宇宙状況認識(SSA)市場調査―オファリング別(サービス (気象、地球近傍物体検出、監視と追跡、深部検出と追跡)、ペイロード システム (地上システム、宇宙ベースのセンサー、データリンク))、軌道範囲別、エンドユーザー別 、オブジェクト別 、および地域別ー予測2025-2037年

出版日: Sep 2025

- 2020ー2024年

- 2025-2037年

- 必要に応じて日本語レポートが入手可能

宇宙状況認識(SSA)市場規模

宇宙状況認識(SSA)市場の収益は、2024 年に約 20億米ドルに達しました。さらに、当社の宇宙状況認識(SSA)市場に関する洞察によると、市場は予測期間中に約 6% の CAGR で成長し、2037 年までに約 30億米ドルの価値に達すると予想されています。

2037年の市場価値

30億 米ドル

成長速度

CAGR

(2025-2037年)主要な市場プレーヤー

L3Harris Technologies

Kratos Defense & Security Solution

Parsons Corporation.

NorthStar Earth & Space

日本の主要なプレーヤー

NEC Corporation

Fujitsu Limited

IHI Corporation

Axelspace Corporation

宇宙状況認識(SSA) 市場概況

世界市場分析、地域別2037年

2037年 には、北米市場は、約 33% の最大の市場シェアを保持すると予測されています

市場セグメンテーションシェア、オファリング別 (%), 2037年

市場セグメンテーションシェア、地域別 (%)、2037 年

| 予測年 | : 2025 – 2037年 |

| 基準年 | : 2024年 |

| 最も急成長している市場 | : アジア太平洋地域 |

| 最大の市場 | : 北米地域 |

宇宙状況認識(SSA)市場分析

市場の定義

宇宙内の物体を追跡および識別して、その軌道を確立し、その動作状況を学習する手法は、宇宙状況認識(SSA) と呼ばれます。 SSA は、物体の将来の位置を予測するのにも役立ち、危険を回避するために宇宙管理者にコンジャンクションの可能性を警告します。

宇宙状況認識(SSA)市場の成長要因

以下は、宇宙状況認識(SSA)市場の主な成長要因の一部です。

- 宇宙の危険なデブリ– 宇宙空間には多くの危険な破片が散乱しており、それらは主に消滅した人工物体です。この破片には、損傷した衛星、さまざまなミッションで使用されるカメラやその他のツール、打ち上げロケット段階の残骸などが含まれる場合があります。

- 6050回以上の打ち上げで飛来した56450個の追跡物体があります。同機関によると、米国宇宙監視ネットワークは定期的にこの破片の28200個の破片を追跡しています。

- 宇宙を中心としたセンシング活動の増加– 海事や航空などのいくつかの分野は、気象監視や RF マッピングなどの宇宙ベースのセンシング活動に関与しています。

- SSA を適用する活動に関与する商用サービスがますます増えており、これが市場の成長を後押しすると予想されます。たとえば、2019 年 4 月に、NorthStar Earth & Space Inc. は ExoAnalytic Solutions と協力して、衛星などの高価値の宇宙資産に焦点を当てた商用サービスを開発しました。このサービスは、SSA からの情報を使用して衛星とスペースデブリの衝突を予測し、回避することを目的としていました。

最新の開発

- 2021 年 4 月に、Lockheed Martinは、ドイツ宇宙機関が地球周回軌道上の物体のリアルタイム認識のために、その指揮制御システムである iSpace を選択したと発表しました。

- 2021 年 2 月に、Astros Scale Holdings Co., Ltd.は、#SpaceSustainability プロジェクトの Web サイトの正式リリースを発表しました。

課題

小型衛星の打ち上げを計画している衛星事業者が直面する課題は、予測期間中に市場の成長を妨げるはずです。衛星の打ち上げ、打ち上げ前の計画、ミッションをサポートするサービスは、SSA を提供します。しかし、衛星の無線周波数と軌道スロットを規制する国際電気通信連合などの機関の複雑な法律は、不利な規制によってその運用に課題をもたらすことがよくあります。この要因は市場の成長を制限するはずです。

宇宙状況認識(SSA)市場セグメンテーション軌道範囲別(%), 2037年

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

宇宙状況認識(SSA)市場レポートの洞察

|

レポートの洞察 |

|

|

CAGR |

6% |

|

予測年 |

2025―2037年 |

|

基準年 |

2024年 |

|

予測年の市場価値 |

30億米ドル |

宇宙状況認識(SSA)市場セグメント

当社は、宇宙状況認識(SSA)市場に関連するさまざまなセグメントにおける需要と機会を説明する調査を実施しました。当社はオファリング、軌道範囲、エンドユーザー、オブジェクトに基づいて市場を分割しました。

オファリングに基づいて、宇宙状況認識(SSA)市場は、サービス、ペイロード システム、ソフトウェアに分割されています。これらのうち、サービスのサブセグメントは、予測期間中に最大の市場シェア約 50% を保持するはずです。これは、SSA テクノロジーの開発、気象サービス ネットワークの進歩、および監視と追跡を通じて衛星の適切な機能を確保する必要性によるものです。

SSA に基づくさまざまなサービスの需要を高めるもう 1 つの重要な側面は、米国宇宙軍などの重要な組織によるこれらのサービスの開発と使用です。その一例は、宇宙軍の深宇宙レーダー システムである深宇宙先進レーダー機能 (DARC) です。このプログラムは、あらゆる天候や時間帯で宇宙をサポートするため、世界と国家の安全保障にとって重要なステップであると考えられています。

軌道範囲に基づいて、宇宙状況認識(SSA)市場は、地球近傍、深宇宙に分割されています。このうち、地球近傍のサブセグメントは、2037 年末までに約 68% の最大の市場シェアを保持すると予想されています。このサブセグメントの成長は、主に地球低軌道 (LEO) 上の不要な物体を追跡する必要性により起こっています。

National Aeronautics and Space Administration (NASA) によると、Space Surveillance Network (SSN) センサーは現在、27,000 個以上の軌道上のゴミを含む宇宙ゴミを追跡しています。

|

オファリング別 |

|

|

軌道範囲別 |

|

|

エンドユーザー別 |

|

|

オブジェクト別 |

|

宇宙状況認識(SSA)市場の地域概要

北米地域の宇宙状況認識(SSA) は、NASA と米国国防総省 (DoD) の存在により、主に、予測期間中に最大 33% の最大の市場シェアを保持すると予想されます。さらに、この地域は監視衛星の数でも世界をリードしています。 2024 年の時点で、米国は 122以上になると軍事衛星を地球の軌道上に配置していると推定されています。

これらの衛星の安全性は、SSA が提供する、衛星付近のスペースデブリの運用環境に関する情報に大きく依存します。したがって、国防総省による衛星監視における進歩は、市場の成長にプラスの影響を与えると予想されます。市場はまた、国防総省が宇宙状況認識(SSA)に多額の費用を費やしたことから恩恵を受けるはずだ。

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

アジア太平洋地域は、2025―2037 年に、宇宙状況認識(SSA)市場が最も急速に成長するはずです。この地域は、2037 年末までに宇宙状況認識(SSA) 市場の約 29% を占めるはずです。インド、日本、中国など、この地域のいくつかの新興国は、SSA の適用において顕著な能力を示しています。

その一例は、中国が主導国の一つである、アジア太平洋地上設置光学空間観測システム (APOSOS) です。このプロジェクトは、アジア太平洋宇宙協力機構(APSCO)の加盟国および参加国の光学望遠鏡を利用した宇宙観測のための統一ネットワークを構築するものであります。

SSA の日本市場は、地球軌道から大きなデブリを除去するための国の研究と取り組みのおかげで成長するはずです。宇宙航空研究開発機構(JAXA)によると、地球に衝突する可能性のある地球近傍の物体を探索するために同研究開発部門が開発中の技術は、宇宙状況認識(SSA)に効果的に役立つはずだ。

宇宙状況認識(SSA)調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

宇宙状況認識(SSA)市場の成長影響分析、地域別 (2025―2037年)

競争力ランドスケープ

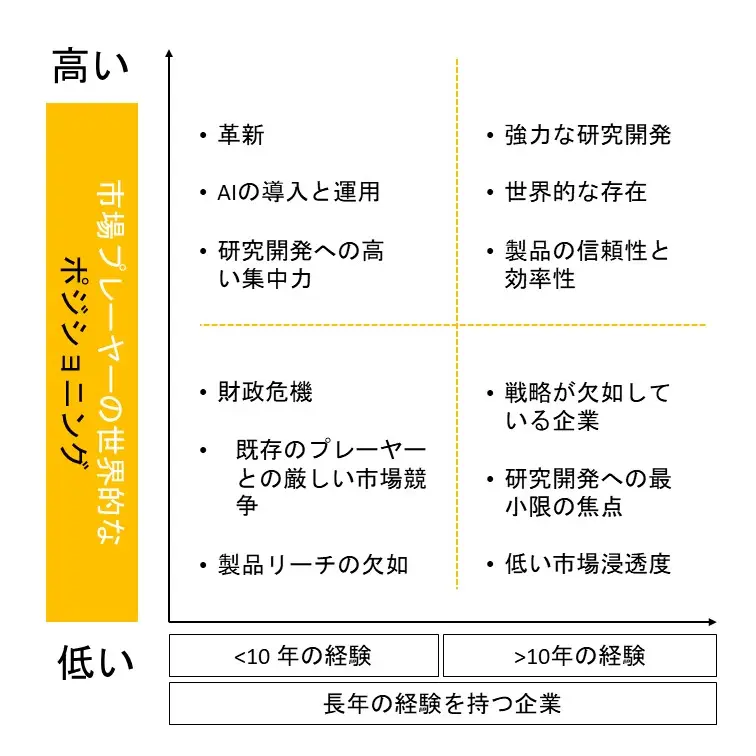

世界の宇宙状況認識(SSA)市場中に主なプレーヤーには、Lockheed Martin Corporation.、L3Harris Technologies, Inc.、Kratos Defense & Security Solutions, Inc.、Parsons Corporation.、NorthStar Earth & Space Inc.、などが含まれます。さらに、日本市場のトップ 5 プレーヤーは、Fujitsu Limited、IHI Corporation、Astroscale Holdings Inc.、NEC Corporation、およびAxelspace Corporation.、 などです。この調査には、世界の宇宙状況認識(SSA)市場におけるこれらの主要なプレーヤーの詳細な競争分析、企業概要、最近の傾向、および主要な市場戦略が含まれています。

宇宙状況認識(SSA)主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

宇宙状況認識(SSA)マーケットレポート

関連レポート

- 2020ー2024年

- 2025-2037年

- 必要に応じて日本語レポートが入手可能