ドライブライン市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― アーキテクチャ別、コンポーネント別、車両タイプ別、及び地域別―世界市場の見通しと予測 2026-2035年

出版日: Jan 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

ドライブライン市場規模

2026―2035年までのドライブライン市場の市場規模はどのくらいですか?

ドライブライン市場に関する当社の調査レポートによると、市場は予測期間2026―2035年において複利年間成長率(CAGR)7.8%で成長すると予想されています。2035年には市場規模は3,420億米ドルに達すると見込まれています。しかし、当社の調査アナリストによると、基準年の市場規模は2025年には1,620億米ドルにとどまると予測されています。

市場シェアの観点から、ドライブライン市場を支配すると予想される地域はどれですか?

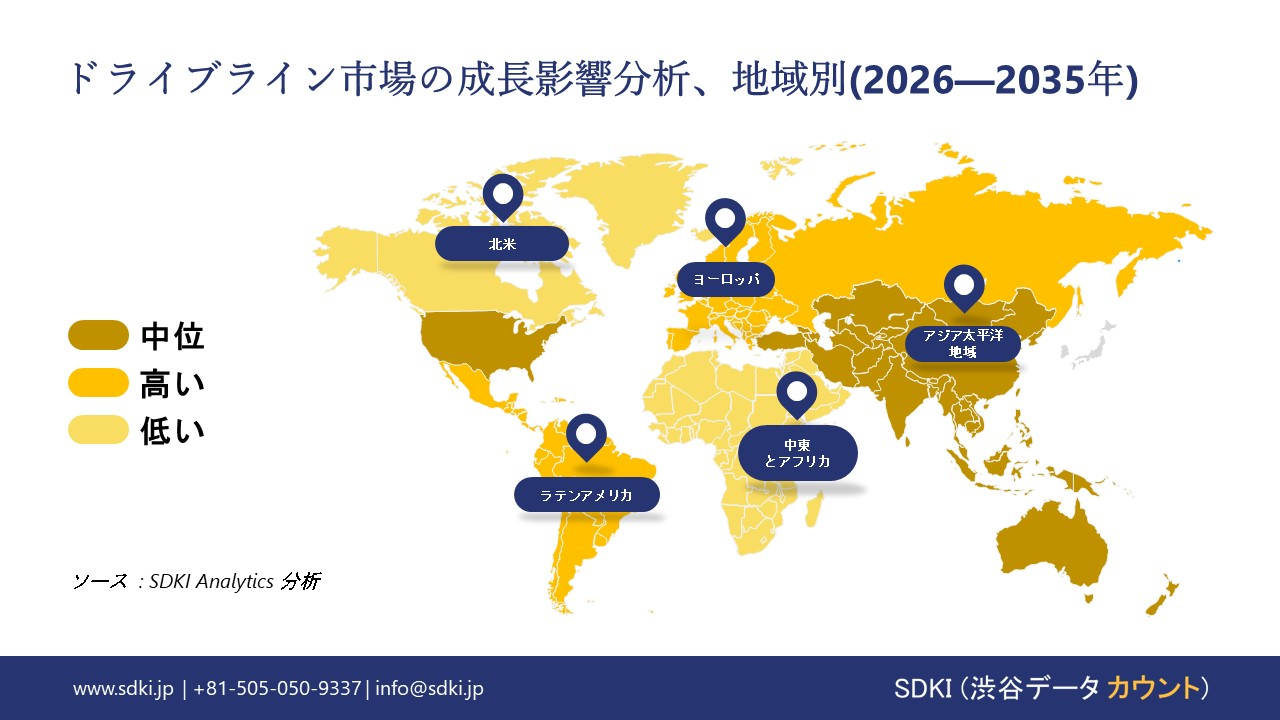

ドライブライン業界に関する当社の市場調査によると、アジア太平洋地域(APAC)は予測期間を通じて約48.8%の圧倒的な市場シェアを維持し、世界トップの地位を維持すると予想されています。また、市場は最も高い複利年間成長率(CAGR)で成長する見込みで、今後数年間で最も有望な機会が見込まれます。この急速な成長は、主に自動車生産の増加、電気自動車(EV)インフラへの投資の増加、産業とEVの普及を促進する政府の政策、そして可処分所得の増加を伴う消費者基盤の拡大によって推進されています。

ドライブライン市場分析

とは何ですか?

自動車と車両工学において、ドライブライン(またはドライブライン)とは、トランスミッションから駆動輪へ動力を伝達するコンポーネントの集合体を指します。これは、エンジン/トランスミッションと駆動輪間の相対的な動きを調整し、動力伝達の最終段階を担うサブシステムです。

ドライブライン市場の最近の傾向は何ですか?

当社のドライブライン市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています。

- SUVとクロスオーバー車における全輪駆動(AWD)と四輪駆動機能への需要増加 –

世界中でSUVとクロスオーバー車が消費者に好まれ続けていることは、先進的な四輪駆動(AWD)ドライブラインシステムへの需要を直接的に増加させています。SDKI分析レポートによると、2024年にはSUVが世界の軽自動車市場の46%以上を占めると予想されています。 あらゆる地域の購入者は、AWDの安全性、トラクション、そしてパフォーマンスにおけるメリットを求めています。これが、パワートランスファーユニット(PTU)、リアドライブモジュール(RDM)、先進のリミテッドスリップデファレンシャル、そして洗練されたドライブライン制御ソフトウェアといったコンポーネントの生産量を世界市場で押し上げています。

- 世界的な電気自動車(EV)への移行とeアクスルの需要 –

内燃機関(ICE)から電動パワートレインへの移行は、ドライブライン市場の構造改革を効果的に進めています。国際エネルギー機関(IEA)の報告書によると、電気自動車の販売台数は2024年に17百万台を超え、前年比で3.5百万台増加すると予測されています。EV販売台数の増加は、新しいドライブラインアーキテクチャ、特に統合型eアクスルの需要を直接的に押し上げています。eアクスルは、モーター、ギアボックス、パワーエレクトロニクスを統合した複数のコンポーネントで構成されており、世界的なドライブライン市場の成長を後押ししています。

日本の現地プレーヤーにとって、ドライブライン市場の収益創出ポケットとは何ですか?

世界的な電気自動車(EV)移行の存在は、Aisin Seiki (Aisin Corp.)、JTEKT、NSKなどの日本の駆動系部品メーカーにとって主要な収益機会を生み出しています。EVの推進は、高度で高効率なeアクスル、eドライブモジュール、電動モーター用の高精度ギアとベアリングへの大きな需要を生み出します。貿易と輸出は、駆動系部品に関して地元メーカーが確保する主要な利益です。日本は2024年に3.91兆円の自動車部品と付属品の輸出を確保しましたが、そのうち米国が1.21兆円で最大の輸出先であり、中国、タイ、メキシコがそれに続きます。輸出収入の創出に加えて、グリーン成長戦略などの政府政策は、国内の次世代自動車技術の研究開発に資金を提供しています。この支援は、統合eアクスル生産に多額の投資をしているAisinのような企業が技術的優位性を維持するのに役立ちます。

ドライブライン市場に影響を与える主な制約は何ですか?

地政学的な不安定性やサプライチェーンの集中化に対する脆弱性は、ドライブライン市場の成長にとって大きな阻害要因となっています。電気自動車用モーターや高性能ベアリングに使用されるネオジムなどの重要材料は、貿易制限の影響を受けやすい特定の地域に供給源が集中しています。これにより、調達プロセスに混乱が生じ、運用コストが高騰します。さらに、中間部品の製造拠点が少数の地域に集中していることも、世界のドライブライン供給市場におけるボトルネックとなっています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

ドライブライン市場レポートの洞察

ドライブライン市場の今後の見通しは?

SDKI Analyticsの専門家によると、ドライブライン市場の世界シェアに関連するレポートの洞察は以下のとおりです:

|

レポートの洞察 |

|

|

2026―2035年までのCAGR |

7.8% |

|

2025年の市場価値 |

1,620億米ドル |

|

2035年の市場価値 |

3,420億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

ドライブライン市場はどのようにセグメント化されていますか?

ドライブライン市場の展望に関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場をアーキテクチャ別、コンポーネント別、車両タイプ別にセグメント化しました。

ドライブライン市場はアーキテクチャによってどのように区分されていますか?

アーキテクチャ別に基づいて、ドライブライン市場は全輪駆動/四輪駆動(AWD/4WD)、前輪駆動(FWD)、後輪駆動(RWD)に分割されています。全輪駆動/四輪駆動(AWD/4WD)は、最も普及しており、今後も最も成長が見込まれる駆動方式であり、将来的に48%のシェアを占めると予測されています。AWD方式は、センターデフまたはトランスファーケースを用いて両車軸に動力を配分することで、トラクション、安定性、走行性能を向上させ、市場における適用範囲を広げています。AWDは、高性能セダン、クロスオーバー、SUV、ピックアップトラックにとって不可欠な主流技術として重要な役割を果たしています。AWDの需要は、安全性、走行性能、あらゆる天候条件下での安心感といった消費者のニーズによって牽引されており、これが駆動方式セグメントにおけるAWDのシェアに影響を与えています。

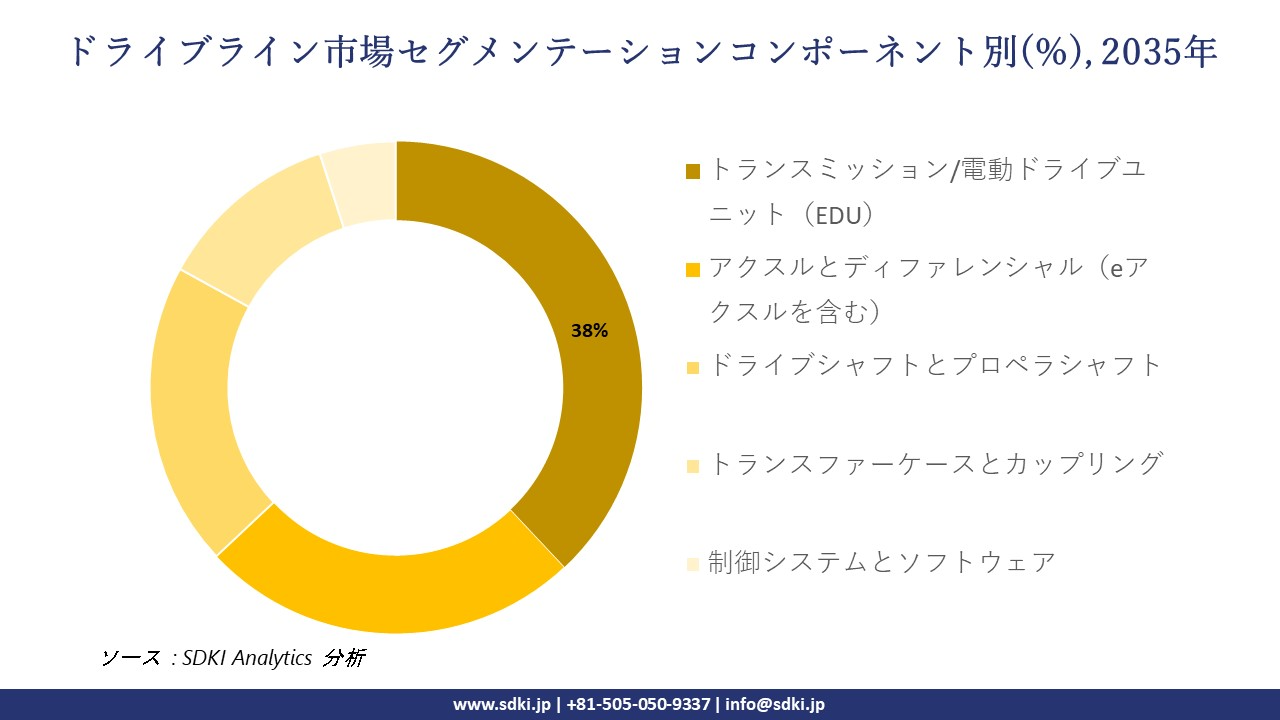

ドライブライン市場はコンポーネント別にどのように区分されていますか?

コンポーネント別に基づいて、ドライブライン市場はトランスミッション/電動ドライブユニット(EDU)、アクスルとディファレンシャル(eアクスルを含む)、ドライブシャフトとプロペラシャフト、トランスファーケースとカップリング、制御システムとソフトウェアに分割されています。コンポーネントセグメントの中で、トランスミッション/電動ドライブユニット(EDU)サブセグメントが38%のシェアを占め、最も大きな割合を占める見込みです。内燃機関(ICE)車とハイブリッド車では、これは多段式オートマチックトランスミッション、無段変速機(CVT)、またはデュアルクラッチトランスミッション(DCT)を指します。電気自動車においては、電気モーター、パワーエレクトロニクス、そして(通常は)1速または2速の減速ギアボックスを統合した電動駆動ユニットを指します。電気自動車市場の拡大に伴い、EDUの適用範囲も広がっています。米国やヨーロッパといった先進市場に加え、アジアやラテンアメリカの新興市場も新たな成長センターとなりつつあり、2024年には電気自動車の販売台数が60%以上増加し、約600 000台に達すると予測されています。こうした状況は、世界の駆動系コンポーネント市場における大きな需要を生み出しています。

以下は、ドライブライン市場に該当するセグメントのリストです:

|

親セグメント |

サブセグメント |

|

アーキテクチャ別 |

|

|

コンポーネント別 |

|

|

車両タイプ別 |

|

ソース: SDKI Analytics 専門家分析

ドライブライン市場傾向分析と将来予測:地域市場展望概要

アジア太平洋地域は、自動車産業における地域的リーダーシップにより、ドライブラインの強力な市場となっています。市場は将来的に48.8%のシェアを占めると予想され、予測期間中に8.1%のCAGRを記録すると予測されています。中国、日本、韓国の国家産業政策は、従来の内燃機関システムから電動駆動ユニットへの移行を加速させることで、ドライブライン市場を変化させています。中国の工業情報化部(MIIT)は、2024年までに13百万台の新エネルギー車(NEV)販売目標を継続的に実施しており、統合型eアクスルの需要を直接的に押し上げています。日本の経済産業省は、グリーン成長戦略を通じてEV開発を支援しています。Toyota、Nissan、Hondaなどの企業は、eドライブプラットフォームの導入を加速させています。

SDKI Analyticsの専門家は、ドライブライン市場に関するこの調査レポートのために、以下の国と地域を調査しました:

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

北米のドライブライン市場の市場パフォーマンスはどうですか?

北米は、トラックやSUVの優位性と量産セグメントの電動化により、ドライブラインの発展途上市場です。ピックアップ、SUV、バンなどの軽トラックが米国市場を席巻しており、2024年の軽自動車販売の75%を占めています。高トルク、高積載量の車両の電動化は、ドライブラインに特有の課題をもたらし、この地域での牽引やオフロードでの使用に対応できる堅牢なeアクスルの革新を促進しています。フォードF-150ライトニング、シボレーシルバラードEV、リビアンR1Tなどの車両の発売には、高い車両総重量(GVWR)と持続的なパフォーマンス向けに設計された耐久性のある電動ドライブラインが必要であり、北米のドライブライン市場に特殊で高価値なセグメントが形成されています。

ドライブライン調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

SDKI Analyticsの調査者によると、ドライブライン市場見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートでは、市場プレーヤーは、製品や技術の投入、戦略的パートナーシップ、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体における競争優位性を獲得しようとしていると指摘されています。

ドライブライン市場で事業を展開している世界有数の企業はどこですか?

当社の調査レポートによると、世界のドライブライン市場の成長に重要な役割を果たしている主な主要企業には、 ZF Friedrichshafen AG、Robert Bosch GmbH、GKN Automotive (Dana Limited)、BorgWarner Inc.、Schaeffler AG などが含まれています。

ドライブライン市場で競合している日本の主要企業はどこですか?

市場見通しによると、日本のドライブライン市場のトップ5企業は、Aisin Corporation、JTEKT Corporation、NSK Ltd.、Mitsubishi Electric Corporation、Hitachi Astemo, Ltd などです。

市場調査レポートには、グローバル ドライブライン 市場分析調査レポートの主要プレーヤーの詳細な競合分析、企業プロファイル、最近の傾向、主要な市場戦略が含まれています。

ドライブライン市場の最新のニュースや傾向は何ですか?

- 2025年4月:Nexteer Automotiveは、オーバーンヒルズ本社にて、EVをはじめとする様々な駆動方式の耐久性、軽量設計、NVH性能を向上させる3つの先進的なドライブライン技術を発表しました。新ソリューションには、最適化されたフェイススプラインアクスル、8ボールジョイント、プレミアムダブルオフセットジョイントに加え、より幅広いアプリケーションに対応するためにサイズを拡大したクロスグライドジョイントが含まれます。

- 2023年4月:NTN Europeは、NTNとSNRブランドでドライブライン製品群を発売しました。この製品群は、要求の厳しいアプリケーション向けに設計されたギアボックスベアリングとクラッチレリーズベアリングで構成されています。このポートフォリオは、550種類以上の製品ラインナップと、アフターマーケットでの使用に耐える堅牢なOEレベルの品質を備え、ヨーロッパとアジアの車両モデルのトランスミッションの耐久性と信頼性を向上させます。

ドライブライン主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

ドライブラインマーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能