ラージフォーマットディスプレイ(LFD)市場調査レポート、規模とシェア、成長機会、メーカー、傾向洞察分析―技術別、製品タイプ別、解像度別、輝度(nits)別、アプリケーション別、サービス別、地域別 - 世界市場の展望と予測2026-2035年

出版日: Jan 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

ラージフォーマットディスプレイ(LFD)市場規模

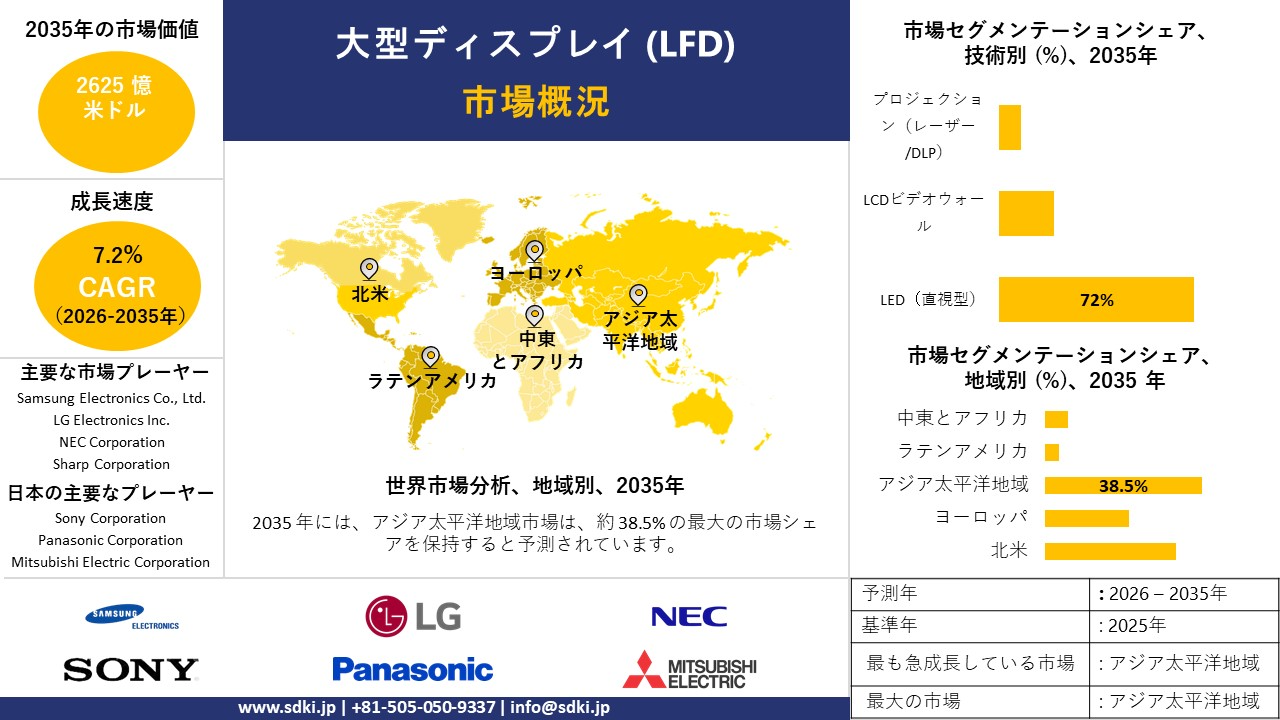

ラージフォーマットディスプレイ(LFD)市場に関する当社の調査レポートによると、市場は予測期間(2026―2035年)において年平均成長率(CAGR)7.2%で成長すると予想されています。2035年には、市場規模は265億米ドルに達する見込みです。しかし、当社の調査アナリストによると、基準年の市場規模は132億米ドルがありました。

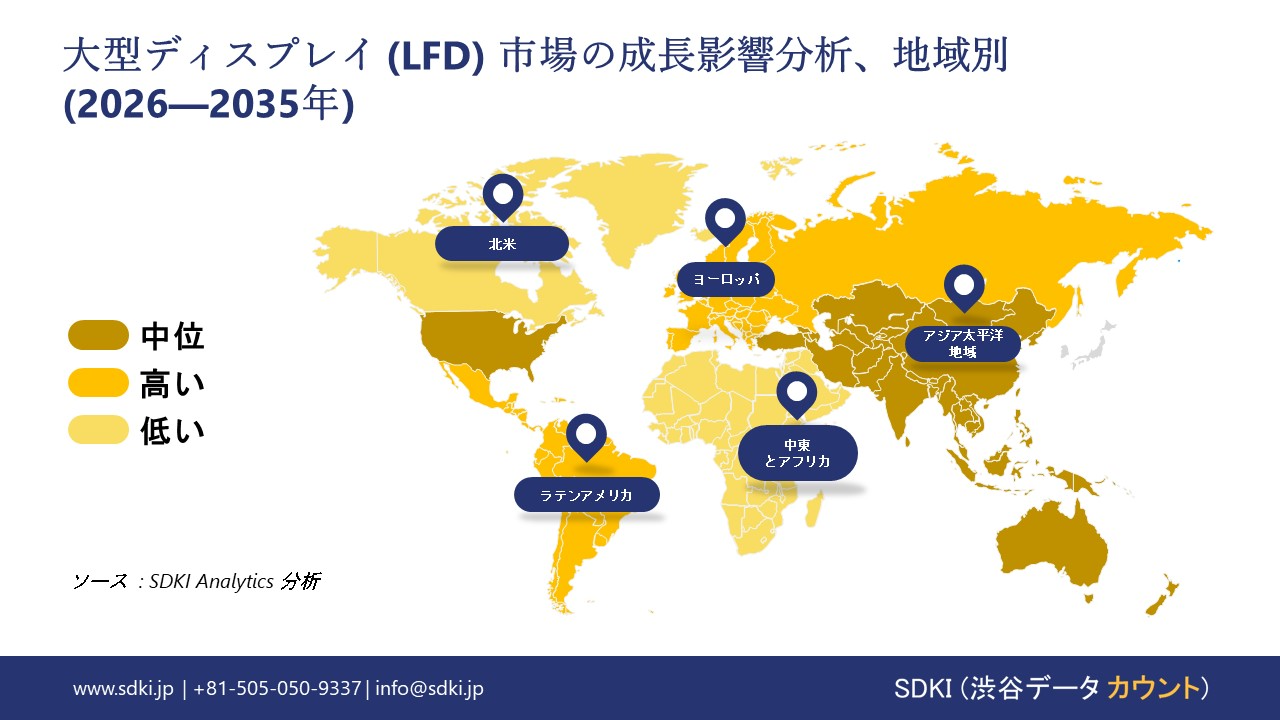

ラージフォーマットディスプレイ(LFD)に関する当社の包括的な市場調査によると、アジア太平洋地域は予測期間を通じて約38.5%の圧倒的な市場シェアを維持し、依然として圧倒的な地位を維持すると予想されます。同時に、同地域は最も高いCAGRで成長すると予測されており、今後数年間で最も有望かつ加速的な成長機会が見込まれることを示しています。

この二重のリーダーシップは、この地域が主要な消費ハブであると同時に、デジタルサイネージにおける最速成長のイノベーションフロンティアとして、その根幹を成す役割を担っていることを強調しています。この成長は、主に強力で相乗効果を生み出す要因、スマートシティや交通網への大規模かつ継続的なインフラ投資、世界で最も急速に普及している5Gとデジタル屋外広告(DOOH)、そしてディスプレイパネルおよび関連技術の世界的な製造・イノベーションセンターとしての地位によって支えられています。

ラージフォーマットディスプレイ(LFD)市場分析

ラージフォーマットディスプレイ(LFD)は、通常32インチを超えるフラットスクリーンディスプレイで、家庭用エンターテインメントではなく、商業、専門、または産業用途を対象としています。これらのタイプのディスプレイは、LCD(液晶ディスプレイ)、LED(発光ダイオード)、OLED(有機EL)、電子ペーパーなどの複数の技術を採用し、高輝度・高解像度の映像コンテンツを提供します。従来のテレビとは異なり、LFDは24時間365日稼働するように設計されており、埃や熱に耐える頑丈な筐体と、リモートアクセスによるコンテンツ管理を可能にする柔軟な接続システムを備えています。当社のラージフォーマットディスプレイ(LFD)市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核を担うと予測されています。

- 教育インフラへの投資増加-

インタラクティブ・フラットパネル・ディスプレイ(IFPD)はLFD市場の重要な部分であり、その発展は主に教育施設の近代化によって促進されています。学習の質を向上させるため、政府は従来の黒板をデジタルインタラクティブスクリーンに置き換えるために多額の資金を費やしています。2025年8月、米国国勢調査局は、米国政府による教育分野の公共施設建設への季節調整済み年間支出額が1,126憶米ドルに達したと発表しました。当社のアナリストの見解によると、教育インフラへのこの巨額の設備投資は、学校や大学がハイブリッド学習とデジタルコラボレーションを支援するために教室をタッチ対応のLFDで改修する中で、ラージフォーマットディスプレイの購入に直接的な影響を与えています。

- 小売業におけるデジタルトランスフォーメーション –

小売業は、実店舗での顧客とのインタラクションと売上向上のため、デジタルサイネージへの積極的な移行を進めており、業務用LFDの需要が高まっています。こうした設備投資は、小売業の好調な業績に支えられています。シンガポール統計局( Singstat )によると、シンガポールの小売売上高は2025年10月時点で前年同月比4.5%増加しました。当社のアナリストの見解では、小売活動の増加により、店舗オーナーは消費者の注目を集めるためにビデオウォールやデジタルキオスクなどのダイナミック広告サービスに投資しており、その結果、ショッピングモールや繁華街のアウトレットにおける高輝度ラージフォーマットディスプレイの需要が維持されていると考えられます。

ラージフォーマットディスプレイ(LFD)市場において、日本の現地企業はラージフォーマットディスプレイ(LFD)の輸出に関してどのような利益を得るのですか?

日本のディスプレイ機器メーカーは、特に放送や医療用画像といったハイエンド市場において、高信頼性の映像ソリューションに対する世界的なニーズを戦略的に活用できる立場にあります。Sony と Panasonicなどの企業は、日本の光学技術の優秀性というイメージを活かし、重要なサイネージに利用されるハイエンドの映像機器を輸出しています。財務省のデータに基づき電子情報技術産業協会(JEITA)が発表したデータによると、2025年9月の映像機器と呼ばれる製品カテゴリーの日本の輸出額は35752百万円に達すると予想されています。アナリストの観察によると、この好調な輸出実績は、日本の映像技術に対する世界的な関心が継続していることを示しており、国内のLFDメーカーに次世代の8KおよびマイクロLEDディスプレイパネルを世界の商業市場に向けて開発するための安定した収入源を提供することになると考えられます。

マイクロLEDといった次世代ディスプレイ技術への投資と開発を主導するために必要な財務基盤を国内企業に提供し、高付加価値のグローバル商用ディスプレイ市場における競争優位性を維持していく上で重要な役割を果たします。

市場の制約

当社の調査レポートによると、原材料および部品コストの変動性、そしてサプライチェーンの脆弱性は、予測期間中の市場成長を阻害する要因の一つとなっています。例えば、LGディスプレイの2023年Form 20-Fによると、原材料と主要部品は2021―2023年の売上原価の55―60%を占めており、価格は四半期ごとに交渉され、供給の不均衡に左右されます。LFDパネルの製造は、複数の重要な原材料を複雑なグローバルサプライチェーンに依存しており、サプライヤーの集中化が顕著です。また、四半期ごとの価格設定は、生産者を原材料コストの変動と納期の不確実性にさらし、市場の成長を鈍化させます。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

ラージフォーマットディスプレイ(LFD)市場レポートの洞察

SDKI Analyticsの専門家によると、以下はラージフォーマットディスプレイ(LFD)市場の世界シェアに関連するレポートの洞察です。

|

レポートの洞察 |

|

|

2026―2035年のCAGR |

7.2% |

|

2025年の市場価値 |

132憶米ドル |

|

2035年の市場価値 |

265憶米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

ラージフォーマットディスプレイ(LFD)市場セグメンテーション

ラージフォーマットディスプレイ(LFD)市場の展望に関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場を技術別、製品タイプ別、解像度別、輝度(nits)別、アプリケーション別、サービス別にセグメント化しました。

ラージフォーマットディスプレイは技術別に基づいて、LED(直視型)、LCDビデオウォール、プロジェクション(レーザー/DLP)に分割されています。調査によると、LED(直視型)は予測期間中に72%のシェアを占め、主要なサブセグメントになると予想されています。高輝度、優れた信頼性、シームレスな拡張性、そしてLEDおよび半導体業界全体の推進による継続的な性能向上により、LED(直視型)が優位に立っています。ラージフォーマットディスプレイのアプリケーションでは、旧式のリアプロジェクションやタイル型LCDシステムが時代遅れとなり、インパクトの大きい設置ではLEDがデフォルトの選択肢となっています。米国では、2025年3月にインフラ投資・雇用法(IIJA)により公共交通機関の近代化に390憶米ドルが割り当てられており、ラージフォーマットディスプレイの利用を後押ししており、市場の需要に影響を与えています。

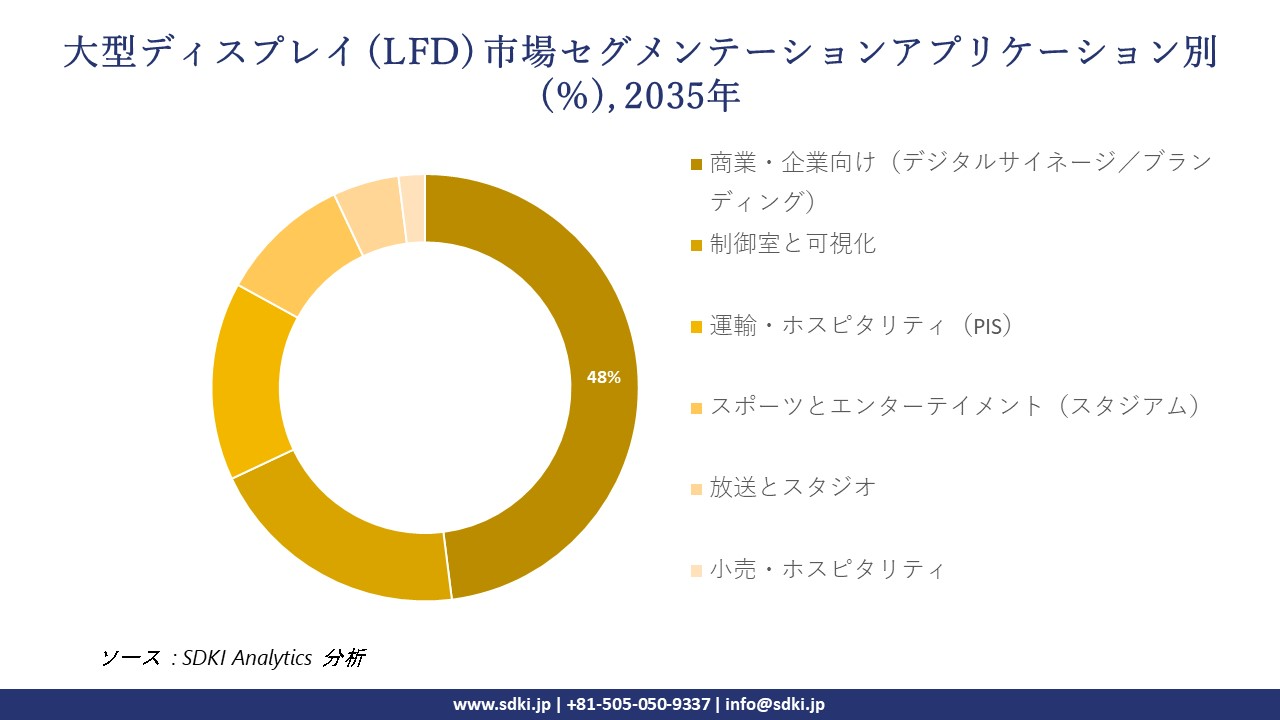

ラージフォーマットディスプレイはアプリケーション別に基づいて、商業および企業(デジタルサイネージ/ブランディング)、制御室と可視化、運輸・ホスピタリティ(PIS)、スポーツとエンターテイメント(スタジアム)、放送およびスタジオ、小売・ホスピタリティに分割されています。調査によると、商業および企業セグメントは予測期間中に48%のシェアを占めると予想されています。商業および企業アプリケーションには、小売環境、企業ロビー、銀行ホール、レストラン、ホスピタリティ施設での広告、ブランディング、情報、コミュニケーションに使用されるLFDが含まれます。これは、静的な印刷メディアから動的なデジタルコミュニケーションへの世界的な移行によって推進されている、最も広範かつ普及した使用例です。幅広いサイズ、解像度、価格帯のラージフォーマットディスプレイの需要により、堅牢で競争力のある製造エコシステムが生まれます。

以下は、ラージフォーマットディスプレイ (LFD) 市場に該当するセグメントのリストです。

|

親セグメント |

サブセグメント |

|

技術別 |

|

|

製品タイプ別 |

|

|

解像度別 |

|

|

輝度(nits)別 |

|

|

アプリケーション別 |

|

|

サービス別 |

|

ソース: SDKI Analytics 専門家分析

ラージフォーマットディスプレイ(LFD)市場傾向分析と将来予測:地域市場展望概要

アジア太平洋地域のラージフォーマットディスプレイ市場は、政府主導による地下鉄、鉄道、空港交通ハブの拡張により、旅客情報システム(PIS)や広告へのディスプレイ利用が拡大しており、拡大傾向にあります。その結果、アジア太平洋地域はラージフォーマットディスプレイ市場において最大の市場となり、予測期間中に38.5%のシェアを獲得すると予想されています。これに伴い、アジア太平洋諸国は予測期間中に11%の年平均成長率(CAGR)で成長すると予測されています。

中国では、306の都市交通路線が運行しており、総延長は10,165.7kmに達します。この地域の駅では、列車の時刻表、道案内、安全情報などを表示する複数のラージフォーマットディスプレイが求められています。また、インドでは、アダニグループが今後5年間で約150憶米ドルを投資し、空港ネットワークの旅客数を年間2億人に拡大する予定です。そのため、空港における情報提供や時刻表表示の拡充による交通管理の改善のため、新しいディスプレイボードの導入が求められています。政府が追跡するインフラ指標と承認された民間投資予算は、24時間365日稼働、高輝度、高信頼性を備えたLFDの年間数万台の新規設置に直接反映されています。

SDKI Analyticsの専門家は、このラージフォーマットディスプレイ(LFD)市場に関する調査レポートのために、以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東とアフリカ |

|

ソース: SDKI Analytics 専門家分析

ヨーロッパでは、EUグリーンディールと建築物のエネルギー性能に関する指令(EPBD)の改修が、ラージフォーマットディスプレイの市場需要を支えています。改訂された建築物のエネルギー性能に関する指令(EU)は、EU内のすべての新築公共建築物を2028年以降ゼロエミッションとし、大規模なエネルギー改修を実施することを義務付けています。これは、市庁舎、大学、病院などの公共部門の不動産の大規模な改修において、ラージフォーマットディスプレイの導入を含む年間改修率の向上を目指しています。例えば、フランスのレジリエンス・復興計画(2025年4月)には、エネルギーのアップグレードに特化した67億ユーロの投資が含まれています。 建物の排出量を削減し、エネルギー効率を向上させること。建物改修のためのこの投資により、客室予約、エネルギー消費ダッシュボード、社内コミュニケーションなどのためのデジタルサイネージネットワークの利用が拡大し、これらはすべてネットワーク管理型LFDによって実現されます。

ラージフォーマットディスプレイ(LFD)調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

SDKI Analyticsの調査者によると、ラージフォーマットディスプレイ(LFD)の市場見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートでは、市場プレーヤーは、製品や技術の投入、戦略的パートナーシップ、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体の見通しにおいて競争優位性を獲得しようとしていると指摘されています。

当社の調査レポートによると、世界のラージフォーマットディスプレイ(LFD)市場の成長において重要な役割を果たしている主要企業には、Samsung Electronics Co., Ltd.、LG Electronics Inc.、 Sharp NEC Display Solutions, Ltd.、 Leyard Optoelectronic Co., Ltd.、 Barco NVなどが含まれます。さらに、市場展望によると、日本のラージフォーマットディスプレイ(LFD)市場における上位5社は、Sony Corporation、 Panasonic Connect Co., Ltd.、 Sharp Corporation, EIZO Corporation、 JVCKenwood Corporationなどです。本市場調査レポートには、これらの主要企業の詳細な競合分析、企業概要、最近の傾向、主要な市場戦略が含まれています。

ラージフォーマットディスプレイ(LFD)市場ニュース

- 2025年5月、Innoluxは持続可能なラージフォーマットディスプレイ製造をサポートするために、プラント7に40MWhのエネルギー貯蔵システムを建設すると発表しました。

- Panasonicは2024年9月、Fire TVを搭載したOLEDおよびミニLEDテレビの新ラインナップで米国のテレビ市場に再参入し、ラージフォーマットディスプレイの商業戦略を2025年まで拡大しました。

ラージフォーマットディスプレイ(LFD)主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

ラージフォーマットディスプレイ(LFD)マーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能