アルミナ三水和物市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― グレードタイプ別、アプリケーション別、エンドユーザー産業別、機能性別、販売チャネル別、及び地域別―世界市場の見通しと予測 2026-2035年

出版日: Feb 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

アルミナ三水和物市場規模

2026―2035年までのアルミナ三水和物市場の市場規模はどれくらいですか?

世界のアルミナ三水和物(ATH)産業を牽引する難燃剤とフィラーアプリケーションを評価します。本レポートでは、プラスチック、エラストマー、コーティングにおける安全性と性能向上のための需要を分析・分析します。2026―2035年の間に6.1%のCAGRで成長すると予想され、市場規模は2025年の32億米ドルから2035年には58億米ドルに増加すると予測されています。

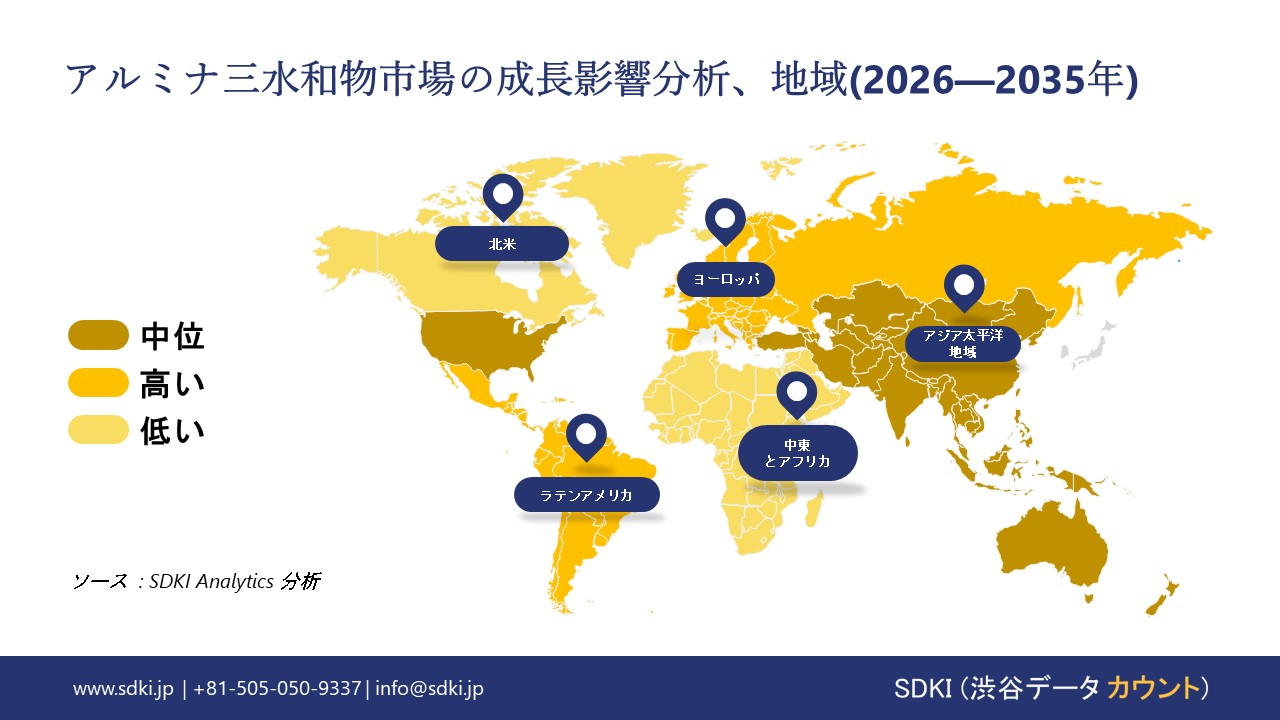

市場シェアの観点から、どの地域がアルミナ三水和物市場を支配すると予想されますか?

当社の市場調査によると、アジア太平洋地域(APAC)はアルミナ三水和物(ATH)市場において確固たるグローバルリーダーであり、最大の市場シェアと最も高い成長率を誇ります。APAC地域は、予測期間中に約48%という圧倒的な市場シェアを維持しながら、同時に最も高い複利年間成長率(CAGR)を達成すると予測されています。この二大リーダーシップは、この地域の巨大かつ成長を続けるプラスチック、ポリマー、建設産業によって推進されています。これらの産業では、厳格な防火規制と急速なインフラ整備に支えられ、ATHが難燃剤と充填剤として広く使用されています。

アルミナ三水和物市場分析

アルミナ三水和物とは何ですか?

アルミナ三水和物(ATH)市場は、プラスチック、ゴム、コーティング剤における難燃剤と煙抑制剤の充填剤として主に用いられる鉱物化合物を供給しています。また、アルミニウム化学品の製造原料として、また接着剤やシーラントなどのアプリケーションにおける充填剤としても利用されています。

アルミナ三水和物市場の最近の傾向は何ですか?

当社のアルミナ三水和物市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています。

- ハロゲンフリー難燃剤の採用拡大を促す火災安全規制 –

当社の調査レポートによると、世界的な火災安全規制の厳格化により、プラスチックや建設資材におけるATHの使用が増加しています。ヨーロッパ委員会による2024―2025年の建設製品規制の施行規則改正では、断熱材、パネル、ケーブルの耐火性能の検証が重視されており、非毒性難燃剤としてのATHの優位性が高まっています。さらに、ユーロスタット2024では、EU全体の非住宅建設生産量の着実な増加が言及されており、これが適合材料の需要を支えています。同様に、米国消費者製品安全委員会は、電気製品と建築製品に対して厳格な可燃性要件を維持しています。こうした火災安全規制の遵守義務は、建設分野とポリマーアプリケーションにおけるATHの世界的な需要の大幅な増加につながっています。

- 世界的な電線とケーブルの電化がATHベースの難燃性フィラーを牽引 –

当社の調査レポートによると、電力網の拡張と電化は、電線とケーブル絶縁システムにおけるATH消費量を増加させます。米国エネルギー情報局(EIA)の2025年版では、送電網の近代化に関連した継続的な送電と配電投資が言及されており、これにより難燃性ケーブルコンパウンドの需要が増加するとされています。さらに、ユーロスタットの報告書では、複数のEU加盟国における電力インフラへの支出について言及されています。ATHは高温で水を放出し、有毒な煙を出さずに消火作用を発揮するため、好まれています。電化に伴うケーブルの拡張は、世界の電力インフラにおけるATH消費量の増加につながります。

アルミナ三水和物市場は日本の市場プレーヤーにどのような利益をもたらすですか?

アルミナ三水和物市場は、統合バリューチェーン全体にわたって日本の市場プレーヤーに多くの機会を提供しています。経済産業省の化学産業ビジョンでは、無機化学品と機能性材料を重点製造拠点として挙げており、これらは経済安全保障促進法の下で支援されており、国内生産の強靭化を奨励しています。さらに、GX基本方針では、アルミナ三水和物が技術的に位置付けられている建設、エレクトロニクス、モビリティのエンドユーザー分野において、無毒性とハロゲンフリーの材料を推進しています。企業レベルでは、Resonac Holdings CorporationとNippon Light Metal Holdingsは、2024年度有価証券報告書において、難燃性フィラーやスペシャリティケミカルアプリケーションを支える主要な無機材料として水酸化アルミニウムとアルミナ誘導体を開示しており、経営陣はエレクトロニクス、ケーブル、建設業界の顧客からの堅調な需要にも言及しています。両社は、市場見通しのセクションで、より付加価値の高い機能性材料へのポートフォリオのアップグレードを強調しています。日銀短観によると、化学メーカーの設備投資意欲は2025年まで好調であり、これが安定した稼働率につながっています。政策の継続性と企業戦略を総合すると、日本企業にとって2030年まで永続的なチャンスがあることを示しています。

アルミナ三水和物市場に影響を与える主な制約は何ですか?

アルミナ三水和物(ATH)市場における主要な制約要因は、水酸化マグネシウムなどの代替難燃剤と比較して熱安定性が比較的低いことです。このため、高温で加工されるポリマーへの使用が制限され、エンジニアリングプラスチックなどの主要産業におけるアプリケーション可能性が制限されています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

アルミナ三水和物市場レポートの洞察

アルミナ三水和物市場の今後の見通しは何ですか?

SDKI Analyticsの専門家によると、以下はアルミナ三水和物市場の世界シェアに関連するレポートの洞察です:

|

レポートの洞察 |

|

|

2026―2035年までのCAGR |

6.1% |

|

2025年の市場価値 |

32億米ドル |

|

2035年の市場価値 |

58億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

アルミナ三水和物市場はどのようにセグメント化されているか?

アルミナ三水和物市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場をグレードタイプ別、アプリケーション別、エンドユーザー産業別、機能性別、販売チャネル別にセグメント化しました。

アルミナ三水和物市場はグレードタイプによってどのように区分されていますか?

グレードタイプ別に基づいて、アルミナ三水和物市場は、建築、製紙、セラミックスに使用される、ファイングレード(難燃剤、接着剤、コーティング剤に使用)、中級グレード(プラスチック、ゴム、電線とケーブル複合材)、粗粒度(建設、紙、陶磁器)に分割されています。市場シェア分布を考慮すると、均一な粒子サイズと効果的な難燃性を提供するファイングレードアルミナ三水和物が、2035年までに46%のシェアを占めると予測されています。ヨーロッパ化学物質庁によると、アルミナ三水和物はREACH規制の枠組みに登録されており、EU市場での使用に関する安全基準と環境基準への適合が確認されています。この規制承認は、産業界における継続的な採用を促進し、安定した市場見通しを支えています。

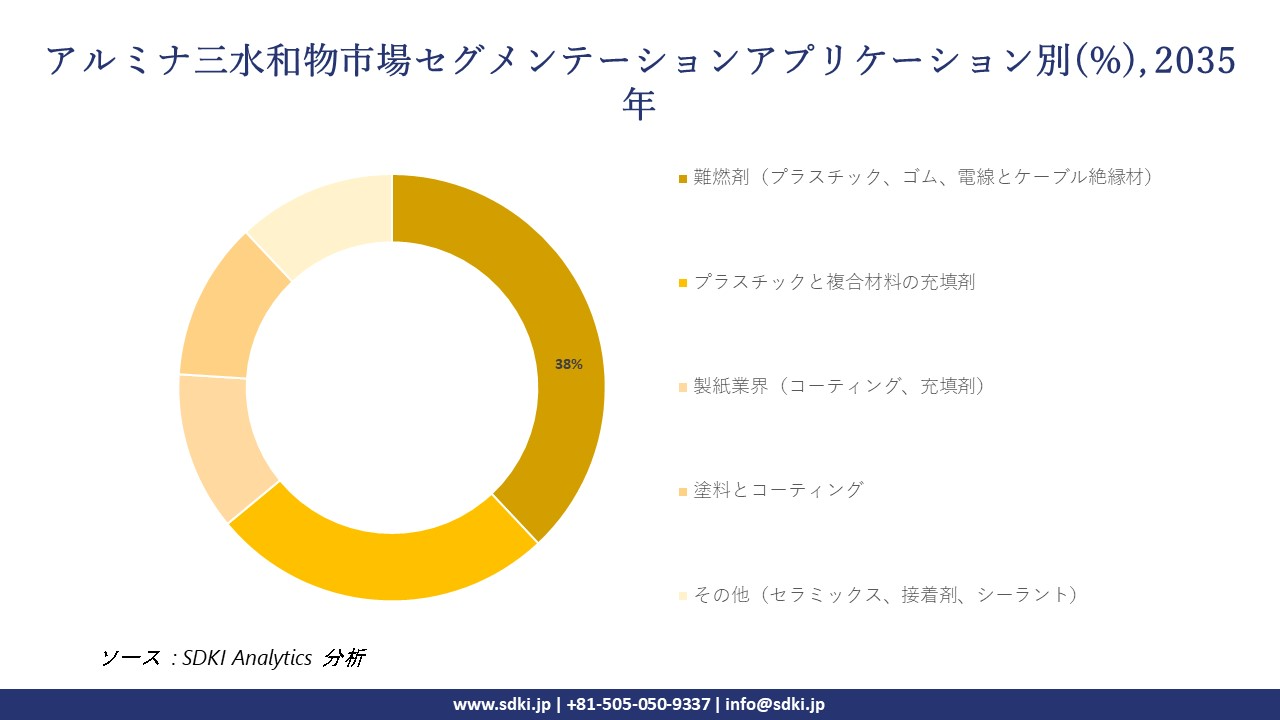

アルミナ三水和物市場はアプリケーションによってどのように区分されていますか?

アプリケーション別に基づいて、アルミナ三水和物市場は、難燃剤(プラスチック、ゴム、電線とケーブル絶縁材)、プラスチックと複合材料の充填剤、製紙業界(コーティング、充填剤)、塗料とコーティング、その他(セラミックス、接着剤、シーラント)に分割されています。使用傾向を考慮すると、建設、電気、輸送業界における安全要件の高まりを背景に、難燃剤アプリケーションは2035年に38%の市場シェアを獲得し、市場をリードすると予想されます。アルミナ三水和物は、その煙抑制効果と熱吸収性から、これらのアプリケーションで広く好まれています。調査報告書の知見によると、規制遵守が材料選定に影響を与え続けるため、難燃性材料の需要は持続的に高まっています。

以下は、アルミナ三水和物市場に該当するセグメントのリストです:

|

親セグメント |

サブ‑セグメント |

|

グレードタイプ別 |

|

|

アプリケーション別 |

|

|

エンドユーザー産業別 |

|

|

機能性別 |

|

|

販売チャネル別 |

|

ソース: SDKI Analytics 専門家分析

アルミナ三水和物市場傾向分析と将来予測:地域市場展望概要

アジア太平洋地域は、アルミナ三水和物の開発地域の1つであり、予測期間中に6.2%のCAGRが見込まれています。エネルギーと通信用のワイヤとケーブルインフラストラクチャへの投資は、市場の成長を支えています。当社の調査レポートでは、この地域が世界で48%のシェアを占め、支配的になると予想されていることが強調されています。国家エネルギー安全保障とデジタル接続プログラムは、ATH難燃性ケーブルを使用する電力網とブロードバンドネットワークへの投資の余地を生み出します。インド政府が開始した改訂された配電セクタースキーム(RDSS)は、配電インフラストラクチャの近代化に3,03,758クローレを割り当てました。同様に、東南アジア全域の国家光ファイバーネットワークプロジェクトでは、準拠したケーブルが必要であり、これも市場でアルミナ三水和物の需要を生み出しています。

SDKI Analyticsの専門家は、このアルミナ三水和物市場に関する調査レポートのために、以下の国と地域を調査しました:

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

北米におけるアルミナ三水和物市場の市場パフォーマンスはどうですか?

北米では、プラスチック、電線・ケーブル、塗料、コーティング剤、建築資材などにおいて、非毒性でハロゲンフリーの難燃剤と煙抑制剤としてアルミナ三水和物が広く使用されており、その市場は堅調に成長しています。米国の建築と火災法規の改正により、より安全な難燃剤の使用が義務付けられ、アルミナ三水和物の需要が高まっています。国際建築基準(IBC)と全米防火協会(NFPA)の生命安全基準では、この地域の建築資材に非ハロゲン系難燃剤を使用することが義務付けられており、建設会社は火災安全のためにこれらの資材に頼っています。

アルミナ三水和物調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

SDKI Analyticsの調査者によると、アルミナ三水和物の市場見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートによると、市場関係者は、製品・技術の投入、戦略的提携、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体における競争優位性を獲得しようとしています。

アルミナ三水和物市場で事業を展開している世界有数の企業は誰ですか?

当社の調査レポートによると、世界のアルミナ三水和物市場の成長に重要な役割を果たしている主な主要企業にはHuber Engineered Materials、Nabaltec AG、Almatis GmbH、Sumitomo Chemical Co., Ltd.、MAL Magyar Alumínium Termelő és Kereskedelmi Zrt などが含まれます。

アルミナ三水和物市場で競合している主要な日本企業はどこですか?

市場展望によると、日本のアルミナ三水和物市場のトップ5プレーヤーは、Sumitomo Chemical Co., Ltd.、Nippon Light Metal Company, Ltd.、Taki Chemical Co., Ltd.、Showa Denko K.K.、Kanto Denka Kogyo Co., Ltd などです。

市場調査レポートには、世界的なアルミナ三水和物市場分析調査レポートにおける主要企業の詳細な競合分析、企業プロファイル、最近の傾向、主要な市場戦略が含まれています。

アルミナ三水和物市場の最新のニュースや傾向は何ですか?

- 2025年8月:Vinacominと韓国のDaejoo KC Groupは、超微粒子アルミナ三水和物とベーマイトの生産を計画しています。これは、リチウムイオン電池や先端材料へのアプリケーションを支援することを目的としています。

- 2023年8月:Sumitomo Chemicalは愛媛工場において超微粒子α-アルミナの量産を開始しました。これにより、電子機器と産業用途向けの高性能アルミナの供給体制が強化されます。

アルミナ三水和物主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

アルミナ三水和物マーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能