油田機器市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析― 機器タイプ別、アプリケーション別、及び地域別―世界市場の見通しと予測 2025-2035年

出版日: Oct 2025

- 2020ー2024年

- 2025-2035年

- 必要に応じて日本語レポートが入手可能

油田機器市場エグゼクティブサマリ

1) 油田機器市場規模

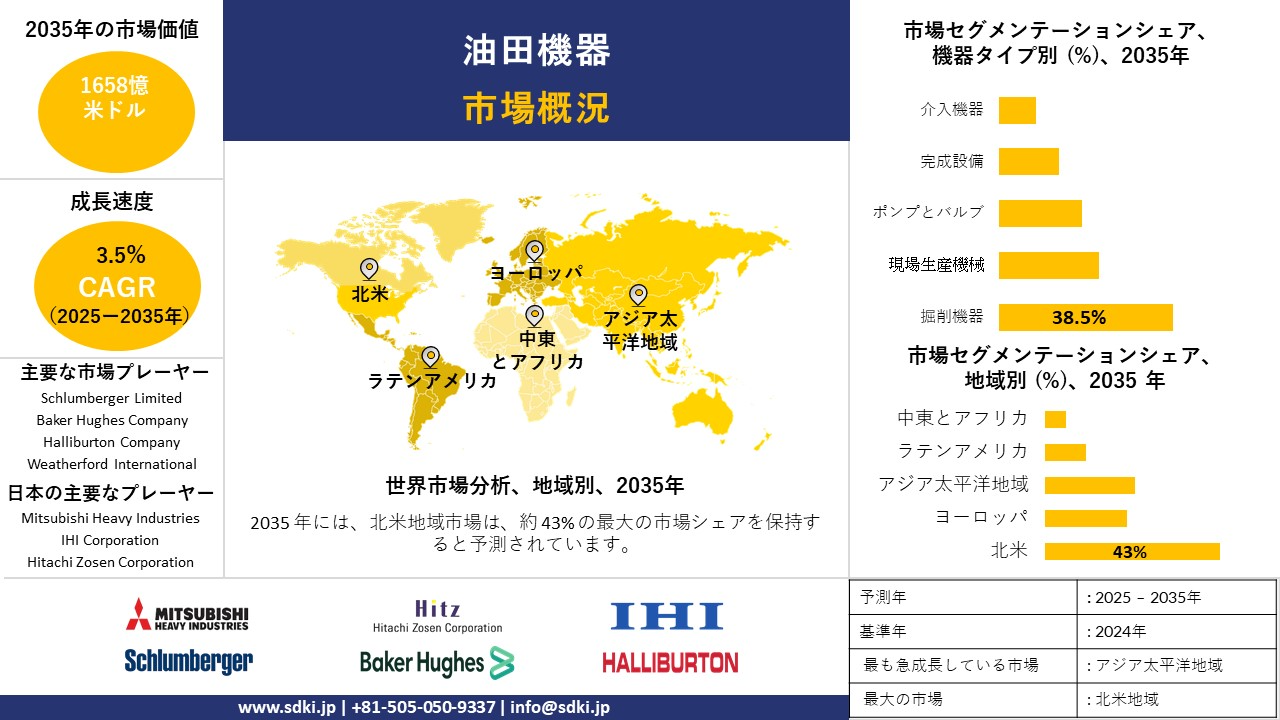

油田機器市場に関する当社の調査レポートによると、市場は2025―2035年の予測期間中に3.5%の年平均成長率(CAGR)で成長すると予想されています。2035年には、市場規模は1,658億米ドルに達すると見込まれています。

しかし、当社の調査アナリストによると、基準年の市場規模は1,223.2億米ドルがありました。世界的なエネルギー需要の増加と掘削技術の急速な進歩は、油田機器市場の着実な成長を牽引しています。

2) 油田機器市場の傾向 – 好調な軌道を辿るセクション

SDKI Analyticsの専門家によると、予測期間中に油田機器市場の傾向として予測される分野には、掘削機器、圧力制御システム、ポンプ・バルブなどが含まれます。予測期間中に油田機器市場を牽引すると予想される主要な傾向について、以下に詳細をご紹介します:

|

市場セグメント |

CAGR (2025–2035年) |

主要な成長要因 |

|

掘削機器 |

3.8% |

シェールオイルの拡張、自動化、掘削リグの近代化 |

|

圧力制御システム |

3.9% |

高圧井、安全規制、インフラのアップグレード |

|

ポンプとバルブ |

4.2% |

オフショア開発、流体管理、エネルギー需要 |

|

フィールド生産機械 |

3.1% |

排出ガス規制、老朽化したインフラ、デジタル技術による改修 |

|

海底機器 |

4.3% |

深海探査、モジュラーシステム、地域投資 |

ソース: SDKI Analytics 専門家分析

3) 市場の定義 – 油田機器は何ですか?

油田機器とは、基本的に石油・ガスの上流事業で利用される特殊な機械・ツールであり、探査、掘削、採掘、生産を主な機能としています。製品は、掘削リグ、圧力制御システム、ポンプ、バルブ、そして陸上および海上環境向けに製造されたフィールド生産機械など、幅広い資産を網羅しています。

油田機器市場は、技術力を通じてエネルギー企業が世界の石油・ガス需要に対応できるよう支援する上で重要な役割を果たしています。非在来型埋蔵量、古い油井の再生、そしてAI、IoT、自動化などの先進技術の統合が、成長の要因となっています。

4) 日本の油田機器市場規模:

成長著しい日本の油田機器市場は、年平均成長率(CAGR)が約3.0%と予測されています。日本政府はエネルギー安全保障の確保を目指し、海洋エネルギー開発能力の拡大を進めており、高度な海底掘削技術機器の需要が高まっています。この傾向は、エネルギー源の多様化と輸入依存度の低減を目指す政府主導の取り組みによって歓迎されています。

厳しい環境規制とカーボンニュートラル目標を掲げる日本の事業者は、コンパクトでエネルギー効率の高い油田システムを求めています。この変化により、従来型機器から、スマートでコンプライアンス対応可能な代替機器への置き換えが進んでいます。

- 日本の現地市場プレーヤーの収益機会:

日本の現地市場プレーヤーにとって、油田機器市場に関連するさまざまな収益機会は次のとおりです:

|

収益創出の機会 |

主要成功指標 |

主な成長要因 |

市場洞察 |

競争の激しさ |

|

掘削機器製造 |

精密掘削装置に対する国内の高い需要 |

陸上探査区域の拡大 |

日本の上流部門は自動化リグへの投資を進めています |

中程度 |

|

レンタル・リースサービス |

移動式掘削装置および補助装置の稼働率 |

中規模事業者のコスト効率向上 |

アセットライトモデルへの関心が高まっています |

高 |

|

メンテナンス・改造サービス |

機器の稼働時間とライフサイクルの延長 |

成熟油田におけるインフラの老朽化 |

レガシーシステムの改修需要が高まっています |

低 |

|

自動化・制御システム |

Mask |

|||

|

カスタム製作(小型・中型機器) |

||||

|

流体ハンドリング・ポンプシステム |

||||

|

オフショア支援機器 |

||||

ソース: SDKI Analytics 専門家分析

- 日本の油田機器市場の都道府県別内訳:

以下は、日本の油田機器市場の都道府県別の内訳です:

|

都道府県 |

CAGR (2023–2035年) |

主要な成長要因 |

|

北海道 |

8% |

陸上探査区域の拡大、良好な地質構造 |

|

新潟県 |

8.5% |

自動化改修中の既存油田、政府支援による再開発 |

|

秋田県 |

8.5% |

成熟油井の集中、保守・介入機器の需要 |

|

山口県 |

Mask |

|

|

福岡県 |

||

ソース: SDKI Analytics 専門家分析

油田機器市場成長要因

当社の油田機器市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています:

- EPAのメタン基準によるゼロエミッション制御とガスイメージングの導入義務化:ゼロエミッションに向けた規制強化は、石油・ガス機器市場の成長に寄与しています。例えば、米国EPA(環境保護庁)による石油・ガス部門からのメタンおよび揮発性有機化合物(VOC)排出に関する最終規則は、事業者に対し、新規排出源においてゼロエミッションの空気圧式制御装置およびポンプの改修または設置を義務付ける厳格な性能基準を定めています。

この規制変更により、メタン排出量の70-80%削減目標が達成され、主に95%の排出回収効率を達成できる制御装置への初期投資として13億米ドルを超える支出が見込まれます。競争環境に関しては、ハリバートンによる10-K報告書の分析によると、インフレ抑制法(IRA)の超過トンあたり900米ドルを超えるメタン規制により、中規模事業者の年間コンプライアンス負担が約150―200百万米ドル増加する可能性があり、低排出ガス代替技術への投資が促進される可能性があります。これにより、適合機器の販売需要が高まることが期待されます。

- 安定した掘削リグ数による機器収益源の拡大を背景に、国際的な上流事業の回復力:当社の調査レポートでは、掘削リグ数の安定が上流事業の回復力を高め、予測期間中に世界の石油機器市場における収益源が拡大すると予測されていることが強調されています。例えば、2024年2月にハリバートンが提出した10-K報告書では、国際的な探査と生産活動の成長が強調されています。この拡大は、サウジアラビア、UAE、インドネシアにおけるNational Oil Company(NOC)主導の事業拡大によって推進されています。

市場のもう一つの主要なプレーヤーはBaker Hughesで、同社は2025年2月のForm 10-Kで、油田サービス・機器(OFSE)の国際売上高が2023―2024年に425百万米ドル超から11000百万米ドルに増加すると報告しました。さらに、米国輸出入銀行が油田機器およびエンジニアリングサービスに対する100百万米ドルを超える長期融資保証を承認したことは、連邦政府による輸出促進への支援を示しています。最後に、UAEにおけるサプライチェーンのローカリゼーションは、リードタイムの短縮と競争力の向上につながると期待されます。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

レポートの洞察 - 油田機器市場の世界シェア

SDKI Analyticsの専門家によると、以下は油田機器市場の世界シェアに関するレポートの洞察です:

|

レポート洞察 |

|

|

CAGR |

3.5% |

|

2024年の市場価値 |

1223.2億米ドル |

|

2035年の市場価値 |

1658憶米ドル |

|

過去のデータ共有対象 |

過去5年間(2023年まで) |

|

将来予測対象 |

今後10年間(2035年まで) |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

油田機器市場セグメンテショーン分析

油田機器市場の見通しに関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場を機器タイプ別とアプリケーション別にセグメント化しました。

油田機器市場は機器タイプ別に基づいて、掘削機器、 現場生産機械、 ポンプとバルブ、 完成設備と介入機器に分割されています。石油・ガス上流事業は、従来型および非従来型の埋蔵量を採掘するために地下埋蔵量への接続を可能にする掘削機器がベースとなっています。掘削機器は生産ライフサイクルの開始に役立ち、深海やシェール層でのより複雑な掘削を支援し、成熟した油田の再開発に不可欠です。現在のシステムは、自動化、ロボットによる配管管理、リアルタイム分析を組み合わせ、精度、安全性、効率性を向上させています。これらのシステムは極限条件を想定して設計されているため、掘削後に適用される他の油田機器よりも優れた性能を発揮します。2035年には油田機器市場が38.5%成長すると予測されており、この成長はエネルギー需要の増加と、世界中の深海およびシェール層での探査の拡大によって牽引されています。

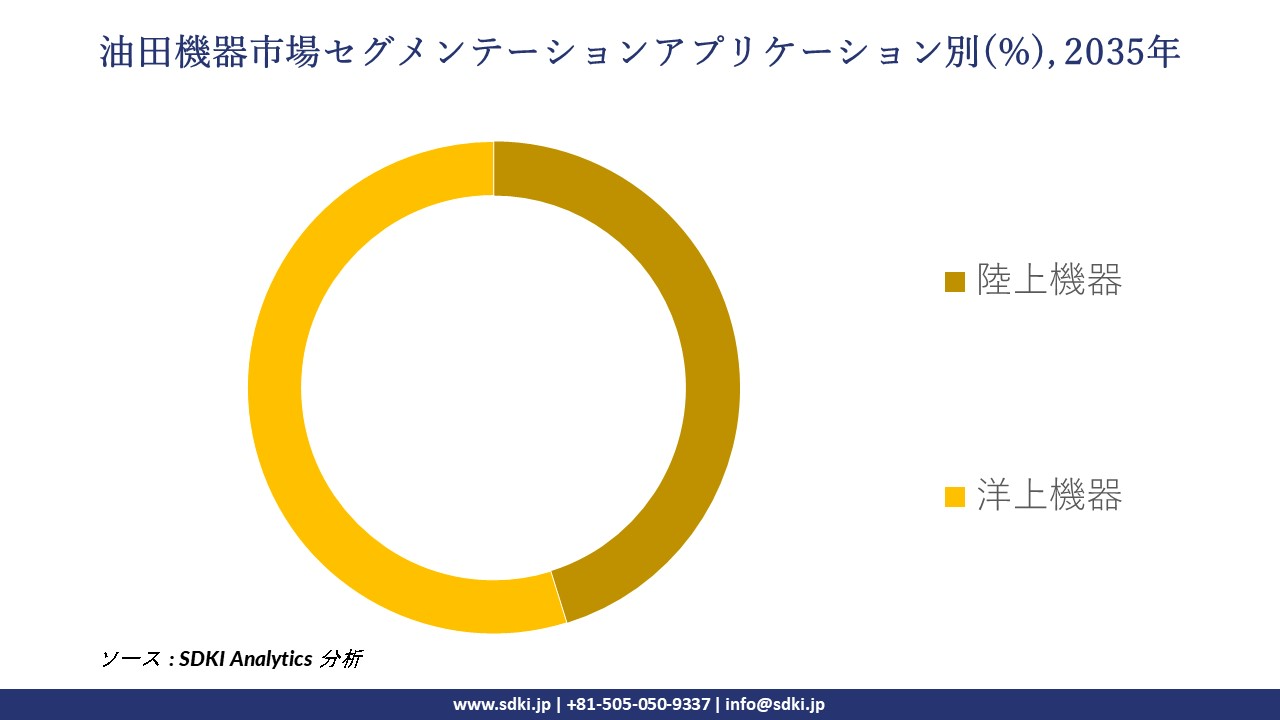

さらに、 油田機器市場はアプリケーション別に基づいて、陸上機器、洋上機器に分割されています。油田機器市場は、低コスト、物流の容易さ、拡張性といった特徴を持つ陸上機器が市場を支配しています。陸上機器には、陸上操業に適用される掘削リグ、生産ユニット、流体処理システムが含まれます。陸上機器は設置が迅速で、メンテナンス費用が低く、輸送インフラとの統合が容易なため、高密度の油井地帯や中規模事業者に適しています。2035年までに油田機器セクターの在庫は45.2%に達すると推定されており、陸上リグ数の増加、国内石油に対する政府補助金、そして陸上リグや流体管理システムのアップグレードといった陸上技術の向上が、この市場拡大を牽引する要因となっています。

以下は、油田機器市場に該当するセグメントのリストです:

|

親セグメント |

サブセグメント |

|

機器タイプ別 |

|

|

アプリケーション別 |

|

ソース: SDKI Analytics 専門家分析

世界の油田機器市場の調査対象地域:

SDKI Analyticsの専門家は、油田機器市場に関するこの調査レポートのために以下の国と地域を調査しました:

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

油田機器市場の制約要因

石油機器市場における世界的なシェアを阻害する主要な要因の一つは、世界的な原油価格の急激な上昇と下落であり、これは探鉱予算と設備投資に直結します。価格が下落すると、石油会社は掘削プロジェクトを延期または中止する傾向があり、機器の需要が減少します。この不確実性により、メーカーやサービスプロバイダーは長期的な投資プロジェクト計画を策定することが困難になります。さらに、環境規制や再生可能エネルギーへの世界的な変化は、油田事業に適応を迫り、機器のアップグレードや展開をさらに減速または制限することになります。

油田機器市場 歴史的調査、将来の機会、成長傾向分析

-

油田機器メーカーの収益機会

世界中の油田機器メーカーに関連する収益機会のいくつかは次のとおりです:

|

事業機会分野 |

対象地域 |

成長要因 |

|

先進掘削機器 |

北米 |

シェールオイルブーム、水平掘削および水圧破砕技術 |

|

オフショア支援システム |

中東とアフリカ |

深海および超深海探査プロジェクトの拡大 |

|

圧力流量制御装置 |

アジア太平洋地域 |

エネルギー需要の増加、精製および石油化学部門への投資増加 |

|

オンサイト生産機械 |

Mask |

|

|

自動化およびIoT統合 |

||

|

レンタルおよびリースサービス |

||

|

メンテナンスおよび改造ソリューション |

||

|

カスタム製作およびモジュラーユニット |

||

ソース: SDKI Analytics 専門家分析

-

世界の油田機器シェア拡大の実現可能性モデル

当社のアナリストは、世界中の業界専門家が信頼し、適用している有望な実現可能性モデルをいくつか提示し、油田機器市場の世界シェアを分析しています:

|

実現可能性モデル |

地域 |

市場成熟度 |

医療制度の構造 |

経済発展段階 |

競争環境の密度 |

適用理由 |

|

PESTEL分析 |

グローバル(クロスセクター) |

成熟から新興へ |

地域によって異なる - 政策と法的影響を評価するために使用されます |

全段階 |

中―高 |

政治、経済、社会、技術、法務、環境要因を評価します |

|

ポーターのファイブフォース分析 |

北米、ヨーロッパ |

高度成熟 |

強力な規制機関 |

先進国 |

高 |

競争の激しさ、サプライヤーの力、新規参入の脅威を評価します |

|

SWOT分析 |

アジア太平洋地域、MENA |

新興から成長へ |

複雑 - 規制枠組みは進化しています |

発展途上国 |

中 |

社内の強み/弱み、および社外の機会/脅威を特定します |

|

費用便益分析(CBA) |

Mask |

|||||

|

シナリオプランニング |

||||||

|

技術成熟度(TRL) |

||||||

|

バリューチェーン分析 |

||||||

ソース: SDKI Analytics 専門家分析

市場傾向分析と将来予測:地域市場の見通しの概要

➤北米の油田機器市場規模:

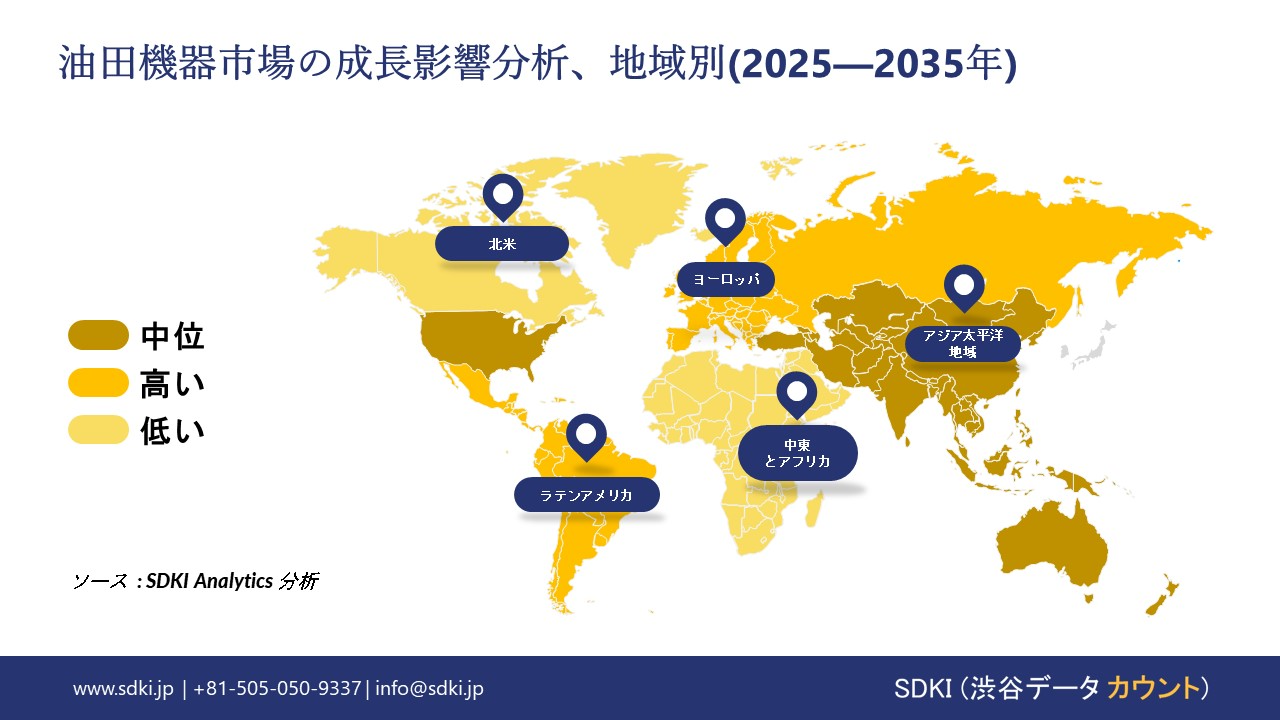

SDKI市場調査アナリストの調査によると、北米の油田機器市場は、予測期間中に43%以上の市場シェアを獲得し、世界の油田機器市場で主導的な地位を確保すると予測されています。市場の成長は、高度な掘削技術によって支えられています。米国は、水平掘削と水圧破砕において世界をリードする国の一つであり、これにより抽出効率が大幅に向上し、運用コストが削減されます。リアルタイム監視、AIベースの診断、予知保全ツールの導入増加により、油田機器の需要が高まっています。さらに、市場の成長は持続可能性基準によっても推進されています。電動リグと低排出ガス機器に対する需要の高まりは、環境目標と規制遵守と一致していることがわかりました。

- 北米の油田機器市場の市場強度分析:

|

カテゴリー |

米国 |

カナダ |

|

市場成長の可能性 |

強 |

中程度 |

|

規制環境の複雑さ |

複雑 |

標準 |

|

価格体系 |

市場主導型 |

ハイブリッド |

|

熟練人材の確保 |

Mask |

|

|

標準および認証フレームワーク |

||

|

イノベーション エコシステム |

||

|

技術統合率 |

||

|

市場参入障壁 |

||

|

投資環境 |

||

|

サプライチェーンの統合 |

||

|

競争の激しさ |

||

|

顧客基盤の高度化 |

||

|

インフラ整備状況 |

||

|

貿易政策の影響 |

||

ソース: SDKI Analytics 専門家分析

➤ヨーロッパの油田機器市場規模:

ヨーロッパの油田機器市場は、予測期間中に世界市場において着実な成長が見込まれています。市場の成長は、オフショアおよび深海での事業拡大の増加に牽引されています。北海および地中海地域では、特に深海および超深海域におけるオフショア活動が増加しており、防噴装置、ライザー、海中制御システムなどの高性能機器が求められています。さらに、市場の成長は、技術の近代化と持続可能性への要求の高まりによっても牽引されています。ヨーロッパ連合(EU)の厳格な規制策定により、メーカーは低排出でエネルギー効率の高い機器の採用を迫られており、電動リグやスマート監視システムの革新が加速しています。企業は、持続可能性の目標を達成するために、AI、IoT、自動化を活用してレガシーインフラを改修しています。

- ヨーロッパの油田機器市場の市場強度分析:

|

カテゴリー |

イギリス |

ドイツ |

フランス |

|

市場成長の可能性 |

中程度 |

強 |

中程度 |

|

規制環境の複雑さ |

複雑 |

標準 |

標準 |

|

価格体系 |

市場主導型 |

市場主導型 |

ハイブリッド |

|

熟練人材の確保 |

Mask |

||

|

標準および認証フレームワーク |

|||

|

イノベーション エコシステム |

|||

|

技術統合率 |

|||

|

市場参入障壁 |

|||

|

投資環境 |

|||

|

サプライチェーンの統合 |

|||

|

競争の激しさ |

|||

|

顧客基盤の高度化 |

|||

|

インフラ整備状況 |

|||

|

貿易政策の影響 |

|||

ソース: SDKI Analytics 専門家分析

➤アジア太平洋地域の油田機器市場規模:

アジア太平洋地域の油田機器市場に関する市場調査と分析によると、予測期間中、この地域の市場は世界市場の中で最も急速に成長する地域になると予想されています。アジア太平洋市場は2.9%のCAGRで成長すると見込まれています。市場の成長は、LNGインフラへの投資の増加によるものです。世界的な液化天然ガス(LNG)への移行に伴い、極低温ポンプ、コンプレッサー、特殊バルブの需要が増加しています。LNGターミナルとパイプラインは、安全な運用のために高度な油田グレードの機器を必要としています。さらに、再生可能エネルギーと油田操業の統合が進んでいることも、この地域の市場の成長を牽引しています。特に遠隔地では、二酸化炭素排出量の削減を目的として、太陽光や風力エネルギーを動力源とするハイブリッドリグが増加しています。この傾向は、電力システムと制御モジュールのイノベーションを加速させています。

- アジア太平洋地域の油田機器市場の市場強度分析:

アジア太平洋地域の油田機器市場に関連する国の市場強度分析は:

|

カテゴリー |

日本 |

南韓国 |

マレーシア |

中国 |

インド |

|

市場成長の可能性 |

中程度 |

強 |

中程度 |

強 |

強 |

|

製造業の設備投資の勢い |

中 |

高 |

中 |

高 |

高 |

|

自動化とロボティクスの需要 |

高 |

高 |

中 |

高 |

中 |

|

インフラプロジェクトのパイプライン |

Mask |

||||

|

資金調達の容易さ(リース) |

|||||

|

サプライチェーンの統合 |

|||||

|

熟練した人材の確保 |

|||||

|

アフターマーケットとサービスの需要 |

|||||

|

グリーン化/改修の機会 |

|||||

|

規制と基準の複雑さ |

|||||

|

市場参入障壁 |

|||||

|

貿易政策の影響 |

|||||

ソース: SDKI Analytics 専門家分析

油田機器業界概要と競争ランドスケープ

油田機器市場メーカーシェアを独占する世界トップ10社は:

|

会社名 |

本社所在地 |

油田機器との関係 |

|

Schlumberger Limited |

米国 |

掘削、生産、圧力制御システム |

|

Baker Hughes Company |

米国 |

油田サービス、掘削ツール、坑井建設 |

|

Halliburton Company |

米国 |

掘削、仕上げ、生産設備 |

|

Weatherford International |

Mask |

|

|

National Oilwell Varco |

||

|

TechnipFMC |

||

|

Saipem S.p.A |

||

|

Aker Solutions ASA |

||

|

Petrofac Limited |

||

|

Nabors Industries Ltd. |

||

ソース: SDKI Analytics 専門家分析と会社ウェブサイト

油田機器の世界および日本のトップ10の消費者は:

| 主要消費者 | 消費単位(数量) | 製品への支出 – 米ドル価値 | 調達に割り当てられた収益の割合 |

|---|---|---|---|

| INPEX Corporation |

|

||

| INPEX Corporation | |||

| XXXX | |||

| XXXXX | |||

| xxxxxx | |||

| xxxxxxxx | |||

| xxxxx | |||

| xxxxxxxx | |||

| xxxxxx | |||

| XXXXX | |||

日本の油田機器市場におけるメーカーシェアを独占するトップ10社は以下のとおりです:

|

会社名 |

事業状況 |

油田機器との関係 |

|

Mitsubishi Heavy Industries |

日本発祥 |

海洋掘削システムおよびエネルギー設備 |

|

IHI Corporation |

日本発祥 |

石油・ガス関連産業機械 |

|

Hitachi Zosen Corporation |

日本発祥 |

圧力容器および海洋エネルギーシステム |

|

JGC Corporation |

Mask |

|

|

Yokogawa Electric Corp. |

||

|

Fuji Electric Co., Ltd. |

||

|

Toyo Engineering Corp. |

||

|

Chiyoda Corporation |

||

|

Sumitomo Heavy Industries |

||

|

Kawasaki Heavy Industries |

||

ソース: SDKI Analytics 専門家分析と会社ウェブサイト

油田機器 市場 包括的企業分析フレームワーク

市場内の各競合他社について、次の主要領域が分析されます 油田機器 市場:

- 会社概要

- リスク分析

- 事業戦略

- 最近の動向

- 主要製品ラインナップ

- 地域展開

- 財務実績

- SWOT分析

- 主要業績指標

油田機器市場最近の開発

油田機器市場に関連する最近の商業化と技術の進歩のいくつかは、日本だけでなく世界的にも注目されています:

|

月と年 |

関係企業 |

油田機器市場とのつながり |

|---|---|---|

|

2025年3月 |

Hitachi Construction Machinery Co., Ltd. |

Hitachiは、使用済み作動油を再生する技術を開発し、再生油圧ショベルに適用しました。これにより、作動油の消費量を削減し、運用コストを削減するとともに、エネルギー関連プロジェクトにおける重機の持続可能な利用を促進し、油田機器市場を支援します。 |

|

2025年9月 |

Baker Hughes、Turkish Petroleum (TPAO), TP-OTC |

Baker Hughesは、トルコのサカリヤ・ガス田フェーズ3向けに統合型海底生産システムおよびインテリジェント仕上げシステムを供給する契約を獲得しました。これにより、深海生産技術の進歩と海洋エネルギー開発の効率化が促進され、油田機器市場が強化されます。 |

ソース:各社プレスリリース

目次

関連レポート

よくある質問

- 2020ー2024年

- 2025-2035年

- 必要に応じて日本語レポートが入手可能