自動車用シールド市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― シールドタイプ別、アプリケーション別、及び地域別―世界市場の見通しと予測 2025-2035年

出版日: Sep 2025

- 2020ー2024年

- 2025-2035年

- 必要に応じて日本語レポートが入手可能

自動車用シールド市場エグゼクティブサマリ

1)自動車用シールド市場規模

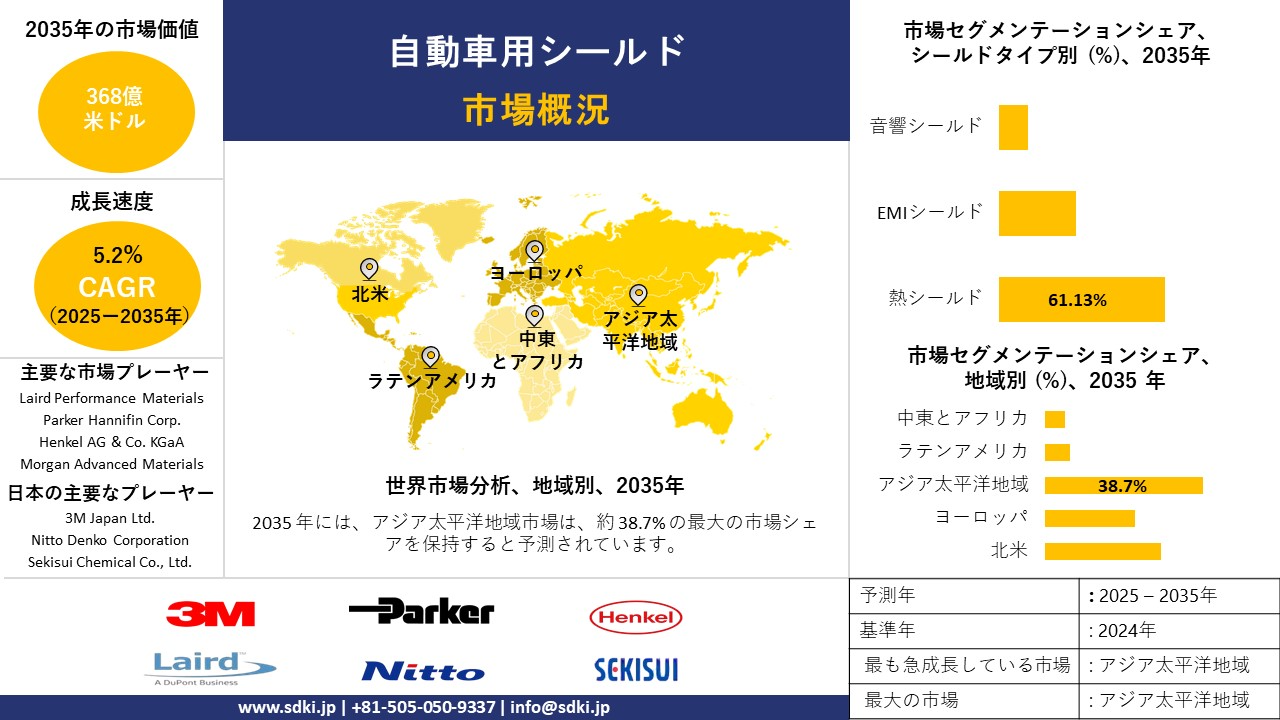

当社の自動車用シールド市場調査レポートによると、市場は予測期間2025ー2035年中に年平均成長率(CAGR)5.2%で成長すると予想されています。2035年には、市場規模は368億米ドルに達すると見込まれています。

しかし、当社の調査アナリストによると、基準年の市場規模は215億米ドルでしました。電気自動車の生産台数の増加と、堅牢なEMIと熱保護を必要とする先進運転支援システム(ADAS)の導入が、この市場の主要な成長要因と考えられています。

2)自動車用シールド市場の傾向 – 好調な推移を示す分野

SDKI Analyticsの専門家によると、予測期間中に予測される自動車用シールド市場の傾向には、EMIシールド、熱シールド、導電性コーティングなどが含まれます。予測期間中に自動車用シールド市場をリードすると予想される主要な傾向について、以下に詳細をご紹介します:

|

市場セグメント |

主要地域 |

CAGR(2025ー2035年) |

主要な成長要因 |

|

EMIシールド |

アジア太平洋地域 |

5.8% |

車両コネクティビティ(5G、V2X)の普及、車両1台あたりの電子制御ユニット(ECU)数の増加、厳格なグローバルEMC規制と規格 |

|

熱シールド |

ヨーロッパ |

5.6% |

EVバッテリーとパワートレインの高電力密度、厳格な熱暴走安全プロトコル、熱管理のための軽量材料イノベーション |

|

導電性コーティング |

北米 |

6.2% |

コンフォーマルと軽量シールドソリューションの需要、フレキシブルエレクトロニクスアプリケーションの成長、過酷な環境における優れた耐腐食性 |

|

導電性ポリマー |

アジア太平洋地域 |

5.9% |

EVの航続距離延長のための軽量化要件、複雑な部品形状の設計柔軟性、リサイクル性と持続可能性の優位性 |

|

シールドケーブル |

ヨーロッパ |

5.5% |

ADASセンサーのデータ伝送ニーズの増加、高速車載ネットワーク(例:Ethernet)の採用、高密度配線アーキテクチャにおけるクロストークの軽減 |

ソース: SDKI Analytics 専門家分析

3)市場の定義 – 自動車用シールドとは何ですか?

自動車用シールド市場は、車両の電子システムを電磁干渉(EMI)から保護し、重要な機能システムを過熱から保護するのに役立つ部品と材料の設計、製造、供給に特化した産業です。製品には、導電性ガスケット、シールドテープ、金属製エンクロージャ、ヒートラップ、特殊コーティングなど、幅広いソリューションがあります。その基本的な機能は、ますます電子化とソフトウェア定義化が進む車両の信頼性、安全性、コンプライアンスに準拠することです。

この市場は、基本的に現代の自動車の電動化とデジタル化によって推進されています。しかし、これは独立した製品セクターではなく、電気自動車(EV)、先進運転支援システム(ADAS)、車載コネクティビティの進歩を支援する重要な基盤産業でもあります。

4)日本の自動車用シールド市場規模:

成長著しい日本の自動車用シールド市場は、年平均成長率(CAGR)5.52%と予測されています。政府による電動化推進と高性能車輸出におけるリーダーシップが、日本市場の主要な成長牽引要因です。日本の国家グリーン成長戦略ではカーボンニュートラルへの関心が高まっており、国内自動車メーカーは電気自動車やハイブリッド車の開発と生産を開始せざるを得なくなっています。

さらに、日本のOEMは、高度なADASやコネクティビティ機能を搭載した高付加価値車に常に注力することで、グローバルな競争力を維持しています。これは最終的に、プレミアムで技術密度の高い輸出に焦点を当て、優れたシールドソリューションの統合を促進し、信頼性を確保し、国際安全基準を満たすことにつながります。日本の現地市場プレーヤーにとって、自動車用シールド市場に関連するさまざまな収益機会は次のとおりです:

- 日本の現地市場プレーヤーの収益機会:

日本の現地市場プレーヤーにとって、自動車用シールド市場に関連するさまざまな収益機会は次のとおりです:

|

収益創出の機会 |

主要成功指標 |

主な成長要因 |

市場インサイト |

競争の激しさ |

|---|---|---|---|---|

|

プレミアムOEM統合システム |

高級車市場浸透率、1台あたり平均収益 |

可処分所得の増加、日本人の高級ブランド志向、自動車技術の進歩 |

日本の消費者は、シームレスな車両統合を実現する工場出荷システムを強く好み、アフターマーケットソリューションよりも信頼性とブランドの信頼性を重視しています。 |

高 |

|

サブスクリプション型コンテンツサービス |

加入者維持率、ユーザーあたり平均収益 |

ストリーミングサービスの需要増加、自動車のコネクティビティの向上、通勤中の子供のエンターテイメントニーズ |

市場では、プレミアムコンテンツの継続的な収益モデルがますます受け入れられており、家族は都市部の長距離通勤に多様なエンターテイメントの選択肢を求めています。 |

中 |

|

高度なゲーム統合 |

ゲームコンテンツの利用頻度、ゲーム開発者とのパートナーシップ |

モバイルゲーム人気の高まり、高度なプロセッサ機能、マルチスクリーン・エンターテイメントの需要 |

日本の消費者、特に若年層は、移動中にコンソール並みのゲーム体験を期待しており、高性能エンターテイメントシステムの需要が高まっています。 |

低 |

|

教育コンテンツプラットフォーム |

mask |

|||

|

コネクテッドカー・エンターテイメントサービス |

||||

|

後部座席コントロールシステム |

||||

|

ラグジュアリーカスタマイズサービス |

||||

|

商用車向けフリートソリューション |

||||

ソース: SDKI Analytics 専門家分析

- 日本の自動車用シールド市場の都道府県別内訳:

以下は、日本の自動車用シールド市場の都道府県別の内訳の概要です:

|

都道府県 |

CAGR (%) |

主な成長要因 |

|---|---|---|

|

東京 |

8.7% |

可処分所得の集中度の高さ、高級車の普及率、先進技術インフラ |

|

大阪 |

7.9% |

都市部のファミリー層、商用車フリートの密度、スマートシティへの取り組み |

|

神奈川 |

8.2% |

郊外のファミリー層向け住宅の配置、自動車研究開発センターへの近接性、ハイテク製造拠点の存在 |

|

愛知 |

mask |

|

|

福岡 |

||

ソース: SDKI Analytics 専門家分析

自動車用シールド市場成長要因

当社の自動車用シールド市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています:

- 強化された国際的な電磁両立性(EMC)と自動運転規制要件:当社のアナリストチームは、市場に好影響を与える規制エコシステムを特定しました。例えば、2018ー2025年の間に、規制当局は高レベルのEMCフレームワークから車両レベルの性能ベースのEMCと自動運転規則へと移行しており、その影響は予測期間全体を通じて、道路車両のイミュニティとエミッション試験要件の引き上げに反映されると見込まれます。

EUのEMCフレームワーク(指令2014/30/EU)は、単一市場におけるEMC試験規格の統一のための法的根拠を提供しています。さらに、UNECE WP.29/GREとGRVAワーキングペーパーは、ADAS/ADS機能に関連する車両レベルのイミュニティ要件と試験方法を追加しています。同時に、当社の調査レポートでは、FCCと各国当局が型式承認における送信機とデバイスの適合性に関する要求を厳格化していることが示されています。

現在、自動車用シールドサプライヤーにとって、これらの規制強化は、明確な設計要件とOEMによる設計サイクルの早期関与へと転換すると予想されます。これは、車両ごとのユニット内容の承認を推進し、新しい材料/アセンブリを認定する際にコンプライアンスを実証する必要があるためです。

- 電動化とコネクテッドカーの複雑化(EVバッテリー、V2X/5G、ADASエレクトロニクス)により、車内EMI発生源とシールド需要が増加:電動化の進展と高帯域幅車両コネクティビティの拡大は、自動車用シールド市場の上昇傾向を牽引すると予想されます。これらの傾向は、現代の車両内部の電磁ストレス要因を増大させる可能性があります。さらに、当社の調査レポートで分析されたヨーロッパとユーロスタットの輸送データは、バッテリーのみの電気乗用車の登録台数が2024年末までに前年比30%以上増加し、5.7百万台を超えると予測しています。

さらに、米国エネルギー省(DOE)はEV充電ポートの着実な拡大を強調しています。市場の競争環境に関して、TE ConnectivityはeモビリティとV2Xコネクティビティを主要な成長分野として強調し、3百万の製品資料では、EMIテープ、ガスケット、アブソーバーのターゲットアプリケーションとして自動車の電気システムと次世代通信を挙げています。このように、EV車両の増加、充電インフラの拡大などのマクロ傾向と、OEM仕様のシールド要求などのミクロ傾向の組み合わせは、車両シールド材料とアセンブリの大きな市場を浮き彫りにしています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

レポートの洞察 - 自動車用シールド市場の世界シェア

SDKI Analyticsの専門家によると、自動車用シールド市場の世界シェアに関するレポートの洞察は以下のとおりです:

|

レポートの洞察 |

|

|

CAGR |

5.2% |

|

2024年の市場価値 |

215億米ドル |

|

2035年の市場価値 |

368億米ドル |

|

過去のデータ共有 |

過去5年間(2023年まで) |

|

将来予測 |

今後10年間(2035年まで) |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

自動車用シールド市場のセグメンテーション分析

自動車用シールド市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場をシールドタイプ別、アプリケーション別にセグメント化しました。

シールドタイプ別に基づいて、自動車用シールド市場は、熱シールド、EMIシールド、音響シールドに分割されています。2035年までに、熱シールドは自動車用シールド市場全体の売上高の61.13%を占め、市場を独占すると予想されます。内燃機関、ターボチャージャー、電気自動車などによる過熱から部品を保護するという重要な役割は、車両の小型化と電動化が進むにつれてますます重要になっています。熱シールドは、内燃機関(ICE)と電気自動車(EV)の両方のプラットフォームにおいて、耐久性、安全性、性能の向上に貢献します。高い耐熱性、軽量性、そして過酷な環境への耐性は、他のシールドタイプよりも優れています。厳しい排出ガス規制、エンジンの小型化、そして電気自動車への急速な移行が、市場拡大の原動力となっています。

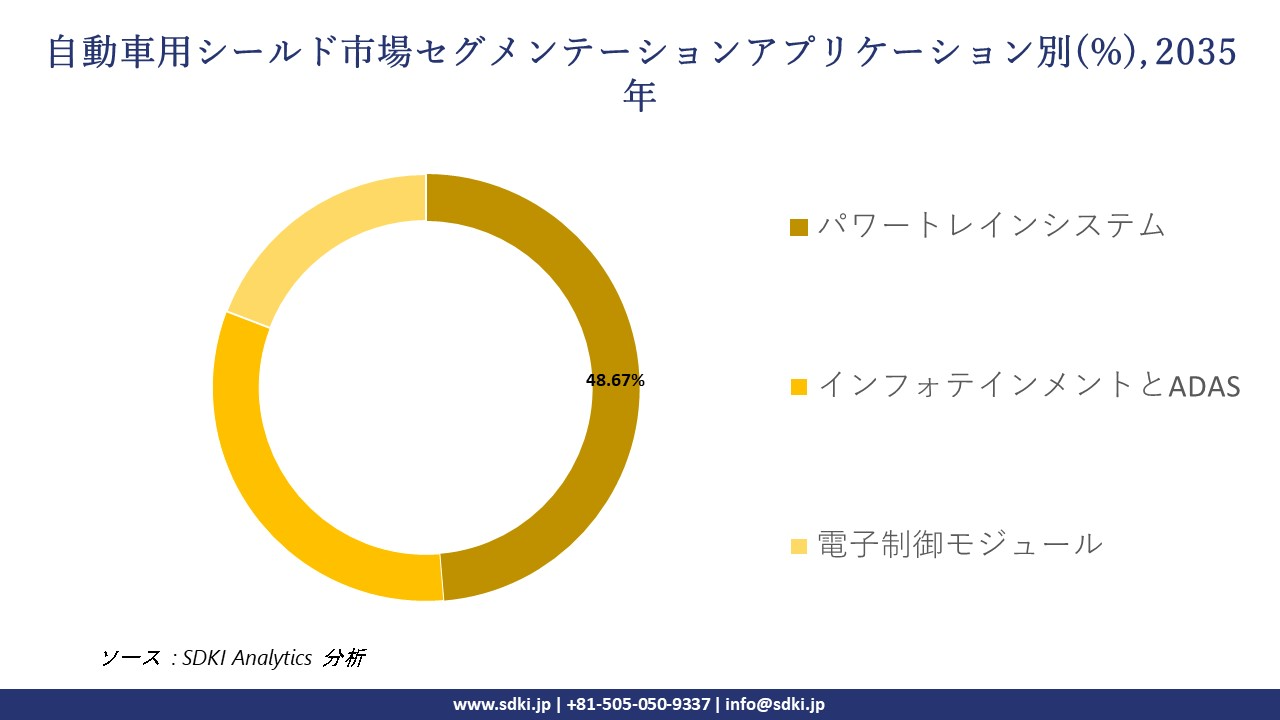

さらに、自動車用シールド市場は、アプリケーション別に基づいて、パワートレインシステム、インフォテインメントとADAS、電子制御モジュールに分割されています。2035年までに自動車用シールド市場における最大のアプリケーションはパワートレインシステムであり、市場シェアは48.67%に達すると予測されています。これらのシステム(エンジン、トランスミッション、電動駆動ユニット)は、熱、EMI、環境曝露を制御するために効率的なシールドを必要とします。シールドは、動作の安定性と、より厳格な安全基準と排出基準への準拠を実現するだけでなく、ハイブリッド車や電気自動車への高度な電子機器やセンサーの導入を可能にします。電動化の進展と高電圧EVプラットフォームの普及に伴い、高い堅牢性とマルチマテリアル特性を備えたパワートレインシールドソリューションの必要性はますます高まっています。以下は自動車用シールド市場に該当するセグメントのリストです:

|

親セグメント |

サブセグメント |

|

シールドタイプ |

|

|

アプリケーション |

|

ソース: SDKI Analytics 専門家分析

世界の自動車用シールド市場の調査対象地域:

SDKI Analyticsの専門家は、自動車用シールド市場に関するこの調査レポートのために以下の国と地域を調査しました:

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

自動車用シールド市場の制約要因

世界の自動車用シールド市場シェアを制約する大きな要因の一つは、自動車メーカーが車両全体のコスト削減に集中するよう求める大幅な値上げ圧力です。特殊複合材や導電性ポリマーといった先進的なシールド材料は、従来の代替品よりも高価になることがよくあります。自動車メーカーは、特に中級車やエコノミークラス車において、消費者の手に届きやすい価格と競争力のある価格を維持するために、製造コストの抑制に常に注意を払いながら、厳しい性能と安全基準を満たすことに苦慮しており、このことが大きな課題となっています。

自動車用シールド市場 歴史的調査、将来の機会、成長傾向分析

-

自動車用シールドメーカーの収益機会

世界中の自動車用シールドメーカーに関連する収益機会の一部は次のとおりです:

|

機会分野 |

対象地域 |

成長の原動力 |

|---|---|---|

|

プレミアム統合システム |

北米 |

高い可処分所得が、高級車の機能とシームレスなテクノロジー統合への需要を牽引 |

|

高度なゲームソリューション |

ヨーロッパ |

若年層におけるゲーム文化の隆盛と車載エンターテイメント技術の早期導入 |

|

教育コンテンツプラットフォーム |

アジア太平洋地域 |

家族旅行中の子どもの発達と教育的なスクリーンタイムへの関心の高まります |

|

コネクテッドストリーミングサービス |

mask |

|

|

商用フリートソリューション |

||

|

後部座席コントロールシステム |

||

|

高級カスタマイズサービス |

||

|

費用対効果の高いアフターマーケットソリューション |

||

ソース: SDKI Analytics 専門家分析

-

自動車用シールドシェアの世界的拡大に向けた実現可能性モデル

当社のアナリストは、世界中の業界専門家が信頼し、適用している有望な実現可能性モデルのいくつかを提示し、自動車用シールド市場の世界シェアを分析しています:

|

実現可能性モデル |

地域 |

市場成熟度 |

経済発展段階 |

競争環境の密度 |

適用理由 |

|---|---|---|---|---|---|

|

プレミアム統合戦略 |

北米 |

成熟 |

先進国 |

高 |

高度な技術インフラが高度な統合要件をサポート |

|

イノベーション主導の拡大 |

ヨーロッパ |

成熟 |

先進国 |

高 |

強力な規制枠組みが技術革新と品質基準を促進 |

|

価値に基づく市場参入 |

アジア太平洋地域 |

新興 |

新興国 |

中 |

急速な経済成長により、プレミアムセグメントとバリューセグメントの両方の製品に対する需要が創出されます |

|

ラグジュアリー重視のアプローチ |

mask |

||||

|

手頃な価格のソリューションモデル |

|||||

ソース: SDKI Analytics 専門家分析

市場傾向分析と将来予測:地域市場の見通しの概要

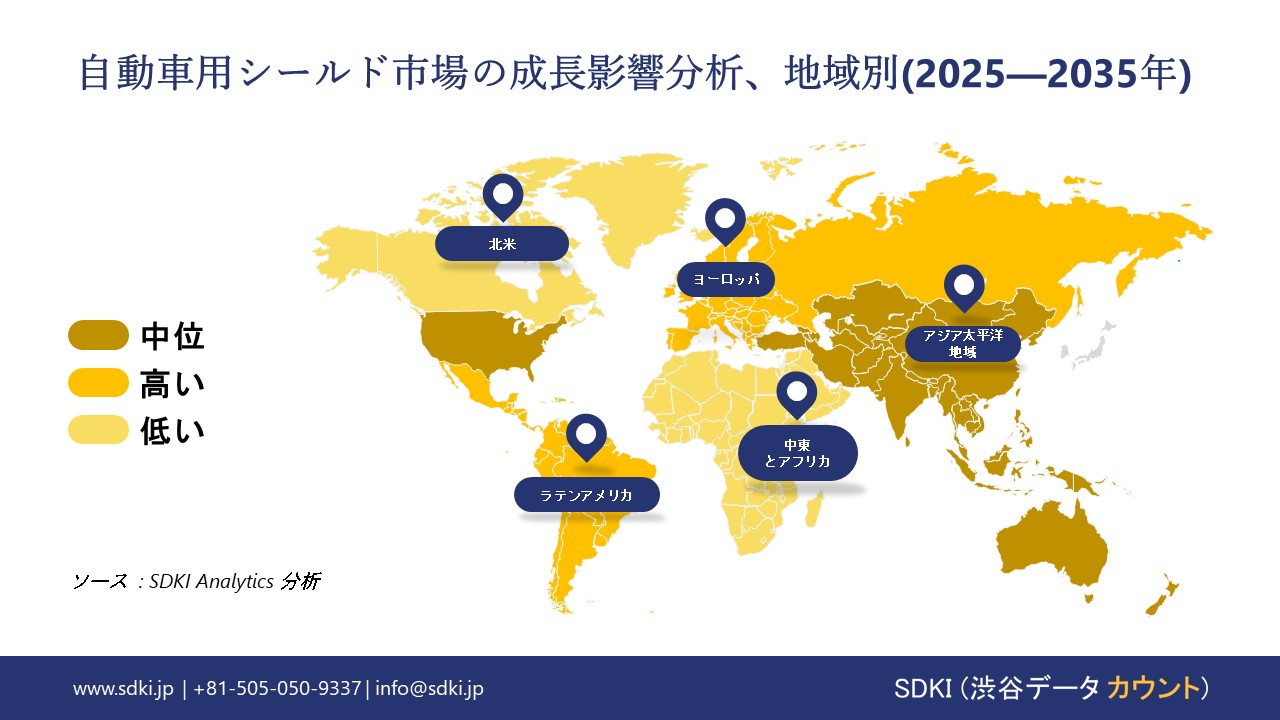

➤北米の自動車用シールド市場規模:

当社の市場調査アナリストは、北米地域の自動車用シールド市場が予測期間中に世界市場で第2位の地位を確保すると予測していることを確認しました。市場の成長は、電動化と高電圧アーキテクチャの増加に支えられています。400Vと800Vシステムを搭載した電気自動車の増加は、電磁干渉と熱負荷を維持するために高度なシールドを必要とすることが分かっています。シリコンカーバイドインバータと高密度電子パッケージが標準になりつつあり、戦略的なシールドソリューションの需要を加速させています。さらに、市場の成長は、ADASと高度なインフォテインメントセットアップを備えた車両の好みの増加に関連しており、インターフェースの損傷を防ぐための効果的なシールドの必要性が高まっています。

- 北米の自動車用シールド市場の市場強度分析:

北米の自動車用シールド市場に関連する国の市場強度分析は次のとおりです:

|

カテゴリー |

米国 |

カナダ |

|

市場成長の可能性 |

強力 |

中程度 |

|

規制環境の複雑さ |

複雑 |

標準 |

|

価格体系 |

市場主導型 |

ハイブリッド |

|

熟練人材の確保 |

mask |

|

|

標準と認証フレームワーク |

||

|

イノベーション エコシステム |

||

|

技術統合率 |

||

|

市場参入障壁 |

||

|

投資環境 |

||

|

サプライチェーンの統合 |

||

|

競争の激しさ |

||

|

顧客基盤の高度化 |

||

|

インフラ整備状況 |

||

|

貿易政策の影響 |

||

ソース: SDKI Analytics 専門家分析

➤ヨーロッパの自動車用シールド市場規模:

ヨーロッパの自動車用シールド市場は、予測期間中に世界市場で持続的な成長が見込まれています。市場の成長は、先進運転支援システムの拡大によって牽引されています。車線維持支援、アダプティブクルーズコントロール、衝突回避などの機能は、新型車の標準機能と見なされており、車載電子機器の複雑さを増しています。シールドは、これらの安全支援システムの精度を損なう可能性のある電磁干渉を防ぐために不可欠です。さらに、市場の成長は、統合インフォテインメントシステム、ナビゲーション、リアルタイムデータサービスを備えたコネクテッドカーの増加によって支えられており、信号の整合性を管理し、システム間の干渉を防ぐためのシールドの需要が加速しています。

- ヨーロッパの自動車用シールド市場の市場強度分析:

ヨーロッパの自動車用シールド市場に関連する国の市場強度分析は次のとおりです:

|

カテゴリー |

イギリス |

ドイツ |

フランス |

|

市場成長の可能性 |

強 |

中程度―強い |

中程度 |

|

規制環境の複雑さ |

複雑 |

標準―複雑 |

標準 |

|

インセンティブと補助金による支援 |

高 |

中程度 |

高中程度 |

|

熟練した人材の確保 |

mask |

||

|

研究開発とイノベーションのエコシステム |

|||

|

EV普及率 |

|||

|

サプライチェーンのレジリエンス |

|||

|

製造基盤の強固さ |

|||

|

技術統合率 |

|||

|

市場参入障壁 |

|||

|

投資環境 |

|||

|

競争の激しさ |

|||

|

アフターマーケットの成熟度 |

|||

|

貿易政策の影響 |

|||

ソース: SDKI Analytics 専門家分析

➤アジア太平洋地域の自動車用シールド市場規模:

アジア太平洋地域の自動車用シールド市場の市場調査と分析によると、この地域の市場は予測期間を通じて世界の自動車用シールド市場で主導的な地位を占め、38.7%の収益シェアを占めると予想されています。市場の成長は、電動化とEV製造エコシステムの拡大に支えられています。インドのFAME IIなどのイニシアチブや中国の積極的なEV補助金は、電気自動車の採用増加を促進しています。電気自動車では、バッテリー、インバーター、オンボード充電器などのコンポーネントに広範な電磁干渉と熱シールドが必要であることがわかっています。さらに、市場の成長は、高密度信号環境でパフォーマンスを維持するために高度なシールドを必要とする自律走行車やコネクテッドカーの需要の増加によって支えられています。

- アジア太平洋地域の自動車用シールド市場の市場強度分析:

アジア太平洋地域の自動車用シールド市場に関連する国の市場強度分析は次のとおりです:

|

カテゴリー |

日本 |

中国 |

インド |

マレーシア |

韓国 |

|

市場成長の可能性 |

中程度―強い |

強 |

中程度 |

強 |

強 |

|

EV普及の勢い |

中程度 |

高 |

低中程度 |

高 |

中程度 |

|

現地調達要件 |

厳格 |

厳格-中程度 |

中程度 |

厳格 |

中程度-厳格 |

|

半導体リスクの影響 |

mask |

||||

|

OEM生産基盤の強固さ |

|||||

|

アフターマーケットの成熟度 |

|||||

|

製造コスト競争力 |

|||||

|

研究開発とイノベーションのエコシステム |

|||||

|

サプライチェーンの統合 |

|||||

|

政策とインセンティブによる支援 |

|||||

|

市場参入障壁 |

|||||

|

輸出志向 |

|||||

|

貿易政策の影響 |

|||||

ソース: SDKI Analytics 専門家分析

自動車用シールド業界概要と競争ランドスケープ

自動車用シールド市場のメーカーシェアを独占する世界トップ10の企業は次のとおりです:

|

会社名 |

本社所在地 |

自動車用シールド関連 |

|

Laird Performance Materials |

米国 |

車載電子機器向けEMIシールド材、ガスケット、部品の製造会社です。 |

|

Parker Hannifin Corp.(チョメリックス部門) |

米国 |

自動車業界向けに幅広いEMIシールド材と熱管理材を開発と製造しています。 |

|

Henkel AG & Co. KGaA |

ドイツ |

EVとADASのEMIシールドと熱管理用導電性接着剤、コーティング材、ギャップフィラー材を提供しています。 |

|

Morgan Advanced Materials |

mask |

|

|

Schaffner Holding AG |

||

|

Tech-Etch, Inc. |

||

|

Kitagawa Industries America, Inc. |

||

|

PPG Industries, Inc. |

||

|

ElringKlinger AG |

||

|

Saint-Gobain Performance Plastics |

||

ソース: SDKI Analytics 専門家分析及び企業ウェブサイト

日本の自動車用シールド市場におけるメーカーシェアを独占するトップ10社は以下のとおりです:

|

会社名 |

事業状況 |

自動車用シールド関連 |

|

3M Japan Ltd. |

日本に特化したサービスを提供するグローバル企業 |

日本の自動車業界向けに導電性テープ、EMIシールド製品、放熱材料を供給しています。 |

|

Nitto Denko Corporation |

日本発祥 |

車載電子部品向け導電性テープ、フィルム、EMIシールド材料の開発と製造を行っています。 |

|

Sekisui Chemical Co., Ltd. |

日本発祥 |

車載ディスプレイや電子機器に使用されるEMIシールド材料を含む機能性ポリマーとフィルムを生産しています。 |

|

Tatsuta Electric Wire & Cable Co., Ltd. |

mask |

|

|

Kitagawa Industries Co., Ltd. |

||

|

Shibaura Electronics Co., Ltd. |

||

|

TDK Corporation |

||

|

NEC Tokin Corporation |

||

|

Fujipoly America Corp. |

||

|

Dexerials Corporation |

||

ソース: SDKI Analytics 専門家分析及び企業ウェブサイト

自動車用シールド 市場 包括的企業分析フレームワーク

市場内の各競合他社について、次の主要領域が分析されます 自動車用シールド 市場:

- 会社概要

- リスク分析

- 事業戦略

- 最近の動向

- 主要製品ラインナップ

- 地域展開

- 財務実績

- SWOT分析

- 主要業績指標

自動車用シールド市場最近の開発

自動車用シールド市場 – 最近の開発

世界と日本における自動車用シールド市場に関連する最近の商業的発売と技術進歩のいくつかは次のとおりです:

|

発行年月 |

会社名 |

自動車用シールド市場との連携 |

|---|---|---|

|

2024年8月 |

Nissan |

Nissanは、メタマテリアルベースの「クールペイント」を試験的に導入しています;この塗料は、車両の表面温度と車内温度を下げ、エアコンのエネルギー消費量を削減します;この塗料は主に熱管理コーティングとして機能しますが、車両表面のパッシブヒートシールドとしても機能し、部品への熱負荷を軽減し、他のシールドソリューションを補完する可能性を秘めています。 |

|

2025年3月 |

Autoneum |

Autoneumは、EVバッテリーハウジング向けに、極度の熱に耐え、電気絶縁性も備えた、マイカフリーの複合ソリューションであるE-Fiberフレームシールドを発表しました;これは、熱と電気を直接的にシールドするものであり、乗員と部品をバッテリーの熱暴走から保護し、EVの安全システムを強化します。 |

ソース:企業プレスリリース

目次

関連レポート

よくある質問

- 2020ー2024年

- 2025-2035年

- 必要に応じて日本語レポートが入手可能