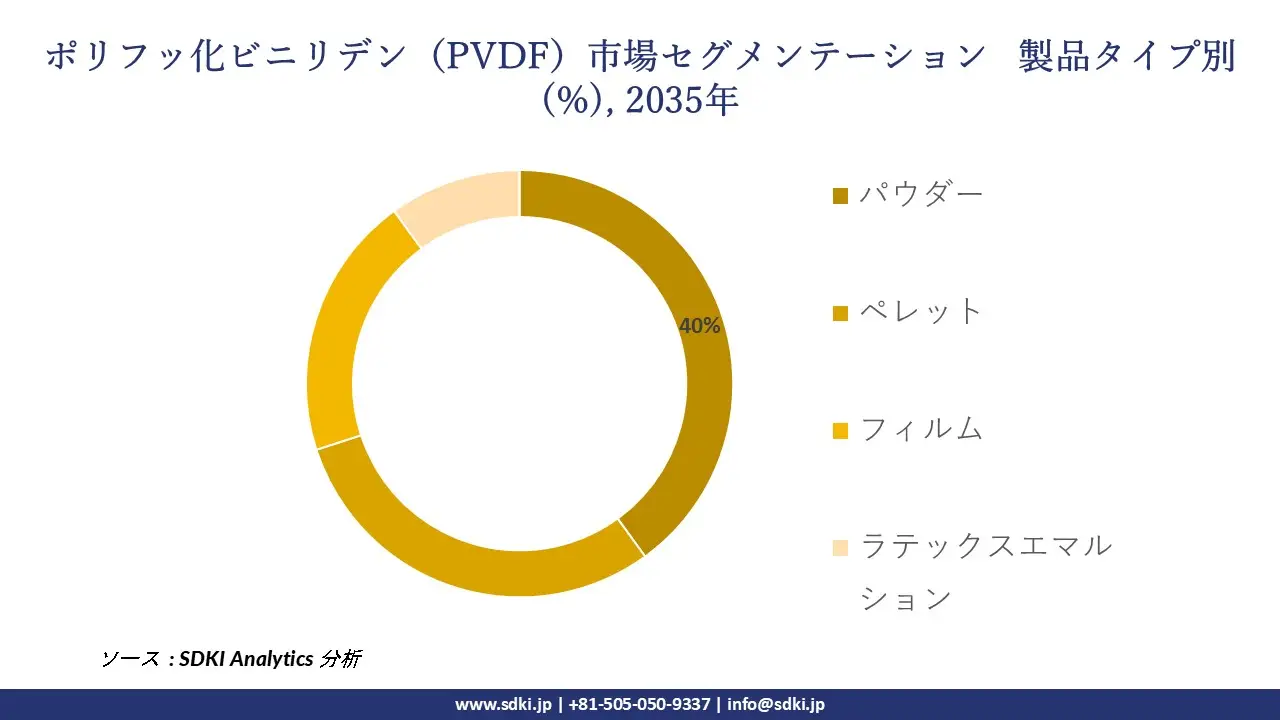

製品タイプに基づいて、ポリフッ化ビニリデン(PVDF)市場は、ペレット、パウダー、ラテックスエマルション、フィルムに分割されています。これら 4 つのサブセグメントのうち、ポリフッ化ビニリデン (PVDF) 市場は、2035 年までに合計市場シェアが約 40% 以上となる粉末セグメントによって支配されると予想されます。粉末状の PVDF は、射出成形などのさまざまな加工技術で使用されます。成形および押出は、PVDF 市場の粉末セグメントで参照されます。塗料、プラスチック、膜などの用途では、スペクトルのこの部分が非常に一般的です。

|

タイプ別 |

|

|

製品タイプ別 |

|

|

アプリケーション別 |

|

ポリフッ化ビニリデン(PVDF)市場の地域概要

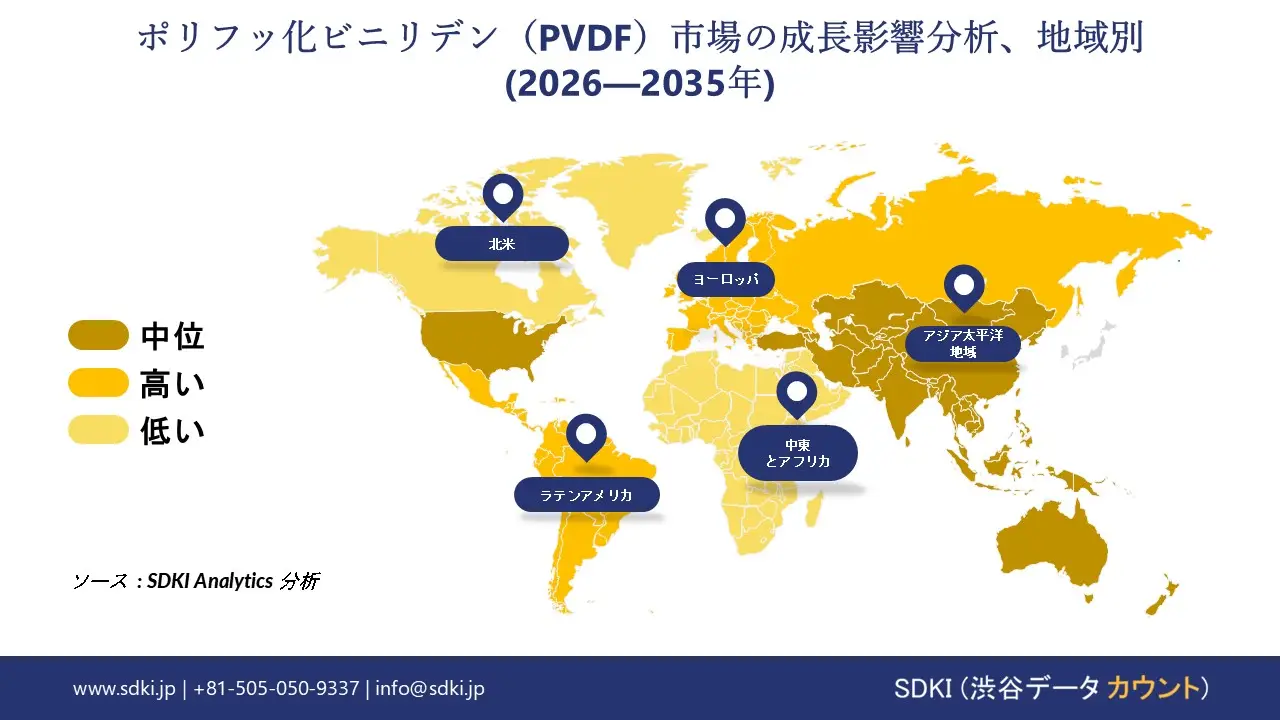

アジア太平洋地域の市場は、市場で最も有利で報酬の高い機会を提供すると予想されています。 2035 年までにアジア太平洋地域が市場シェアの約 35% 以上を占めるようになります。化学産業、エレクトロニクス、中国、日本、韓国、インドなどの自動車生産国などの分野での PVDF の需要の増加などのいくつかの要因により、この優位性に貢献した可能性があります。 2020 年のアジア太平洋地域におけるポリフッ化ビニリデン PVDF 市場の価値は 457百万米ドルです。

日本では、主に国内の自動車産業の増加により市場の成長が推進されています。 8月の日本の新車販売台数は前年同月比17.3%増の340. 3千台となりました。日本自動車販売協会連合会と全国軽自動車二輪車協会によると、2025年8月の国内販売台数は17.3%増の340,342台となりました。

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ヨーロッパ地域の市場も、予測期間中に最大 30% の市場シェアを獲得すると予想されます。太陽電池パネルや風力タービンなどの再生可能エネルギー技術の採用の増加は、その製造に PVDF などの高性能材料を必要とし、欧州での PVDF の需要を支える要因となっています。

ポリフッ化ビニリデン(PVDF)調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

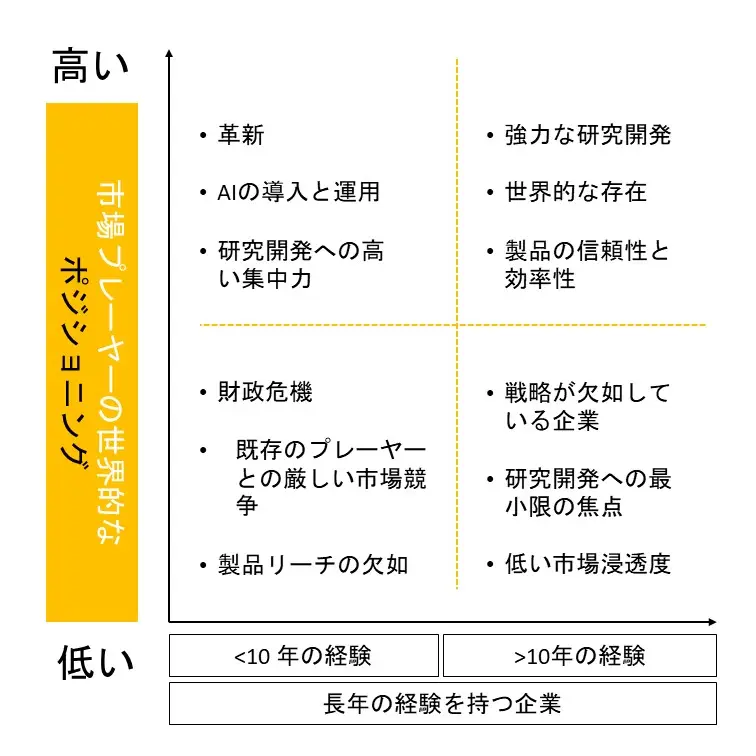

世界のポリフッ化ビニリデン(PVDF)市場中に主なプレーヤーには、3M Company、Arkema group、 DONGYUE GROUP、 Hubei Everflon Polymer CO., Ltd.、 RTP Company、などが含まれます。さらに、日本市場のトップ 5 プレーヤーは、Kureha Corporation、Sinochem Holdings、Solvay Japan Co., Ltd.、DAIKIN INDUSTRIES, LTD.、Shanghai Ofluorine Co., LIMITED.、 などです。この調査には、世界のポリフッ化ビニリデン(PVDF)市場におけるこれらの主要なプレーヤーの詳細な競争分析、企業概要、最近の傾向、および主要な市場戦略が含まれています。

ポリフッ化ビニリデン(PVDF)主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

ポリフッ化ビニリデン(PVDF)マーケットレポート

関連レポート

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能