自動車用TIC市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― サービスタイプ別、調達タイプ別、車両タイプ別、推進タイプ別、アプリケーション別、技術焦点別及び地域別―世界市場の見通しと予測 2026-2035年

出版日: Feb 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

自動車用TIC市場規模

2026-2035年の自動車用TIC市場の市場規模はどのくらいですか?

当社の自動車用TIC市場調査レポートによると、市場は予測期間(2026-2035年)において年平均成長率(CAGR)4.8%で成長すると予想されています。2035年には、市場規模は318億米ドルに達する見込みです。しかし、当社の調査アナリストによると、基準年の市場規模は197億米ドルでしました。

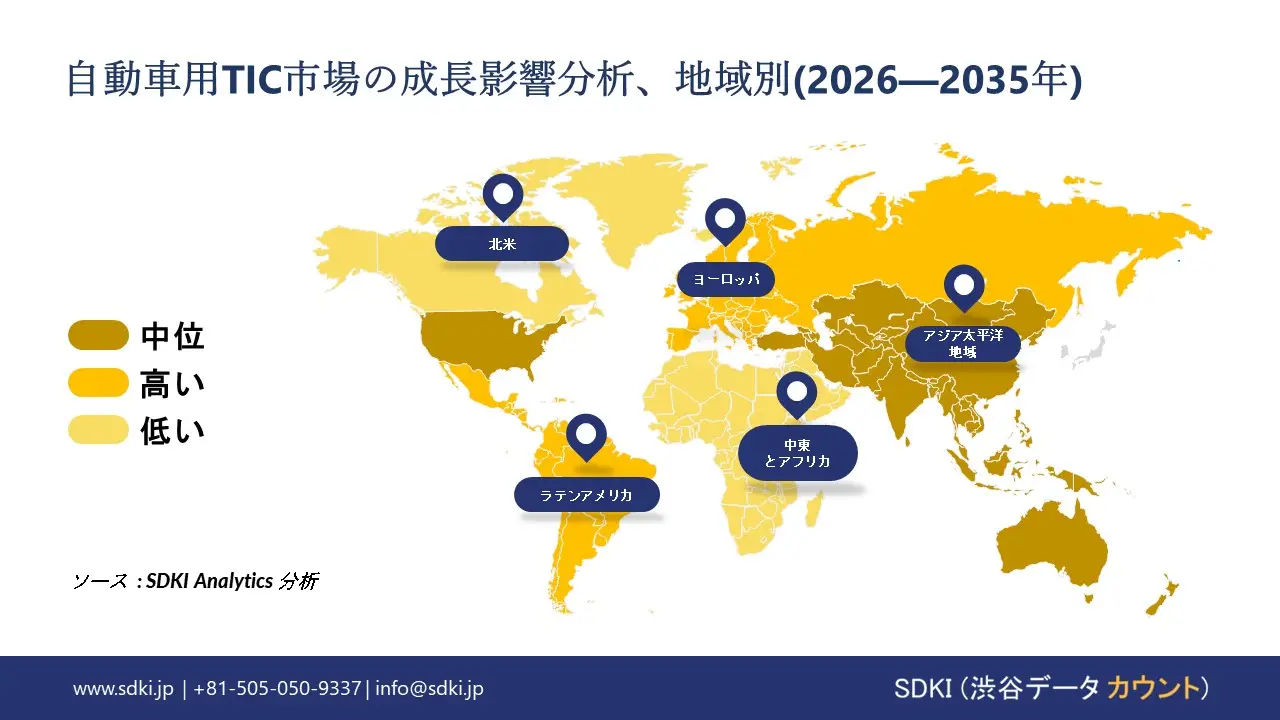

市場シェアの観点から、自動車用TIC 市場を支配すると予想される地域はどれですか?

自動車用TICに関する当社の市場調査によると、アジア太平洋地域は予測期間中に約32%の市場シェアを占め、最も高いCAGRで成長すると予想されており、今後数年間は有望な成長機会が見込まれます。この成長は、主に中国とインドにおける自動車生産の増加と、それを支える中間層の需要増加によって推進されています。

自動車用TIC市場分析

自動車用TICとは何ですか?

自動車用TICとは、車両、部品、システムが定められた安全性、品質、そして規制要件を満たしていることを検証するために行われる活動を指します。製品が使用される前、あるいは使用される前の性能・耐久性チェックからコンプライアンスまで、あらゆることを網羅しています。その目的は、車両のライフサイクル全体にわたるリスクを低減することです。

自動車用TIC 市場の最近の傾向は何ですか?

当社の自動車用TIC市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています。

- 拘束力のあるアクティブセーフティ義務化により義務的な車両テストの範囲が拡大-

当社の調査レポートによると、安全義務化により車両テストの範囲が拡大する見込みです。市場の見通しは、新車のテスト負担を大幅に増やす高度な安全性能要件を固定化した 2 つの大きな規制ブロックによって形作られています。たとえば、米国では、国家道路交通安全局 (NHTSA) が 2024 年 12 月に新車アセスメント プログラム (NCAP) のアップデートを確定し、ブラインド スポット ウォーニング、ブラインド スポット インターベンション、レーン キープ アシスト、歩行者自動緊急ブレーキなど 4 つの ADAS 技術を追加しました。この決定は 2026 年モデルから有効となり、2033 年までの 10 年間のロードマップが伴います。これにより、小売の位置付けや調達リストに直接影響する評価のためにメーカーが満たさなければならないテスト プロトコルが正式に定められました。

さらに、NHTSAの最終規則(FMVSS 127)では、2029年9月までにAEB(歩行者AEBを含む)と前方衝突警報を規定の性能範囲で搭載することを義務付けており、試験速度範囲と夜間の歩行者シナリオが緩和されています。これらの変更により、認証計画と検証走行距離が延長されます。ヨーロッパ連合(EU)では、一般安全規則(規則(EU)2019/2144)がすべての新しい自動車に適用されました。この規則では、ISA、AEB(歩行者/自転車検知機能付き)、居眠り警報、車線維持、後退検知、イベントデータレコーダーなどの機器の搭載が義務付けられており、プラットフォーム間で標準化されたテストスイートが追加されています。さらに、委員会は2038年までに25,000人以上の命が救われると予測しており、義務化の背後にある政策的意図と堅牢な第三者検証の必要性を裏付けています。これらの要件が組み合わさることで、より複雑な認証および生産テストプログラムの適合が求められ、自動車用TICサービスの主要な分野となっています。

- グローバルサイバーセキュリティとソフトウェアアップデートの型式承認-

当社の調査レポートによると、車両はローリングソフトウェアプラットフォームとなり、規制当局は型式承認におけるサイバーセキュリティとアップデートのガバナンスを正式に規定しています。これにより、独立したTIC機関によって実行されることが多いCSMS/SUMS監査、ペネトレーションテスト、アップデートの検証に対する需要が高まっています。UNECE自動車規則調和世界フォーラム(WP.29)は、国連規則第155号(サイバーセキュリティ管理システム)および第156号(ソフトウェアアップデート管理システム)を監督しています。EU官報(EUR Lex 2025/5)に掲載されたEUの統合出版物には、2025年1月に発効する補足3が記載されており、EUの承認に関するアキにおける規制文が確固たるものとなっています。

さらに、UNECEの義務は型式承認と生産適合性を結び付け、初期試験に留まらず継続的な義務を規定しています。実際には、コンプライアンスは一度限りのハードウェアチェックからライフサイクル全体のサイバーセキュリティ管理へと移行し、正式なリスク評価(TARAなど)、インシデント監視、そして安全なOTAアップデートプロセスの実証が求められます。これらは、TIC企業が独立した評価を提供するワークストリームです。規制文書の対象範囲はL/M/N/Oカテゴリーに及び、ECUを搭載するオートバイから大型トラックまでをカバーしているため、監査対象となる車種の範囲は世界的に拡大しています。その結果、ソフトウェアコンプライアンステストと組織監査の持続的で標準に根ざしたパイプラインが実現し、地域全体でTICの役割が深まることが期待されます。

日本の現地企業にとって、自動車用TIC市場の収益創出ポケットとは何ですか?

SDKI市場見通しによると、自動車用TICは、日本のすべての市場参加者にとってこの地域における新たな市場機会を有しています。質問1の意義は、自動車用TICの輸出額というニッチな側面を取り上げることですが、日本国内の現地生産傾向には明確な指標が存在します。経済産業省が実施した自動車生産に関する調査結果によると、エンジン関連製品および安全関連製品の部品・組立生産は着実に増加しています。

内閣府の経済評価は、経済における品質保証の向上に重点が置かれ、適合性評価スキームが奨励されていることを示唆しており、これもまた、地元のTICサービスプロバイダーにとっての機会を示唆しています。JTEKT Corporationの2024年有価証券報告書によると、同社の自動車品質検査サービスはすでに日本国内での調達が70%を超えており、一方デンソーは関東地方と中部地方における社内試験能力の開発を発表しており、国内サービスの提供に注力していることを示唆しています。細分化されたTIC取引の貿易データは入手できませんが、調査結果によると、日本の自動車メーカーは輸出の規制対策として、現地での試験認証を採用するケースが増えています。市場傾向は、特に「規制集約型部品」に関連するTICと次世代自動車関連産業において、2030年まで緩やかな業界成長を予測しています。

自動車用TIC 市場に影響を与える主な制約は何ですか?

当社の市場調査レポートによると、世界各地で非常に厳格かつ断片化された構造を持つ認証要件は、自動車メーカー、特に電気自動車やADASソリューションを開発しているメーカーに大きな影響を与えています。EU、米国、中国、日本を問わず、各地域で個別の型式認証が必要であり、安全性、排出ガス、EMC基準も独自に定められているため、研究開発投資は15-30%増加し、市場投入までの期間は6-18ヶ月延長されます(IATF、2023年)。日本のNCAPと各地域のEMC要件は、認証期間をさらに4―6ヶ月延長し、それぞれ300,000-500,000ユーロの追加投資となります(国土交通省、2022年および自工会、2022年)。一般的な品質認証とは異なり、これらは交渉の余地がなく拘束力があり、政府機関によって発行および施行されます。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

自動車用TIC市場レポートの洞察

自動車用TIC市場の今後の見通しは?

SDKI Analyticsの専門家によると、自動車用TIC市場の世界シェアに関連するレポートの洞察は以下の通りです。

|

レポートの洞察 |

|

|

2026-2035年のCAGR |

4.8% |

|

2025年の市場価値 |

197億米ドル |

|

2035年の市場価値 |

318億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

自動車用TIC 市場はどのようにセグメント化されていますか?

当社は、自動車用TIC市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場は、サービスタイプ別、調達タイプ別、車両タイプ別、推進タイプ別、アプリケーション別、技術焦点別にセグメント化されています。

自動車用 TIC 市場は推進タイプによってどのように区分されていますか?

当社の調査によると、自動車用TIC市場は推進タイプ別に基づいて、内燃機関(ICE)車、電気自動車(EV)とハイブリッド車に分割されています。電気自動車(EV)とハイブリッド車の市場見通しは、予測期間中に58%の収益シェアを占めると予測されています。この成長は政策主導の需要によるもので、 IEAシナリオでは2035年までにEV販売が世界の小型車販売の約50-65%に達すると予測されており、バッテリー、高電圧安全性、ソフトウェアの試験量が固定化されます。

さらに、EPA(環境保護庁)の多種汚染物質基準により、2027-2032年モデルでは車両のCO₂排出量/基準汚染物質が厳しくなり、EV/PHEVのOEMコンプライアンス試験および認証処理が加速します。 OEM資本がこの変化を裏付けています。テスラは2024年第1四半期に20億米ドルを超える設備投資を報告し、生産と充電への投資を継続しており、バッテリーの耐久性とソフトウェアシステムに対する継続的なテスト支出を立証しています。

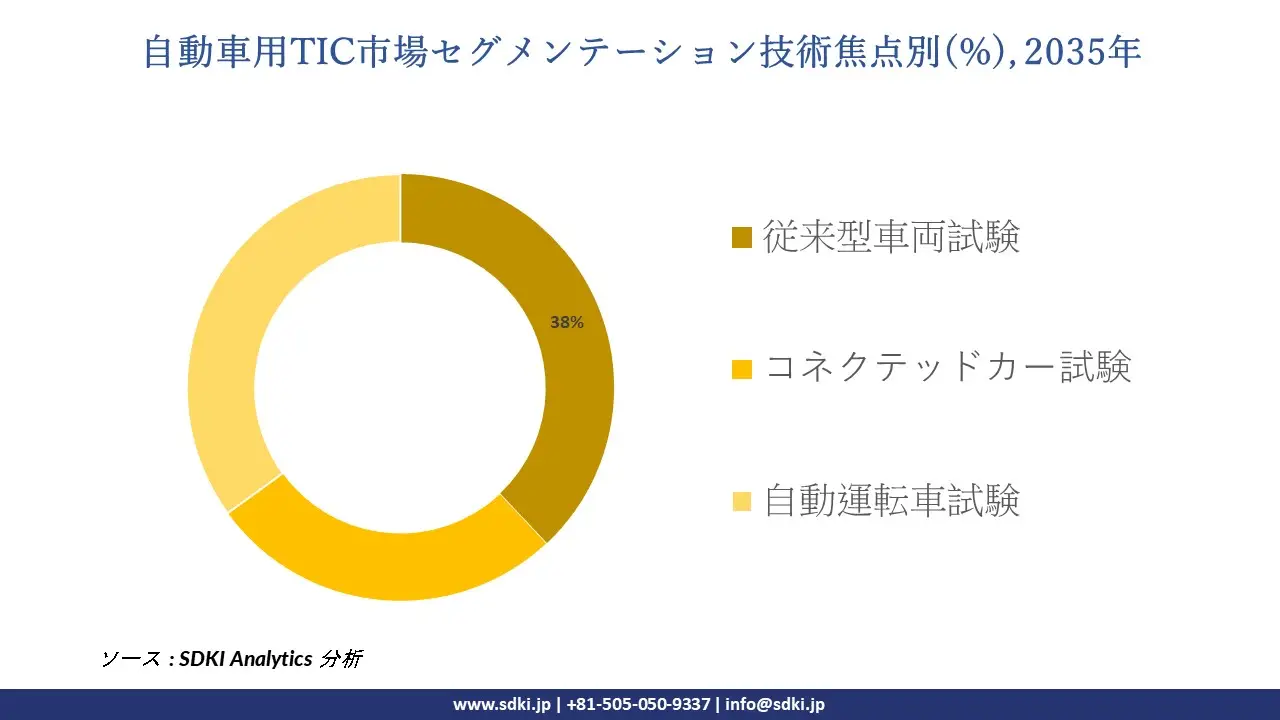

自動車用TIC 市場は技術焦点によってどのように区分されていますか?

当社の調査レポートによると、自動車用TIC市場は、技術焦点別に基づいて、従来型車両試験、コネクテッドカー試験、自動運転車試験に分割されています。これらのうち、自動運転車試験セグメントの市場見通しは良好で、38%という大きな収益シェアを獲得すると予想されています。この成長は、規制の広範さによって支えられています。ブレーキ、照明、ミラー、TPMS、音響などを含むFMVSS試験手順は、現在も数百万台のICE/HEV車両に適用されており、衝突安全性と排出ガス関連のTICワークロードを支えています。

さらに、米国の規制強化により、適用範囲が拡大しています。FMVSS 127は、2029年までに夜間歩行者検知を含むAEB/FCWを義務付け、ADASパッケージを搭載した従来型車両の検証を拡大しています。UNECE WP.29の相互承認と改正(例:UN R79ステアリング/ADSインターフェース)の拡大により、構造的な要因は維持され、従来型システムの認証パイプラインは市場全体で活発に維持されています。地域的には、米国の継続的なアップデート(例:EV向けFMVSS 305a)がFMVSSの既存規格と共存しており、移行期間中も相当規模の従来型試験ポートフォリオが確保されています。

以下は自動車用TIC市場に該当するセグメントのリストです。

|

親セグメント |

サブセグメント |

|---|---|

|

サービスタイプ別 |

|

|

調達タイプ別 |

|

|

車両タイプ別 |

|

|

推進タイプ別 |

|

|

アプリケーション別 |

|

|

技術焦点別 |

|

ソース: SDKI Analytics 専門家分析

自動車用TIC市場の傾向分析と将来予測:地域市場展望概要

アジア太平洋地域の自動車用TIC市場は、32%を超える市場シェアで世界市場を支配し、支配的な地位を維持すると予想されています。また、予測期間を通じて5.7%のCAGRで成長し、最も急速な成長が見込まれています。この市場の成長は、電気自動車の急速な普及に支えられています。

国際エネルギー機関(IEA)の報告書によると、中国における電気自動車の販売台数は2024年に11百万台を超えると予想されており、これは同地域がよりクリーンなモビリティへの急速な移行を浮き彫りにしています。電気自動車の普及拡大は、強力な政府による優遇措置、厳格な排出基準、そして充電インフラの拡充を物語っています。

電気自動車の導入が進むにつれ、バッテリーの安全性、ソフトウェアの信頼性、進化する規制への準拠を確保するためのテスト、検査、認証サービスの需要が加速しています。

SDKI Analyticsの専門家は、自動車用TIC市場に関するこの調査レポートのために、以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

北米の自動車用TIC 市場の市場パフォーマンスはどうですか?

北米の自動車用TIC市場は、予測期間を通じて世界市場において急速な成長を遂げると予想されています。この市場成長の原動力となっているのは、衝突試験義務です。米国運輸省道路交通安全局(NHTSA)の報告書によると、同局は2025年モデルの車両を5つ星衝突試験の対象車両として選定しました。この試験は新車フリートの約87 %をカバーし、正面衝突、側面衝突、横転衝突の各衝突形態における認証済みの安全性評価を義務付けています。

これらの必須の衝突テストは毎年実施され、認定された研究所による構造化された TIC 手順が求められます。 同様に、カナダでは、登録を維持するために定期的な路上走行適合性基準を満たす必要がある、使用中の車両に対する排出ガス検査と安全検査も義務付けています。これらの政府の安全試験プログラムは、米国とカナダ全土において、持続的かつ定量化可能な自動車検査および認証手続きを確立しています。

自動車用TIC調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

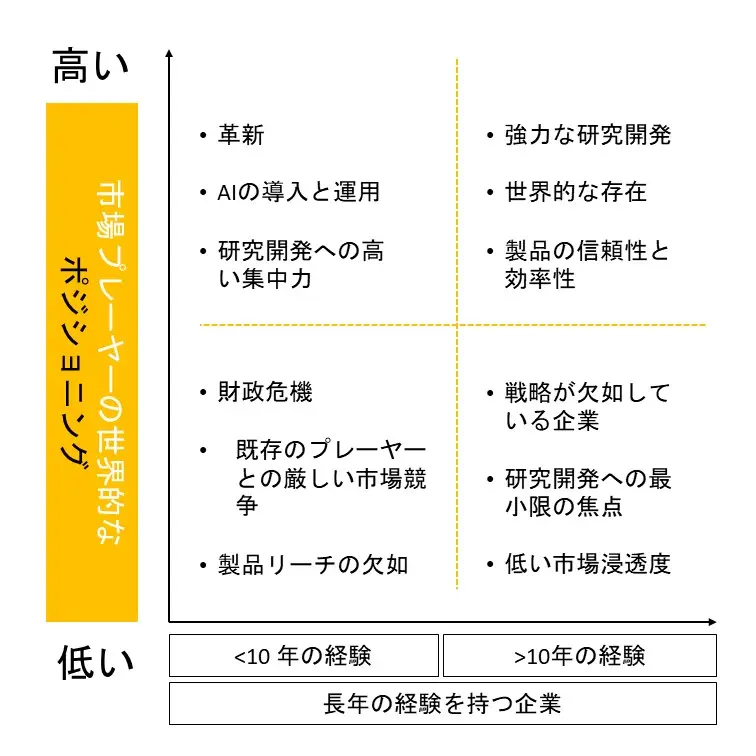

競争力ランドスケープ

SDKI Analyticsの調査者によると、自動車用TIC市場の見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートでは、市場プレーヤーは、製品や技術の投入、戦略的パートナーシップ、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体の見通しにおいて競争優位性を獲得しようとしていると指摘されています。

自動車用TIC 市場で事業を展開している世界有数の企業はどこですか?

当社の調査レポートによると、世界の自動車用TIC市場の成長に重要な役割を果たしている主な主要企業には、 SGS SA、Bureau Veritas SA、TÜV SÜD AG、DEKRA SE、Intertek Group plcなどが含まれます。

自動車用TIC市場で競合している主要な日本企業はどこですか?

市場展望によると、日本の自動車用TIC市場の上位5社は、JAAI、JET、Seiko Instruments Inc.、Applied Science Co., Ltd.、Bureau Veritas Japanなどです。

市場調査レポート研究には、世界的な自動車用TIC 市場分析調査レポートにおける主要プレーヤーの詳細な競合分析、企業プロファイル、最近の傾向、主要な市場戦略が含まれています。

自動車用TIC 市場の最新のニュースや傾向は何ですか?

- 2025年10月、Mitsubishi Heavy Industriesは、イノベーションとサステナビリティに重点を置いた自動車およびモビリティソリューションの進化に向けた新たな取り組みを発表しました。この取り組みは、進化する安全・環境基準への適合を保証する認証・検査サービスの需要を促進することで、日本の自動車用TIC市場を支えます。

- 2025年8月、UL Solutionsは試験、検査、認証を行う企業として初めてEclipse Foundationに加盟し、自動車分野におけるイノベーションを支援しています。この前進は、自動車技術の安全性、コンプライアンス、デジタルトランスフォーメーションを強化するオープンソースエコシステムにおける連携を促進することで、自動車用TIC市場を強化します。

自動車用TIC主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

自動車用TICマーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能