データセンターコロケーション市場調査レポート、規模とシェア、成長機会、及び傾向洞察分析 ― コロケーションタイプ別、ティア標準別、企業規模別、エンドユーザー産業別、地域別―世界市場の見通しと予測 2026-2035年

出版日: Feb 2026

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能

データセンターコロケーション市場規模

2026―2035年までのデータセンターコロケーション市場の規模はどのくらいですか?

データセンターコロケーション市場に関する当社の調査レポートによると、市場は予測期間(2026―2035年)の間に複利年間成長率(CAGR)10.6%で成長すると予想されています。2035年には、市場規模は1,711億米ドルに達すると見込まれています。しかし、当社の調査アナリストによると、基準年の市場規模は622億米ドルでしました。

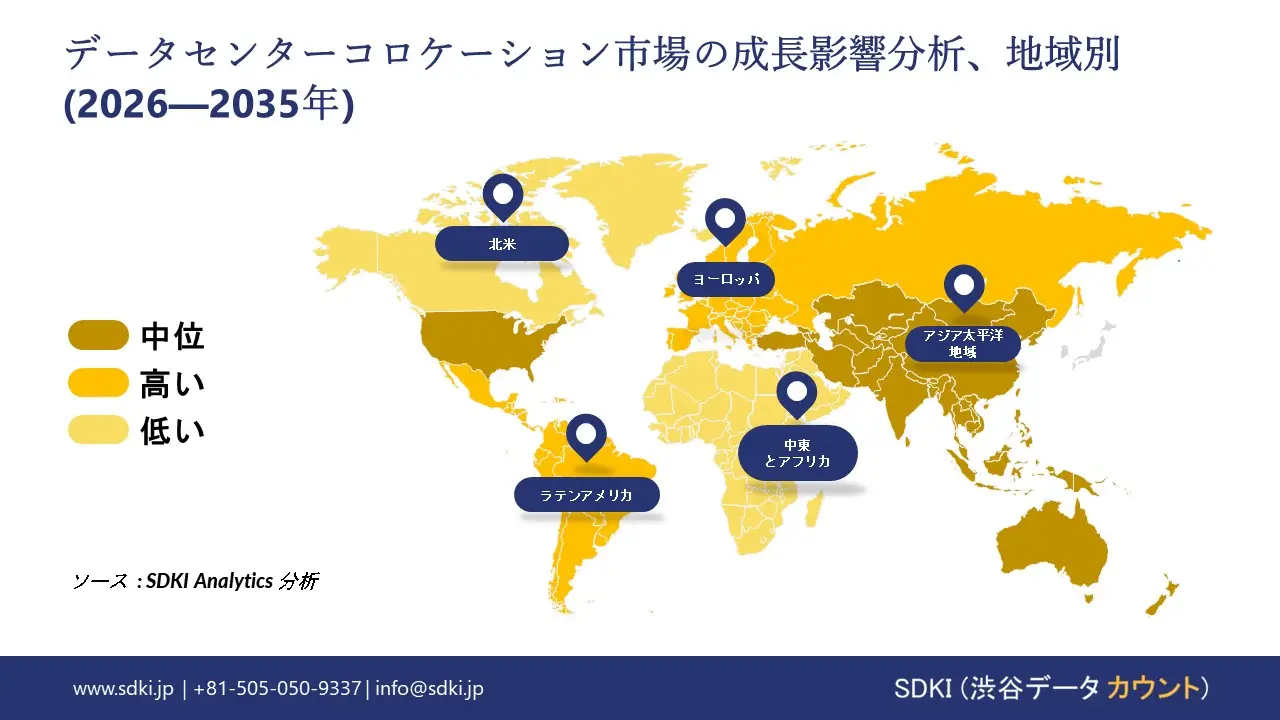

市場シェアの観点から、データセンターコロケーション市場を支配すると予想される地域はどれですか?

データセンターコロケーションに関する当社の市場調査によると、北米市場は予測期間を通じて約35%の市場シェアを占め、最大のシェアを占めると予想されています。一方、アジア太平洋地域市場は複利年間成長率12%で加速すると見込まれており、今後数年間は有望な成長機会が見込まれます。この成長は主に、中国、インド、日本、東南アジアなどの国々におけるデジタル経済の爆発的な成長によるものです。

データセンターコロケーション市場分析

データセンターコロケーションとは何ですか?

データセンターコロケーションとは、企業が自社のサーバーやIT機器を収容するために、スペース、電力、冷却設備、セキュリティ設備をレンタルする施設です。これは、自社で施設を建設・管理する代わりに、テナントが自社のサーバー、ストレージ、ネットワーク機器を契約することを意味します。このエコシステムでは、テナントは共有インフラの料金を支払いながら、自社のサーバー、ストレージ、ネットワーク機器を契約します。

データセンターコロケーション市場の最近の傾向は何ですか?

当社のデータセンターコロケーション市場分析調査レポートによると、以下の市場傾向と要因が市場成長の中核的な原動力として貢献すると予測されています。

- エッジコンピューティングと 5G ネットワークの成長 -

世界中のエコシステムと産業が AI と IoT へと移行するにつれて、データの生成が激化し、中小企業 (SME) にとってデータセンターコロケーション市場が不可欠なものになっています。

その証拠として、世界経済フォーラムの市場見通しによると、2025年まで世界中で毎日463エクサバイト以上のデータが生成されると予想されています。一方、アカデミアの記事によると、5Gの普及により、同年にはモバイル接続数が14億を超えました。

- コストとエネルギー効率の急上昇 -

完全なデジタル化に向けた政府の取り組みと、特に発展途上国における手頃な価格のオペレーティング システムに対するニーズの高まりにより、データセンターコロケーション市場が提供するサービスの需要が総合的に増加しています。

対照的に、米国エネルギー省(DOE)の調査報告によると、米国のデータセンターの電力使用量は2014―2023年の間に58―176TWhに増加しました。

同社は、国の環境・エネルギー保全機関に対し、データセンターの拡張を最適化するための厳格なプロトコルを制定するよう働きかけており、共有施設は基準に完全に適合しています。これにより、この製品の強力な顧客基盤が構築されます。

日本の現地企業にとって、データセンターコロケーション市場の収益創出ポケットとは何ですか?

日本のデータセンターコロケーション市場は、AIの活用と再生可能エネルギーを利用した施設への強い関心により、急速に発展しています。これらの要因は、地元のサービスプロバイダーにとって大きな収益源となっています。

貿易面では、日本は海外におけるデータセンターコロケーションの拡大を支える大規模なICT機器とデジタルサービスを輸出しており、幅広い応用分野への貢献を果たしています。こうした巨大な規模を証明するかのように、経済複雑性観測所(OEC)は、2025年10月における日本からのデータ処理機器用部品・付属品の輸出が前年比6.51%増加したことを記録しました。

インフラ全体をデジタル化するための政府の取り組みと戦略的協力も、分散型データセンターの展開を促進し、地域産業の成長と投資誘致を支援します。

さらに、最近の調査レポートでも強調されているように、ホスト型IT及びクラウドサービスに対する国内の旺盛な需要は、デジタルトランスフォーメーションとエンタープライズアウトソーシングがこの分野の主要な推進力となっていることを浮き彫りにしています。その証拠として、日本貿易振興機構(JETRO)によると、2024年にはAWS、Microsoft、Googleによる日本におけるデータセンター関連投資総額は189億米ドルに達しました。

データセンターコロケーション市場に影響を与える主な制約は何ですか?

SDKI Analyticsの専門家が実施した調査によると、エネルギーコストの高騰と電力供給の制約は、特に持続可能性と規制の圧力の高まりと相まって、世界のデータセンターコロケーション市場の発展に深刻な悪影響を与えることが指摘されています。

問題は、このような施設の実現可能性にあります。今日では信頼性が高く手頃な電力の入手が困難であるため、このような施設は非常に電力を消費し、コロケーション データ センターの拡張に問題が生じます。

サンプル納品物ショーケース

- 調査競合他社と業界リーダー

- 過去のデータに基づく予測

- 会社の収益シェアモデル

- 地域市場分析

- 市場傾向分析

データセンターコロケーション市場レポートの洞察

データセンターコロケーション市場の今後の見通しは?

SDKI Analyticsの専門家によると、データセンターコロケーション市場の世界シェアに関連するレポートの洞察は以下のとおりです。

|

レポートの洞察 |

|

|

2026―2035年のCAGR |

10.6% |

|

2025年の市場価値 |

622億米ドル |

|

2035年の市場価値 |

1,711億米ドル |

|

履歴データの共有 |

過去5年間 2024年まで |

|

未来予測は完了 |

2035年までの今後10年間 |

|

ページ数 |

200+ページ |

ソース: SDKI Analytics 専門家分析

データセンターコロケーション市場はどのようにセグメント化されていますか?

データセンターコロケーション市場の展望に関連する様々なセグメントにおける需要と機会を説明する調査を実施しました。市場は、コロケーションタイプ別、ティア標準別、企業規模別、エンドユーザー産業別セグメントに分割されています。

データセンターコロケーション市場はコロケーションタイプ別どのように区分されていますか?

データセンターコロケーション市場調査レポートによると、コロケーションタイプ別は重要な市場セグメントであり、小売コロケーション、卸売コロケーションという 2 つの重要なサブセグメントがあります。

ここで、当社の調査担当者によると、小売コロケーションは、中小企業や大企業が大規模な全体的契約を結ぶことなくインフラストラクチャをアウトソーシングできる最もアクセスしやすいオプションであるため、予測期間中に最大の市場シェアで市場を支配することになります。

AIワークロード、クラウドコンピューティングの拡大、そして中小企業のデジタル化が市場の原動力となっています。2024年にはAI主導型データセンターへの投資が22%増加すると予測されており、AIワークロードを最適化し、中小企業や中堅企業にとって魅力的な小売コロケーション施設の需要が高まっています。

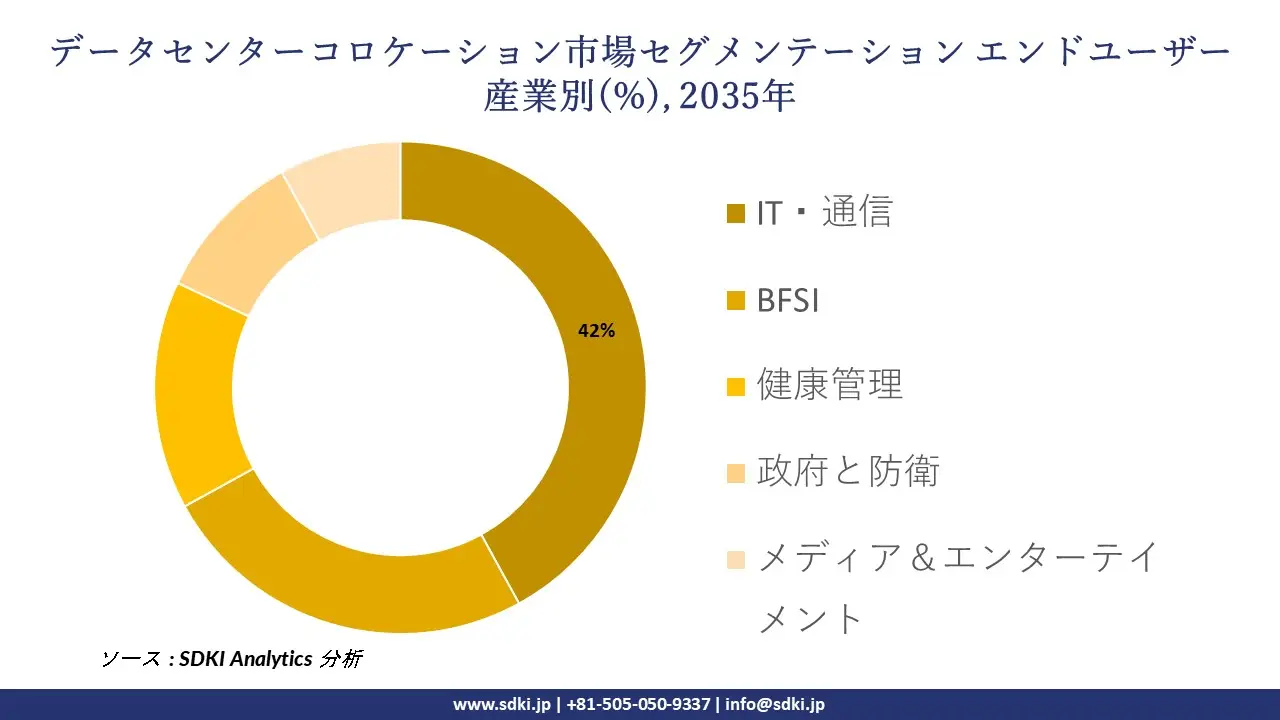

データセンターコロケーション市場は、エンドユーザー産業別どのように区分されていますか?

データセンターコロケーション市場レポートでは、エンドユーザー産業別がもう 1 つの重要な市場セグメントとして特定されており、IT・通信、BFSI、健康管理、政府と防衛、メディア&エンターテイメントのサブセグメントに基づいてさらに分割されていま。

したがって、想定されるタイムラインでは、クラウド プラットフォーム、ハイパースケール コンピューティング、5G 展開へのサポートを活用するためにこの分野でデータセンターコロケーションが求められるため、IT・通信部門がデータセンターコロケーション市場で 42% の市場シェアを獲得し、主導的な地位を占めると予想されます。

5G Americasでは、世界の5G接続は2023年に17.6億に急増し、66%の増加を記録し、2028年までに79億に達すると予測されています。この急激な導入と通信事業者の高い依存度が、データセンターコロケーション市場を牽引しています。

以下は、データセンターコロケーション市場に該当するセグメントのリストです。

|

親セグメント |

サブセグメント |

|

コロケーションタイプ別 |

|

|

ティア標準別 |

|

|

企業規模別 |

|

|

エンドユーザー産業別 |

|

ソース: SDKI Analytics 専門家分析

データセンターコロケーション市場の傾向分析と将来予測:地域市場展望概要

アジア太平洋地域のデータセンターコロケーション市場は、予測期間中に複利年間成長率(CAGR)12%で成長し、最も急速な成長を遂げると予想されています。当社の市場見通しによると、デジタルインフラの5G、クラウドサービス、AI主導の成長が共有施設の成長を牽引する中で、この市場は急速に拡大しています。

当社の市場分析によると、政府及び政府間データの大部分は、この地域の稼働中のデータセンター容量が2025年までに約12.7GWを超え、さらに3.2GWが建設中、13.3GWが計画段階にあることを示しています。これは、堅調な投資と将来の需要を反映しています。

SDKI Analyticsの専門家は、データセンターコロケーション市場に関するこの調査レポートのために、以下の国と地域を調査しました。

|

地域 |

国 |

|

北米 |

|

|

ヨーロッパ |

|

|

アジア太平洋地域 |

|

|

ラテンアメリカ |

|

|

中東及びアフリカ |

|

ソース: SDKI Analytics 専門家分析

北米のデータセンターコロケーション市場の市場パフォーマンスはどうですか?

北米のデータセンターコロケーション市場は、急速なデジタル化、クラウドの成長、及びスケーラブルなインフラストラクチャに対する需要の高まりにより、予測期間内に 35% という最大の市場シェアを維持しながら成長すると予想されています。

米国政府の報告書によると、データセンターは2023年に米国の総電力の約4.4%を消費しており、これはデータセンターの規模拡大と、デジタルサービス及びコロケーションプロバイダーにとっての重要性を反映しています。当社の調査レポートによると、データセンターからのエネルギー需要の増加は主要なインフラ傾向であり、持続的な成長を促進しています。

データセンターコロケーション調査の場所

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ

競争力ランドスケープ

SDKI Analyticsの調査者によると、データセンターコロケーションの市場見通しは、大規模企業と中小規模企業といった様々な規模の企業間の市場競争により、細分化されています。調査レポートでは、市場プレーヤーは、製品や技術の投入、戦略的パートナーシップ、協業、買収、事業拡大など、あらゆる機会を捉え、市場全体における競争優位性を獲得しようとしていると指摘されています。

データセンターコロケーション市場で事業を展開している世界有数の企業はどれですか?

当社の調査レポートによると、世界のデータセンターコロケーション市場の成長に重要な役割を果たしている主な主要プレーヤーには、 CyrusOne、QTS Data Centers、 CoreSite 、EdgeConneX、Global Switch などがあります。

データセンターコロケーション市場で競合している日本の主要企業はどこですか?

市場展望によると、日本のデータセンターコロケーション市場の上位5社は、NTT Communications、 KDDI Telehouse Japan、 MC Digital Realty、 AT TOKYO Corporation、 Equinix Japanなどです。

市場調査レポート研究には、グローバル データセンターコロケーション市場分析調査レポートの主要プレーヤーの詳細な競合分析、企業プロファイル、最近の傾向、主要な市場戦略が含まれています。

データセンターコロケーション市場の最新のニュースや傾向は何ですか?

- 2025 年 8 月: Equinix, Inc. は、世界中でコロケーション及び相互接続サービスを提供しているとして、IDC MarketScape : Worldwide Datacenter Colocation Services 2025 Vendor Assessment でリーダーとして認められました。

- 2023年2月:MC Digital Realtyは、23,000平方メートルの大阪データセンターキャンパスの4番目の建物であるKIX13の正式オープンを発表しました。

データセンターコロケーション主な主要プレーヤー

主要な市場プレーヤーの分析

日本市場のトップ 5 プレーヤー

目次

データセンターコロケーションマーケットレポート

関連レポート

よくある質問

- 2020ー2024年

- 2026-2035年

- 必要に応じて日本語レポートが入手可能