医療用チューブ市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析 ― タイプ別、ソース別、アプリケーション別、形状別、分布別、地域別―世界市場の見通しと予測 2026-2035年

出版日: Feb 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

医療用チューブ市場規模

2026―2035年の医療用チューブ市場の規模はどれくらいですか?

医療用チューブ市場に関する当社の調査レポートによると、市場は予測期間(2026―2035年)の間に約5.9%の年平均成長率(CAGR)で成長すると予想されています。2035年には、世界市場は約220億米ドルに達すると予想されています。しかし、当社の調査アナリストによると、基準年である2025年の市場規模は約125億米ドルとされています。

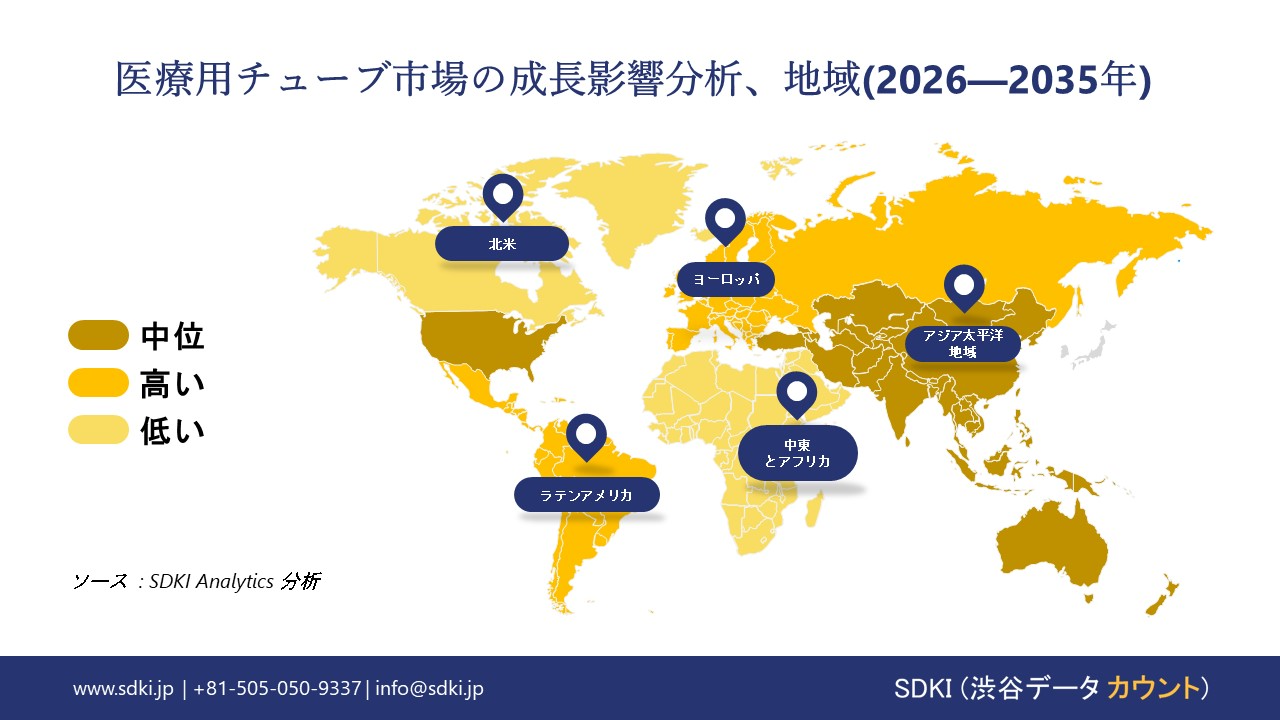

医療用チューブ市場において、市場シェアの面で優位を占めると予想される地域はどこですか?

医療用チューブに関する当社の市場調査によると、アジア太平洋地域(APAC)は、現在の市場規模と将来の成長の両面で最前線に位置し、世界シェアの約34%を占めるとともに、最高の成長率(CAGR)を記録すると予想されています。この二重のリーダーシップは、APACにおけるヘルスケア投資の加速、医療機器製造の拡大、高齢者人口と患者数の増加、そして地域全体での低侵襲手術技術の採用拡大を反映しています。

医療用チューブ市場分析

医療用チューブとは何ですか?

医療用チューブ市場は、生体適合性と滅菌性を考慮して設計された柔軟な中空ポリマーチューブを製造しています。この重要な部品は、ヘルスケアおよびライフサイエンス分野における薬物送達システム、カテーテル、蠕動ポンプ、呼吸器系機器などの用途において、流体の送達、排液、およびデバイス接続に使用されます。

医療用チューブ市場の最近の傾向は何ですか?

当社の医療用チューブ市場分析調査レポートによると、以下の市場動向と要因が市場成長の中核的な原動力として寄与すると予測されています。

- 世界的な入院件数と医療処置件数の増加 –

当社の調査レポートによると、医療利用の増加は医療用チューブの需要を牽引する大きな要因となっています。世界保健機関(WHO)によると、パンデミック後、世界の入院患者数と処置件数は急増し、非感染性疾患の治療件数も2024年には増加しました。さらに、ユーロスタットは、2024年にはEU加盟国全体で退院件数が増加すると予測しており、特にチューブが多用される心血管系および腎臓系治療において顕著です。供給面では、Becton、 Dickinson 、Companyは2024年のForm 10-Kにおいて、血管アクセスデバイスと輸液システムの成長は世界的な処置件数の増加に牽引されたと述べています。したがって、病院医療支出の増加とBDが報告した消耗品の拡大は、需要の伸びを裏付けています。

- 腎透析および慢性疾患ケアインフラの拡大 –

当社の調査レポートによると、慢性疾患治療の拡大は、医療用チューブの頻繁な使用により、その需要を支えています。米国国立衛生研究所(NIH)が資金提供している米国腎データシステム(RDS)によると、2024年には末期腎疾患患者が808000人を超え、治療件数は引き続き増加する見込みです。透析では患者1人につき週に複数のチューブセットが必要となるため、最もチューブを多く使用する治療法の一つとなっています。サプライヤー側では、Fresenius Medical Careは2024年度年次報告書の中で、血液系チューブなどの消耗品が、治療件数に連動した需要と並んで、主要な収益源となっていると述べています。こうした動向は、公的資金による慢性疾患ケアプログラムが実施されている世界中のあらゆる地域に当てはまります。

医療用チューブ市場は日本の市場プレーヤーにどのような利益をもたらすですか?

医療用チューブ市場は、統合された国内および輸出バリューチェーン全体にわたって、日本の市場プレーヤーにいくつかの機会を提供しています。経済産業省の生産動態統計によると、日本の医療機器製造出荷額は2023年度に3.3兆円を超え、医療機器製造の市場見通しによると、生産レベルは2024年まで堅調に推移しています。需要面では、内閣府の経済評価は、2025年までの日本の高齢化社会戦略において、医療機器を引き続き優先成長産業と位置付けています。日本税関の貿易統計によると、2024年の日本の光学機器、写真機器、技術機器、医療機器の輸出額は5.47兆円で、このグループは米国や欧州連合を含む主要な輸出品目の1つであり、高価値の医療機器および精密機器分野での日本の強力な輸出プレゼンスを支えています。さらに、企業の開示情報もこの成長を裏付けています。例えば、Nipro Corporationは2024年度有価証券報告書において、透析・輸液用チューブ製品が国内における主要な収益源である一方、北米およびアジアにおける海外販売の拡大を優先課題としています。同様に、Terumo Corporationの2024年度アニュアルレポートでは、国内の病院と世界への輸出を支えるためにポリマー加工技術への大規模な投資を強調しており、これにより日本のメーカーにとって大きなビジネスチャンスが創出されています。

医療用チューブ市場に影響を与える主な制約は何ですか?

医療用チューブ市場における最大の制約は、特に薬剤送達やインプラントといった重要な用途において、厳格でコストのかかる規制遵守と検証プロセスが求められることです。FDA、ISO、REACHといった規格の進化に対応するには、試験、文書化、品質管理への多大な投資が必要となり、参入障壁が高まっています。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

医療用チューブ市場レポートの洞察

医療用チューブ市場の今後の見通しは何ですか?

SDKI Analyticsの専門家によると、医療用チューブ市場の世界シェアに関連するレポートの洞察は以下のとおりです。

|

レポートの洞察 |

|

|

2026―2035年のCAGR |

5.9% |

|

2025年の市場価値 |

125億米ドル |

|

2035年の市場価値 |

220億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

医療用チューブ市場はどのように分割されていますか?

医療用チューブ市場の展望に関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場を素材タイプ別、アプリケーション別、最終用途産業別、構造タイプ別、機能性別、販売チャネル別にセグメントに分割されていました。

医療用チューブ市場は素材タイプ別にどのように分割されていますか?

素材タイプ別に基づいて、医療用チューブ市場は、ポリ塩化ビニル(PVC)、ポリオレフィン(PP、PE)、熱可塑性エラストマー(TPE、TPU)、シリコーン、その他(ポリカーボネート、フッ素ポリマー)に分割されています。調査レポートによると、ポリ塩化ビニル(PVC)は2035年までに32%の市場シェアを占めると予想されています。ポリ塩化ビニル(PVC)、柔軟性、透明性、耐薬品性、およびコスト効率の高さから、大量の使い捨て医療用途で引き続き広く好まれています。PVCチューブの市場見通しは、病院全体でのカテーテルベースの処置や体液移送システムでの広範な使用によって強化されています。疾病管理予防センターは、入院患者の約15―25%が入院中に短期留置尿道カテーテルを受けており、急性期治療環境でのカテーテルチューブへの継続的な依存を強調していると述べています。この大規模な患者曝露ベースは、標準化された使い捨て医療用チューブ製品におけるPVC材料の継続的な需要を支えています。

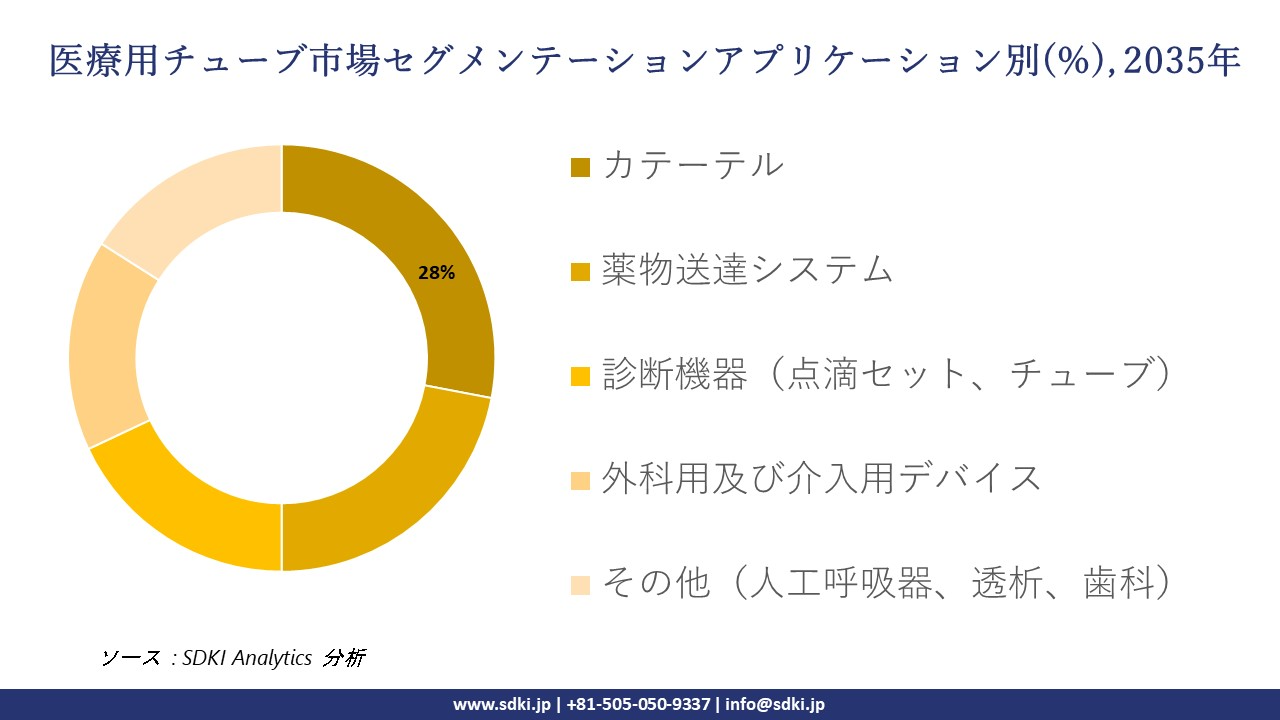

医療用チューブ市場はアプリケーション別にどのように分割されていますか?

アプリケーション別に基づいて、医療用チューブ市場は、カテーテル、薬物送達システム、診断機器(点滴セット、チューブ)、外科用および介入用デバイス、その他(人工呼吸器、透析、歯科)のアプリケーションに分割されています。カテーテルは、急性期および長期の患者ケアにおける重要な役割を担っていることから、2035年までにこのセグメントの28%のシェアを占めると予測されています。カテーテルには、様々な臨床現場において一貫した柔軟性、耐キンク性、生体適合性を備えたチューブが必要です。このセグメントの市場見通しは、低侵襲手術や病院での日常的な介入への依存が継続していることから安定しており、医療システム全体にわたって高性能医療用チューブソリューションに対する安定した需要を維持しています。

以下は医療用チューブ市場に該当するセグメントのリストです。

|

親セグメント |

サブ‑セグメント |

|

素材タイプ別 |

|

|

アプリケーション別 |

|

|

最終用途産業別 |

|

|

構造タイプ別 |

|

|

機能性別 |

|

|

販売チャネル別 |

|

ソース: SDKI Analytics 専門家分析

医療用チューブ市場の動向分析と将来予測:地域市場展望概要

アジア太平洋地域は、中国、インド、日本といった地域における医療製品規制の影響により、医療用チューブ市場が発展途上にあります。当社の市場調査アナリストは、この地域が予測期間中に6.2%という最も高い年平均成長率(CAGR)を記録し、今後数年間で世界市場シェアの約34%を獲得し、主導的な地位を維持すると予測しています。中国の国家医療機器監督管理局(NMPA)は、複雑なカテーテルアセンブリを含む高リスク医療機器の規制プロセスを加速させています。 NMPAは「イノベーション優先審査」という制度を設けており、承認手続きにかかる時間を通常の12―24ヶ月から最大50%短縮し、平均審査期間を6―12ヶ月に短縮することができます。この制度は、低侵襲医療機器における国内のイノベーションを奨励し、地域における先進的、小型、多腔チューブの需要を直接的に促進します。

SDKI Analyticsの専門家は、医療用チューブ市場に関するこの調査レポートのために、以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東およびアフリカ |

|

ソース: SDKI Analytics 専門家分析

北米の医療用チューブ市場のパフォーマンスはどうですか?

米国食品医薬品局(FDA)による画期的デバイス指定と510(k)規制の近代化は、北米の医療用チューブ市場の重要な成長要因の一つです。2025年6月30日現在、FDAと生物製剤評価研究センター(CBER)は、高度に複雑で小型化されたチューブを必要とする神経血管カテーテルや高度な心臓アブレーションシステムなど、1,176件の画期的デバイス指定を付与しています。この迅速化により、市場投入までの期間が短縮され、研究開発が促進され、マルチルーメン設計、編組補強、特殊ポリマーコーティングなどの機能を備えた最先端チューブの需要が直接的に増加します。

医療用チューブ調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

SDKI Analyticsの研究者によると、医療用チューブ市場見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートによると、市場関係者は、製品・技術の投入、戦略的提携、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体の見通しにおいて競争優位性を獲得しようとしています。

医療用チューブ市場で事業を展開している世界有数の企業はどこですか?

当社の調査レポートによると、世界の医療用チューブ市場の成長に重要な役割を果たしている主な主要企業には、 Saint-Gobain Performance Plastics、Freudenberg Medical、Teleflex Incorporated、Raumedic AG、Lubrizol Corporation などが含まれています。

医療用チューブ市場で競合している日本の主要企業はどこですか?

市場展望によれば、日本の医療用チューブ市場のトップ5企業は、Nipro Corporation、 Terumo Corporation、 Asahi Kasei Corporation、 Mitsubishi Chemical Corporation、 Sumitomo Bakelite Co.などです。

医療用チューブ市場分析調査レポートにおける主要企業の詳細な競合分析、企業プロファイル、最近の動向、主要な市場戦略が含まれています。

医療用チューブ市場の最新のニュースや動向は何ですか?

- 2025年4月1日:Asahi Intecc USAは、Medikitとの販売提携を発表し、米国におけるスーパーシース™イントロデューサーシースの販売を開始することで、医療機器ポートフォリオの拡充を図ります。このシース製品は、カテーテル留置を補助するインターベンション処置において使用され、挿入性を向上させ、患者の血管損傷を軽減する設計となっています。

- 2025年3月: TE Connectivity高度なカテーテル用途向けに設計された極小径医療用チューブの新製品ラインを発売しました。このチューブは、低侵襲手術における柔軟性と患者の快適性を向上させます。新チューブ製品は、高まる臨床ニーズに対応し、次世代医療機器メーカーを支援することを目指しています。

医療用チューブ主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

医療用チューブマーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能