市場概要

サービスとしてのブロックチェーン市場は、2019 年に4205億米ドルと評価され、2020年から2025 .

の予測期間中に15.2%のCAGRで、2025 年までに9828億米ドルに達すると予想されています

市場概要

サービスとしてのブロックチェーン市場は、2019 年に4205億米ドルと評価され、2020年から2025 .

の予測期間中に15.2%のCAGRで、2025 年までに9828億米ドルに達すると予想されています。

- 暗号通貨市場の拡大に伴い、2017年12月には多くの新規ユーザーがブロックチェーンと暗号通貨に関する知識を得て、同じものを探求し始めました。したがって、ブロックチェーンと暗号通貨のユーザーが急速に増加しています。ビットコインブロックチェーン市場は、過去数年間で急激な上昇を目撃しています.

- ブロックチェーンは、単一障害点を持たず、単一のコンピュータから変更できないため、しばしば信頼の技術と呼ばれます。さらに、ブロックチェーンは、「スマートコントラクト」などのツールの使用を可能にし、コンプライアンスや請求処理から遺言の内容の配布まで、手動プロセスを自動化する可能性があります。これらは、BFSI業界がブロックチェーンを活用することを奨励している望ましい機能の一部です。

- ブロックチェーンは、インフラストラクチャの設定と維持に関して巨額の投資を必要とします。従来のデータベースと比較して、はるかにリソースを大量に消費します。また、膨大な量のエネルギーを消費し、膨大な帯域幅を必要とし、発展途上国はそれを苦労しています。

レポートの範囲

サービスとしてのブロックチェーンは、技術的側面をアウトソーシングし、ブロックチェーンの動作メカニズムの理解に関与していない組織にとって理想的です。市場は、取引の性質の柔軟性のために、また、セキュリティと費用対効果の高い機能によってサポートされているため、中小企業との牽引力を得ています。デジタルエンティティのアイデンティティと個人アイデンティティのオンライン認証を保護するためには、効率的なブロックチェーンサービスが必要であり、サービスとしてのブロックチェーンオファリングの需要が高まっています

主な市場動向

BFSIは最大の市場シェアを占めると予想されています< />

- 銀行や金融サービス企業はブロックチェーン技術を模索する最も多額の投資企業の1つであるため、サービスとしてのブロックチェーンの提供はBFSI業界に革命をもたらしています.

- これは、この技術の多くの非常に貴重な分散型アプリケーションによるものであり、それによって国境を越えた支払い、送金、交換、インターネットバンキング、貿易金融、顧客を知る(KYC)、リスクとコンプライアンスなど、さまざまな分野で新しいビジネスモデルを生み出しています.

- しかし、銀行や金融機関がこの技術の実行可能な可能性を模索し、市場の成長を促進する可能性が高い同じものに投資しているため、市場はまだ初期段階にあります

アジア太平洋地域は最も高い成長率を目撃すると予想されています

- 2018年5月以降、中国政府は複数の利点があるため、ブロックチェーン技術の採用を推進しています。採掘作業の大半は中国で行われています

- 世界有数のICT(情報通信技術)ソリューションプロバイダーであるファーウェイは、2018年4月に中国でハイパーレジャーベースのブロックチェーンサービスを開始し、企業がいくつかのユースケースシナリオで分散元帳ネットワーク上でスマートコントラクトを開発できるようにすると発表しました

- さらに、タイでは、政府は暗号通貨プロジェクトを積極的に受け入れました。タイの規制当局は、取引所とICOを可能にするために、2018年に暗号通貨ライセンスを確立しました。外国のブロックチェーンビジネスのために明確で具体的なガイドラインが描かれています。

- さらに、韓国政府は2019年のブロックチェーン開発に8億8000万ドルを費やしました。これらすべての要因により、アジア太平洋地域は予測期間中に最も速い成長率を目撃すると予想されています

競争環境

サービスとしてのブロックチェーンの可能性は、世界最大のソフトウェア企業のいくつかによって認識されています。Amazon、Microsoft、IBMの3つの大手クラウドプロバイダーは、クラウドの顧客がすでに利用できるサービスとしてのブロックチェーンプラットフォームを開発しました。ブロックチェーンのスタートアップは、より良い人材プールのためにフリーランサーも雇っています

- 2019年3月 - Tata Consultancy Services(TCS)は、MicrosoftおよびR3テクノロジー(R3)と協力して、スケーラブルな業界横断ブロックチェーンプラットフォームを採用しました。これらのプラットフォーム上に構築されているアンカーソリューションには、スキルマーケットプレイス、高級品の偽造防止、手頃な価格のモビリティ、5G用の共有通信インフラストラクチャ、ロイヤルティおよび報酬プログラムなどがあります

- 2019年2月 - IBMはIBM Food Trustソリューションを「一般公開」し、このソリューションを実験する最新の企業は、売上高で世界第2位のスーパーマーケット企業であるAlbertsons Companiesです。

このレポートを購入する理由:

- エクセル形式の市場予測(ME)シート

- クライアントの要件に従ってカスタマイズを報告

- 3ヶ月のアナリストサポート

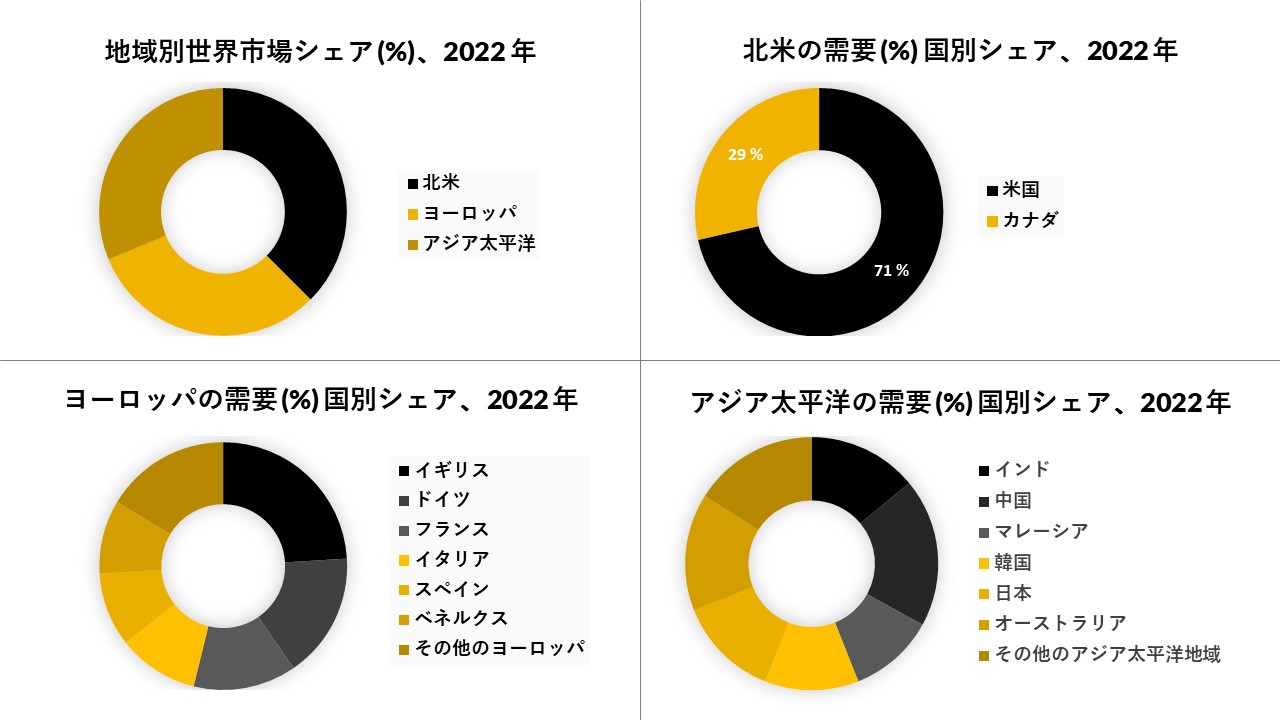

北米(米国およびカナダ)、ラテンアメリカ(ブラジル、メキシコ、アルゼンチン、その他のラテンアメリカ)、ヨーロッパ(英国、ドイツ、フランス、イタリア、スペイン、ハンガリー、ベルギー、オランダおよびルクセンブルグ、NORDIC(フィンランド、スウェーデン、ノルウェー) 、デンマーク)、アイルランド、スイス、オーストリア、ポーランド、トルコ、ロシア、その他のヨーロッパ)、ポーランド、トルコ、ロシア、その他のヨーロッパ)、アジア太平洋(中国、インド、日本、韓国、シンガポール、インドネシア、マレーシア) 、オーストラリア、ニュージーランド、その他のアジア太平洋地域)、中東およびアフリカ(イスラエル、GCC(サウジアラビア、UAE、バーレーン、クウェート、カタール、オマーン)、北アフリカ、南アフリカ、その他の中東およびアフリカ)